The digital forex prediction market is predicated on Ethereum ($ETH) The financial downturn in February is prone to proceed for the remainder of the month. $ETH The inventory will plunge a further 18% from its present worth of $1,950.

Such expectations are in keeping with the token’s current worth actions, as it’s arguably the largest loser among the many largest digital belongings by market capitalization. Because the begin of 2026, Ethereum is down 34.88%, Bitcoin (BTC) is down 23.47%, and XRP is down 24.59%.

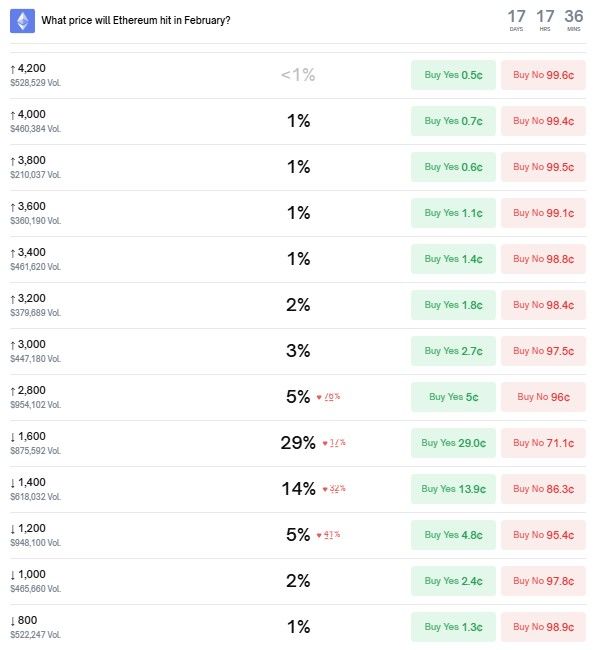

Odds within the digital forex market are 1/20 $ETH Rise to $2,800 in February

Nonetheless, it is price noting that Polymarket’s predictive merchants aren’t notably assured of their estimates of the place issues will occur. $ETH Scheduled to land on the finish of February. Whereas it is true that an 18% drop to $1,600 is essentially the most extensively anticipated worth drop, the chance of really reaching that worth is simply 29% as of press time on February eleventh.

Different comparatively widespread predictions are $1,400 – 14% odds – $1,200 – 5% – $2,800 – 5% – and $3,000 – 3% odds.

Moreover, all targets from $800 to $4,000 are thought-about at the very least considerably believable by the Polymarket cryptocurrency prediction market, as all of them have at the very least a 1% probability of being achieved.

In distinction, costs between $4,200 and $5,000 are thought-about utterly unlikely on the time of writing, with clearly lower than a 1% probability.

It’s also potential that they’ve some backing as a result of numerous buying and selling bot methods that exist out there. It is because a “sure” to those methods might have been bought merely due to the massive payouts out there. $ETH By some means over $4,200.

Equally, the general unfold may simply be distorted by such methods, however it’s troublesome to quantify how a lot.

Ethereum Value Prediction Unfold Reveals Large Uncertainty in Crypto Market

What is just not too troublesome to find out is that the very large dispersion of costs that’s at the very least considerably cheap for Ethereum is indicative of the diploma of uncertainty that prevails within the crypto market on February eleventh.

In the meantime, the debacle that started in late January has satisfied many merchants and analysts that the draw back of the usual digital asset cycle has begun in earnest, with many cash and tokens heading in the direction of new lows.

Alternatively, there’s a sturdy sense that circumstances within the sector are dramatically completely different from earlier years, as a consequence of elevated institutional adoption and acceptance, funding autos reminiscent of the biggest cryptocurrency spot exchange-traded funds (ETFs), and a extra favorable regulatory atmosphere.

These bullish components have led some consultants and merchants to consider that this worth crash is non permanent and that digital belongings may attain new all-time highs as early because the second half of 2026.

Featured picture by way of Shutterstock