U.S. markets closed on Friday with blended indicators throughout the most important indexes, however crypto-related shares, significantly Bitcoin miners, rose considerably on the again of world financial fragility and shifting geopolitical traits.

Listed Bitcoin miners outperform in risky world markets whereas Wall Road reels

On Friday, January twenty third, the 4 main US inventory indexes took on a twin persona, setting the tone for crypto-related shares.

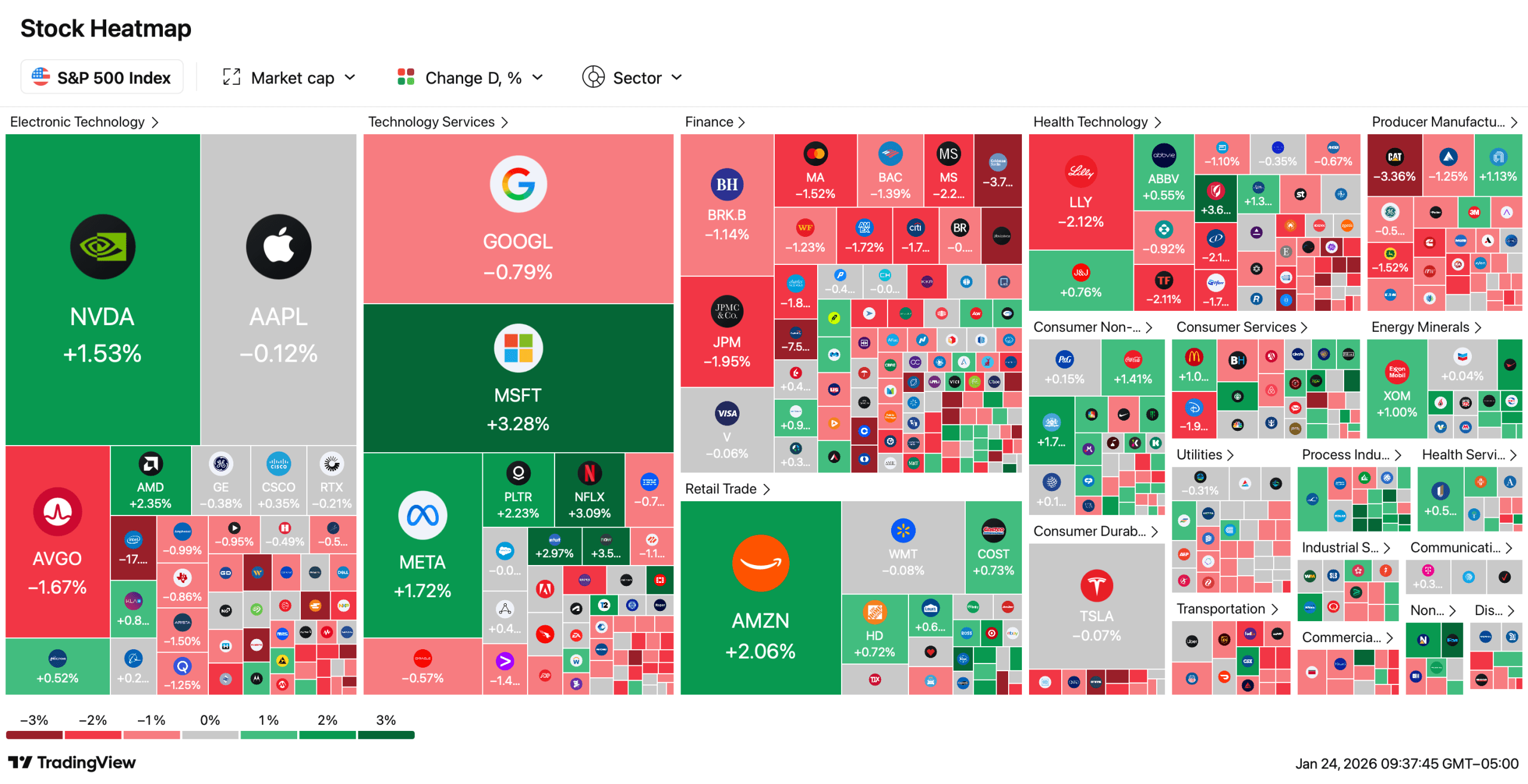

The Nasdaq Composite Index added 65.22 factors to finish at 23,501.24, whereas the S&P 500 Index rose 2.26 factors to six,915.61. In the meantime, the Dow Jones Industrial Common fell 285.30 factors to 49,098.71 and the New York Inventory Change Composite Index fell 40 factors to 22,757.16, pointing to a market that seems assured in pockets however anxious elsewhere.

