Cyber Hornet has utilized to register the S&P Crypto 10 ETF (CTX) with the Securities and Alternate Fee. The CTX Index seeks to offer publicity to the highest 10 cryptocurrencies by market capitalization within the S&P Cryptocurrency Broad Digital Asset Index.

CTX index is performing properly $BTC and $ETHAssign 69% to $BTC and from 14% $ETH. furthermore, $XRP The holding publicity is 5%, Binance Coin 4%, Solana 2%, TRON 1%, Cardano 0.5%, Bitcoin Money 0.4%, Chainlink 0.3%, and Stellar 0.2%.

Balchunas says CTX Basket might grow to be the primary S&P-linked spot ETF

Eric Balchunas, senior ETF analyst at Bloomberg, revealed that Cyber Hornet is making use of for the S&P Crypto 10 ETF (CTX), which might grow to be the primary S&P-linked spot basket. Balchunas mentioned the battle for crypto basket ETF supremacy is just heating up, an indication of accelerating competitors amongst issuers for diversified spot publicity merchandise.

Cyber Hornet has filed for the S&P Crypto 10 ETF (CTX), which might (I consider) be the primary S&P-linked spot basket. The battle for supremacy in digital forex basket ETFs is intensifying.

Holdings breakdown: Bitcoin (69%), Ethereum (14%), $XRP (5%), Binance Coin (4%), Solana (2%), Tron (1%), Cardano… pic.twitter.com/bamvvf8MFA— Eric Balchunas (@EricBalchunas) January 23, 2026

CTX basket is usually advantageous $BTChas grow to be a Bitcoin-dominated ETF. Highlights of this motion $BTC‘s management Whereas it at present has a market capitalization of over $1.5 trillion and is the closest asset in your complete cryptocurrency business; $ETHwhich can solely make $356 billion. $BTC Present benefit is up 59%, adopted by $ETH At 11%. The remaining cryptocurrencies maintain a cumulative 29% share of the market.

On the time of publication, $BTC On the weekly chart, the inventory fell 5.97% to commerce at $89,449, giving it a market cap of $1.79 trillion. $ETH On the weekly chart, the inventory was down 10.24% and was buying and selling at $2,953 with a market cap of $356.4 billion. The third largest token by market capitalization up to now is $XRPwith a market capitalization of $116.5 billion. of $XRP The token fell 7% on the weekly chart, buying and selling For $1.91.

In keeping with Cryptopolitan reportspot crypto ETFs usually provide probably the most direct publicity to cryptocurrencies by holding them. $BTC, $ETHand $XRP. The worth of a spot ETF strikes in correlation with the real-time worth of the underlying token, with minimal deviation.

BlackRock’s IBIT ETF leads spot $BTC ETF house

In the intervening time, BlackRock’s iShares Bitcoin Belief (IBIT) ETF is likely one of the greatest spots $BTC ETF. Moreover, there’s the VanEck Ethereum ETF (ETHV), which gives publicity to Ethereum, and Solana’s REX Osprey SOL Plus Stacking ETF (SSF).

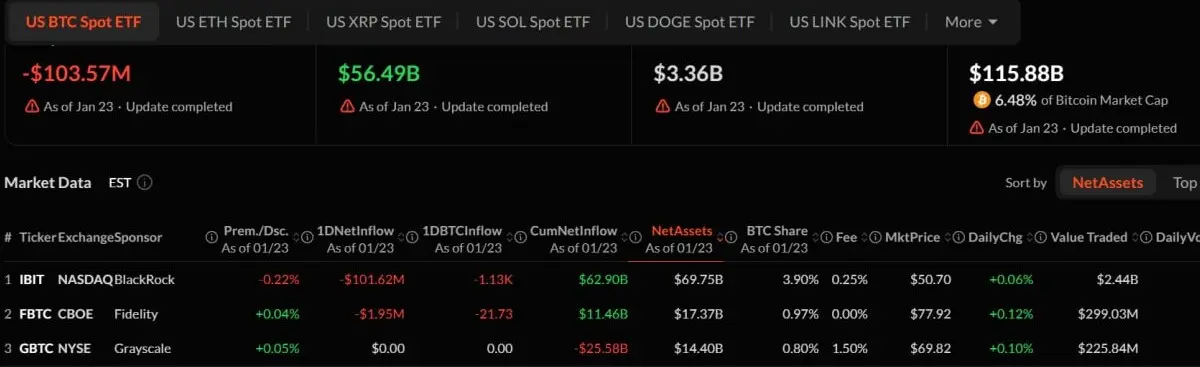

However, monitoring digital forex ETFs is $BTC Holds roughly 1,502,560 items $BTCin response to on-chain knowledge. This equates to a complete of roughly $134.5 billion, or roughly 7% of the entire. $BTC provide. The IBIT ETF dominates this house with a complete web asset worth of $69.75 billion, adopted by the Constancy Clever Origin Bitcoin Fund (FBTC) with a complete web asset worth of $17.37 billion.

us $BTC Breakdown of spot ETFs. Supply: SoSoValue.

Grayscale Bitcoin Belief (GBTC) is the world’s third largest spot crypto ETF. $BTCwith a complete web price of roughly $14.4 billion. On the time of publication, the IBIT ETF had cumulative web inflows of $62.9 billion, FBTC had $11.46 billion, and GBTC had misplaced roughly $25.5 billion as a result of withdrawals.

Traders are exhibiting curiosity in ETFs as a result of regulatory oversight that gives larger transparency and safety. ETFs are simply accessible, identical to common shares traded on U.S. inventory exchanges. CTX ETF achieves danger diversification by holding a number of crypto property. This technique tends to unfold the danger throughout, so even when one asset within the basket underperforms, different property can carry out higher and steadiness the portfolio.