Locked liquidity for Decentralized Monetary (DEFI) functions reached a document of $270 billion in July.

Dappradar’s information exhibits that the locked complete worth (TVL) of the Defi protocol jumped 30% in months, with lively wallets in tokenized stock rising by round 1,600 to over 90,000, leading to a 220% enhance in market capitalization.

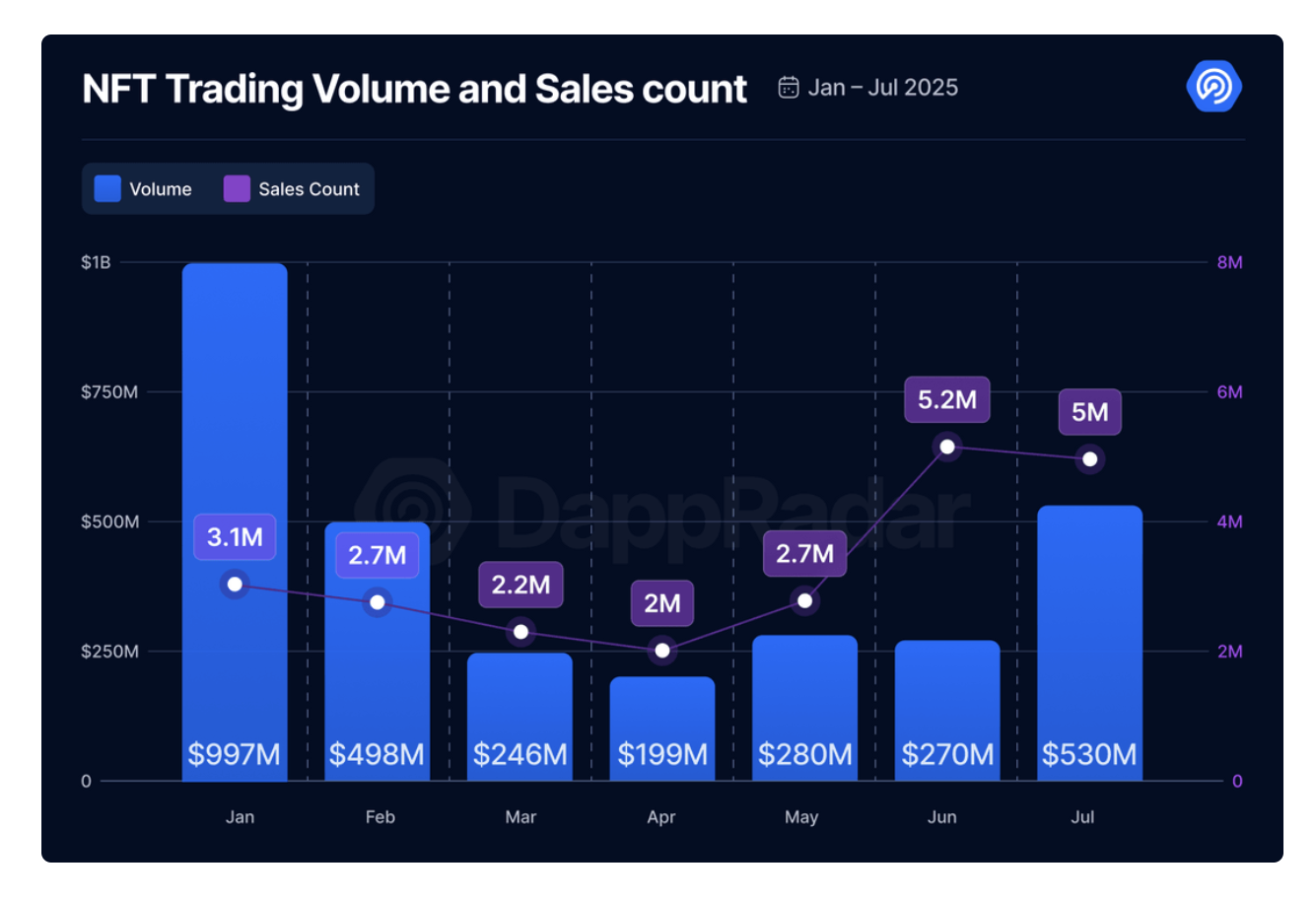

In the meantime, NFT buying and selling quantity rose 96% that month to $530 million. The typical NFT worth doubled to about $105, as extra customers are engaged available in the market.

The sting of the NFT exercise edges earlier than defi

Whereas defi liquidity was rising, person consideration shifted elsewhere. In July, roughly 3.85 million of the 22 million lively wallets interacted with NFT DAPP each day.

Ethereum-based market brule drove a lot of its exercise, incomes as much as 80% of its each day NFT quantity, whereas Opensea has surpassed lively customers with round 27,000 merchants. Zora additionally gained momentum with creator First Layer 2 and $ZORA tokens for low-cost mint.

https://www.youtube.com/watch?v=hpnl-1zrqxk

Main manufacturers continued to experiment with NFTs. Nike.swoosh has partnered with EA Sports activities for Digital Sneaker Drops, and Louis Vuitton, Rolex and Coca-Cola (China) have launched licensed and collectable pilots.

NFT buying and selling quantity additionally rose about 36% in July, up from $389 million in June, however has declined from 2025 at $997 million in January.

Supply: DAPP Radar

As reported by Cointelegraph, there was a revival of curiosity in OG NFT collections like Cryptopunks. Information from NFT flooring costs exhibits that Ethereum-based collections have risen by greater than 25% over the previous month.

Over the previous 24 hours, 9 of the highest 10 NFT gross sales have been crypto vegetation. The one non-punk sale is NFT from web3 artist Beeble.

Associated: Memecoin $79B rally means capital cannot go wherever: exec

The NFT market is much from the 2021 increase

Regardless of the rebound in July, the NFT stays overwhelming in comparison with previous peaks. Dappradar’s 2024 business overview exhibits that NFT buying and selling quantity fell 19% a yr in the past and gross sales fell 18%, making 2024 one of many weakest years since 2020.

Cryptoslam information for H1 2025 additional highlights sluggish restoration. NFT gross sales totaled $2.82 billion, down 4.6% from the second half of 2024.

There was a notable revival in July, however buying and selling volumes and flooring costs have risen, however when buying and selling volumes went all the way down to tens of hundreds of thousands, the market was properly beneath the 2021 excessive.