desk of contents

The place did the quote actually come from? What did Fink truly say? Are the debt issues actual? Why does this preserve occurring with cryptocurrencies? Continuously Requested Questions

No, it wasn’t. Varied posts on X declare that BlackRock CEO Larry Fink warned that the US greenback would flip into “monopoly cash” and finally be “deserted.” A number of accounts repeat that as truth. However this quote is just not Fink’s. This comes from a Reddit person, and it is simple to comply with when you truly learn the supply materials.

The place did that quote actually come from?

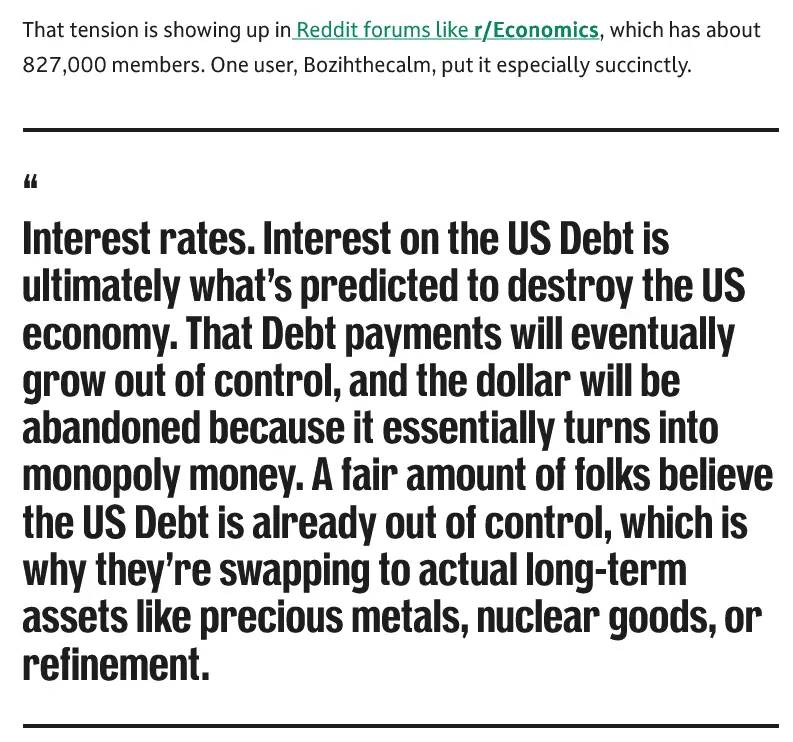

On January 18th, TheStreet revealed an article highlighting the US nationwide debt of over $38 trillion. In it, they cited a Reddit person named Bozihthecalm on the r/Economics subreddit who wrote: “Debt funds will finally get uncontrolled and the greenback will probably be deserted because it basically turns into monopoly cash.”

TheStreet clearly introduced this as an internet remark, not as an government assertion. However someplace between Reddit, TheStreet, and X, the attribution modified. Accounts started pairing the quote with photographs of Fink and the Bitcoin brand, as if the pinnacle of the world’s largest asset administration firm had personally issued a warning concerning the collapse of the greenback.

he did not.

Misattributed Quotes (thestreet.com)

What did Fink truly say?

Fink’s actual feedback have been made on CNBC’s “Squawk on the Road” on January fifteenth. interviewthe place he mentioned BlackRock’s fourth-quarter 2025 earnings and the broader financial system. He spoke brazenly about debt points, however was removed from apocalyptic.

“We did not have fiscal self-discipline…We’re over $38 trillion, proper? We’re rising it. We elevated it final 12 months and we’ll enhance it this 12 months,” Fink stated. He famous that markets proceed to fixate on the Federal Reserve whereas ignoring rising fiscal dangers, including that the debt headlines are “touchdown with a boring thud” regardless of its significance.

He warned that giant price range deficits proceed to drive up rates of interest as a result of “we do not have sufficient financing capability.” However he additionally expressed optimism, arguing that sustaining 3% GDP development over the subsequent 10 to fifteen years might truly cut back the debt-to-GDP ratio, even with giant deficits.

There isn’t any “monopoly cash.” There isn’t any “abandonment”. It merely combines requires fiscal self-discipline with cautious optimism about development.

However are debt issues actual?

completely. The underlying numbers are critical sufficient without having fabricated quotes to promote it.

As of January 7, the US nationwide debt was $38.43 trillion. By February 4th, it had reached $38.56 trillion. Public debt curiosity funds reached $276 billion within the first quarter of fiscal 2026, a rise of 13% from a 12 months earlier, in line with the CBO. As of January 2026, the typical rate of interest on whole marketable debt was 3.35%, and full-year 2025 internet curiosity expense exceeded $1 trillion for the primary time in historical past.

The Committee for a Accountable Federal Funds calls trillions of {dollars} in curiosity funds the “new regular.” That is not a Reddit person’s guess. That is the baseline.

Why does this preserve occurring with cryptocurrencies?

As a result of sensational headlines drive engagement, which drives value motion. Mix a robust title like Larry Fink with a dramatic declare that the greenback is doomed, embody the Bitcoin brand, and your publish will probably be written robotically.

Fink has actually develop into one among crypto’s greatest institutional allies. he went from Bitcoin I am skeptical concerning the launch of the iShares Bitcoin Belief ETF (IBIT), which raised greater than $50 billion in property in its first 12 months. In his 2025 annual letter, he acknowledged that Bitcoin might problem the greenback’s reserve standing if the deficit continues unchecked. A bullish case doesn’t require a false quote to face by itself.

However reliability is necessary. When the crypto trade disguises Reddit feedback as CEO warnings, it fuels the very narrative that critics use to disparage the trade. Please verify earlier than amplifying.

supply:

- The Road — Reddit person Bozihthecalm’s unique article on r/Economics, with context from Fink’s CNBC interview

- JEC month-to-month debt replace — U.S. authorities debt knowledge as of January 7, 2026

- Committee for a Accountable Federal Funds — Evaluation of internet curiosity funds exceeding $1 trillion in 2025

- peterson basis — Curiosity value tracker exhibiting spending knowledge for the primary quarter of fiscal 12 months 2026

- crypto slate — Protection of Fink’s 2025 Annual Letter on Bitcoin and Greenback Dangers