Cryptocurrency change exercise elevated final 12 months, with whole managed and decentralized spot transactions reaching roughly $18.6 trillion, in accordance with blockchain analytics platform CryptoQuant.

$18.6 trillion was a 9% enhance from the earlier 12 months, however progress was considerably slower than the 154% enhance in 2024.. In the meantime, perpetual futures buying and selling continues to carry out effectively, rising 29% year-on-year to $61.7 trillion, a rise of $13.8 trillion in comparison with 2024.

Binance leads Bitcoin and altcoin buying and selling amid market volatility

The buying and selling quantity of cryptocurrency exchanges continues to extend. In 2025, the mixed worth of CEX and DEX reached $18 trillion in spots and $61 trillion in futures. pic.twitter.com/UqofSO2ScI

January 12, 2026

Final 12 months, Binance led Bitcoin everlasting buying and selling with $25.4 billion, almost half of the overall buying and selling quantity of the highest 10 exchanges. Not far behind, OKX, Bybit, and Bitget shaped a powerful second tier, collectively dealing with 11% to 19% of the site visitors, with Hyperliquid accounting for $2.2 trillion (3.7%).

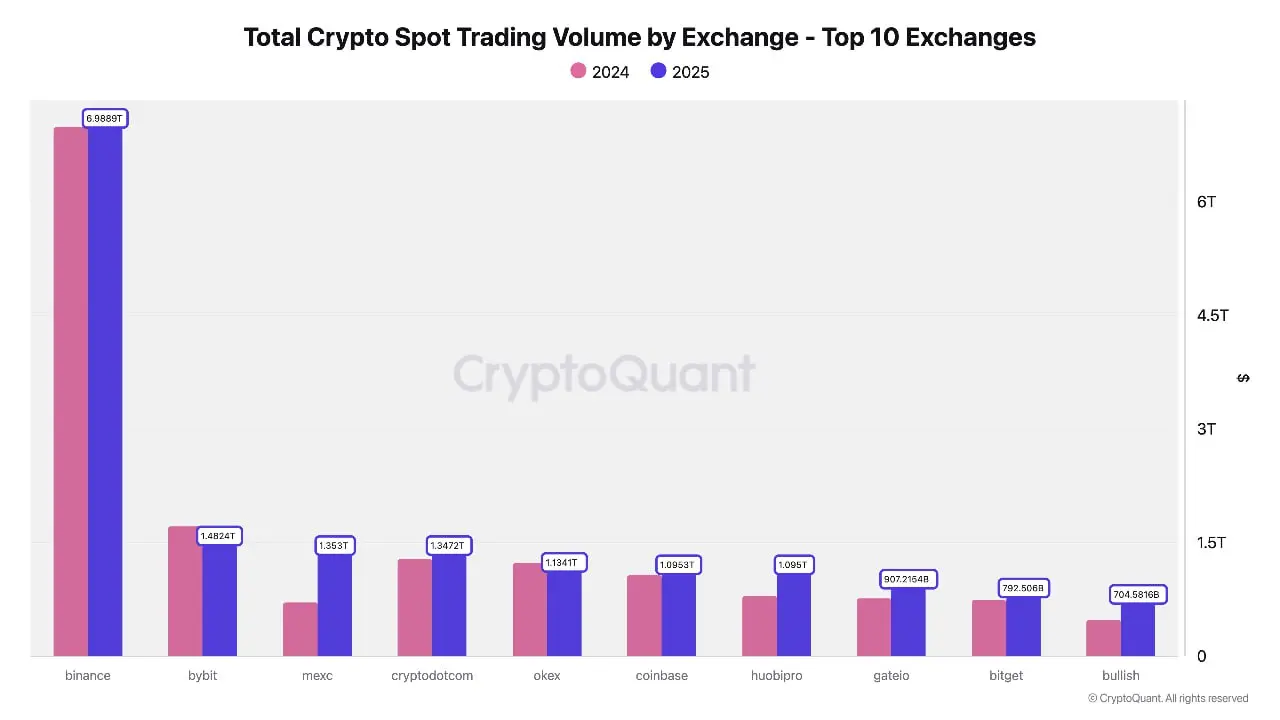

In response to CryptoQuant, the remainder of the platforms, together with Coinbase, collectively contributed This corresponds to roughly 10% of the overall quantity of Bitcoin in everlasting circulation. The analytical platform revealed that almost all of spot buying and selling exercise is focused on a couple of main exchanges. Binance reported spot buying and selling quantity of roughly $7 trillion in its final fiscal 12 months. This $7 trillion accounted for 41% of the highest 10 exchanges’ whole.

Supply: CryptoQuant; spot buying and selling quantity of prime crypto exchanges in 2024-2025.

The analytical platform revealed that Binance dominates each the Bitcoin and altcoin markets with robust exercise. Ethereum, XRP, BNBTRX, and SOL. Bybit, MEXC, and Crypto.com exchanges every have a reported buying and selling quantity of roughly $1.3-1.5 trillion, which varies significantly.

Within the earlier 12 months, Ethereum There was solely slight progress, with a rise of simply 1.68%. in the meantime, BNB rose It rose about 37%, however fell 23% up to now three months in 2025. Despite the fact that short-term profit-taking briefly harm the value, the bullish development signifies strong demand related to the Binance ecosystem.

In response to knowledge from CoinMarketCap, TRON has elevated by about 36 p.c within the final 12 months, however this enhance has declined by 6 p.c up to now three months. Nonetheless, each XRP and Solana ended the 12 months with declines of roughly -15.% and -19.37, respectively. XRP And Solana has had important This fall revisions of roughly -17.53% and -30.16% over the previous three months.

Binance and Coinbase dominate stablecoin reserves, concentrating the market

In response to CryptoQuant, USDT and USDC Binance’s reserves amounted to roughly $47.6 billion final 12 months, representing 72% of the stability of the highest 10 stablecoin exchanges. The analytics platform confirmed OKX and MEXC to be the following leaders with $9.3 billion and $2.2 billion, respectively.

crypto knowledge supplier revealed A small variety of exchanges owned the vast majority of stablecoin liquidity. Bybit, Kraken, and Coinbase had extra modest stakes: Bybit (1.8 billion or 2.8%), Kraken (1.78 billion or 2.7%), and Coinbase (1.1 billion or 1.7%).

CryptoQuant revealed that Binance’s stablecoin reserves reached a brand new report of $51 billion in early November final 12 months. Nonetheless, the crypto knowledge supplier revealed that Binance’s stablecoin reserves amounted to roughly $49 billion on the finish of the 12 months. The evaluation web site confirmed that reserves in 2025 elevated to 51 p.c of the stablecoin reserve degree of 31.7 billion on the finish of 2024.

Reserve statistics present that in 2025, simply two exchanges will maintain greater than half of all reserves, with Binance alone holding $117 billion, which corresponds to a 31.8% enhance in BTC. Ethereum, USDTand USDC. Coinbase got here in second place with 22.1% of $81 billion. In response to preliminary knowledge, Bitfinex got here in third place with $44.4 billion (12.1%), whereas OKX and Upbit managed round $23 billion and $20 billion, respectively.