Warmth map of S&P500.

This uneven footing was additionally mirrored in digital currency-related shares, with efficiency differing tremendously relying on the enterprise mannequin. On the Nasdaq, Coinbase (COIN) fell 2.77%, indicating deep-rooted wariness about crypto buying and selling platforms. In distinction, Technique (MSTR) rose 1.32% and continued to behave extra like a leveraged Bitcoin company than a software program firm.

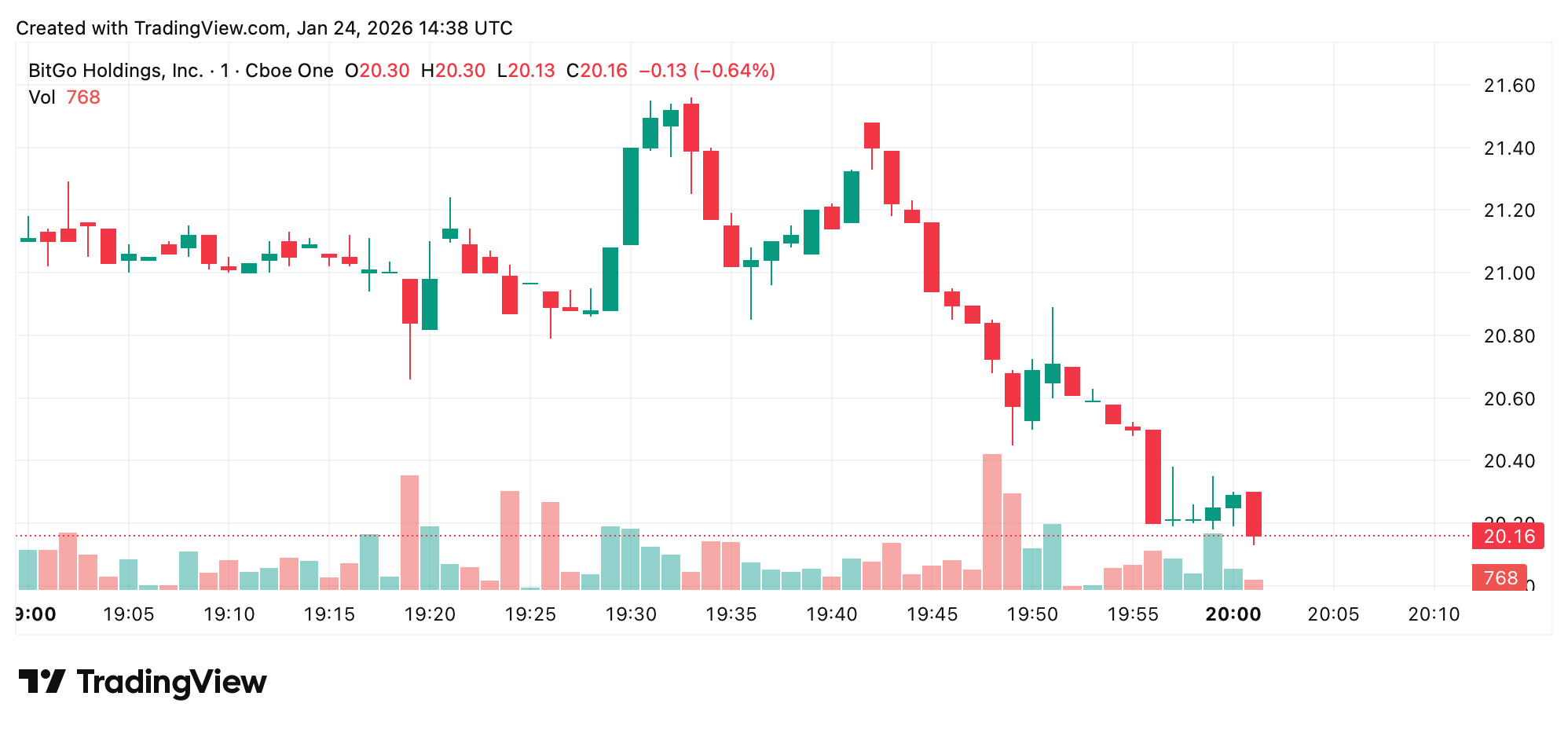

Newly listed firms weren’t spared from the turmoil. Bitgo’s NYSE debut (BTGO) was a blow, with the inventory dropping 21.58% on its first day. Elsewhere on the NYSE, Circle (CRCL) was down simply 0.03%, Bull (BLSH) was down 2%, and Bitmine Immersion Applied sciences (BMNR) was down 0.35%. It is a transfer that displays hesitation fairly than panic, nevertheless it was hesitation nonetheless.

BTGO inventory did not accomplish that properly within the first week.

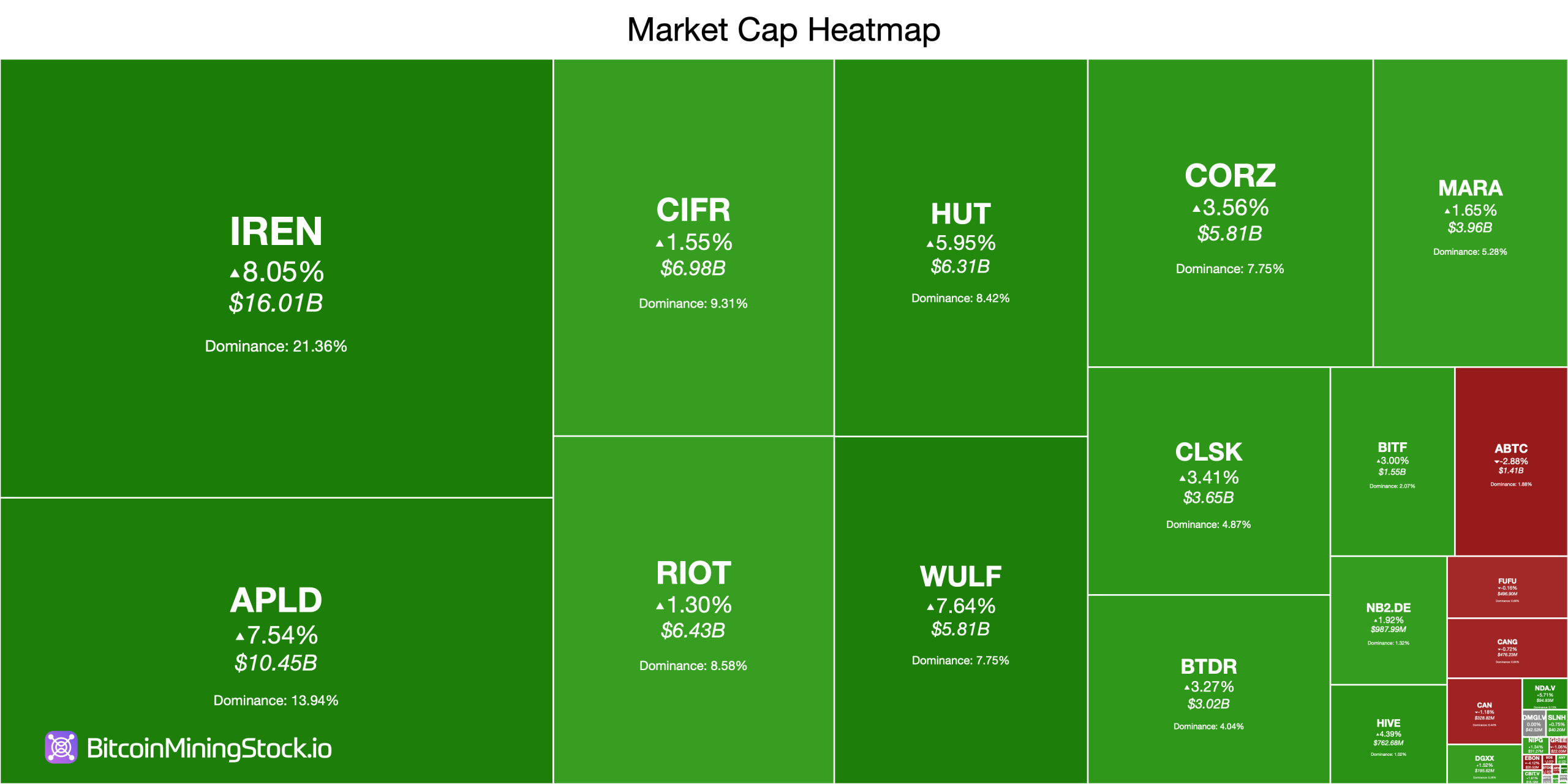

Whereas crypto infrastructure and alternate names remained cautious, Bitcoin mining shares had noticeably stronger worth motion. IREN Restricted led the group, up 8.05% to $56.47, adopted by Utilized Digital Company, up 7.54% to $37.36. TeraWulf rose 7.64% to $13.88 and Hut 8 Corp. rose 5.95% to $58.40, reinforcing the sector’s latest resilience.

Listed minor inventory warmth map.

Mid-career performers additionally trended positively. Core Scientific rose 3.56% to $18.73, CleanSpark rose 3.41% to $13.64, and Bitdeer Applied sciences Group rose 3.27% to $14.50. BitFarms added 3% to commerce at $2.74, whereas Cipher Mining and Riot Platforms posted smaller however nonetheless optimistic strikes at 1.55% and 1.30%, respectively.

Not all miners attended the rally. MARA Holdings rose 1.65% to $10.46, whereas American Bitcoin Corp. stood out as the one loser among the many prime shares, dropping 2.88% to $1.52. Nonetheless, the broader mining cohort was decidedly greener, particularly when contemplating the blended efficiency of conventional shares.

This divergence highlights a rising sample. This implies Bitcoin miners are more and more buying and selling primarily based on operational metrics, stability sheet place, and long-term community expectations fairly than day-to-day inventory sentiment. Amid lingering macro uncertainty, buyers seem like selective, rewarding firms straight concerned in Bitcoin manufacturing whereas taking a extra skeptical view of exchanges and newly listed firms.

Additionally learn: Bitwise launches Bitcoin-linked debasement ETF to counter declining greenback energy

This selectivity is smart in a worldwide surroundings that feels more and more fragile. Financial development stays uneven, central financial institution coverage stays restrictive by historic requirements, and geopolitical developments proceed to inject headline threat right into a market already stretched by valuation and focus issues.

In opposition to this background, digital currency-related shares not transfer as a single transaction. Friday’s session confirmed a transparent divide between infrastructure, miners, and repair suppliers, every reacting in a different way to the identical macro indicators.

For now, Bitcoin mining shares seem like carving out a lane of their very own, supported by strong worth motion and growing operational leverage. Whether or not that resilience lasts will rely much less on the temper on Wall Road and extra on how the broader financial and geopolitical chessboard evolves within the coming weeks.

Continuously requested questions ❓

- Why did the U.S. market finish blended on January twenty third?

Traders balanced energy in indexes centered on tech shares with declines in industrial and broader market benchmarks. - Which crypto shares have underperformed?

Coinbase and several other newly listed crypto firms on the NYSE posted losses throughout the session. - Why did Bitcoin mining shares outperform?

Miners benefited from sector-specific traits fairly than broader inventory sentiment. - What does this indicate for crypto shares going ahead?

Efficiency is changing into more and more dispersed throughout enterprise fashions and is not in step with a single transaction.