U.S. shares opened with a burst of optimism on Wednesday, however that enthusiasm light by mid-afternoon as stronger-than-expected jobs numbers pushed up Treasury yields and waned hopes for short-term rate of interest cuts from the Federal Reserve.

Early Wall Avenue pop wanes as scorching jobs knowledge pushes yields greater, weighs on shares

On the time of this writing, February 11, 2026, the Dow Jones Industrial Common, after briefly rising greater than 300 factors in early buying and selling, was down about 120 factors, or 0.2%, to round $50,068. The S&P 500 index fell about 0.2% to about 6,928, and the Nasdaq Composite Index fell 0.5% to about 23,000. Markets stay open and intraday fluctuations proceed.

The set off was the non-farm payroll report for January, which was delayed as a result of latest authorities shutdown, and confirmed that the variety of workers elevated by 130,000, far exceeding the estimate of almost 50,000. The unemployment price fell from 4.4% to 4.3%, strengthening the view that the labor market stays robust.

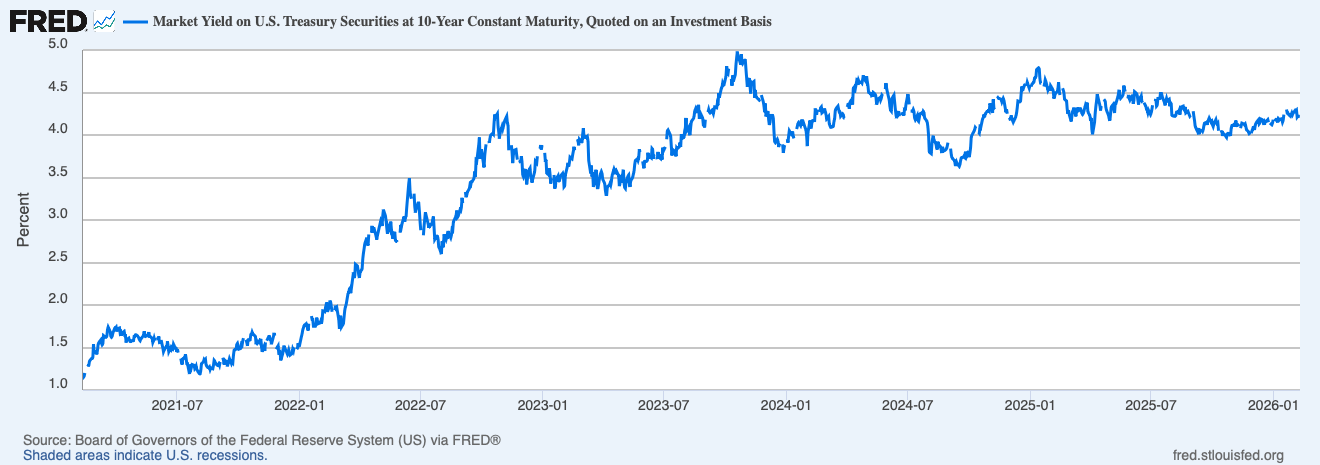

That power had its pitfalls. Authorities bond costs fell, and the yield on 10-year bonds rose to about 4.22% from about 4.18% beforehand. Increased yields usually weigh closely on inventory valuations, particularly in areas of excessive market progress. Merchants are recalibrating their expectations that the Fed will ease in 2026, with restricted rate of interest cuts now factored in and most expectations transferring past mid-year.

The estimated market yield on a 10-year fastened maturity U.S. Treasury invoice, on an funding foundation, represents the annualized return an investor would require to carry a 10-year U.S. Treasury bond, expressed as a share of its worth relatively than its face worth.

The reversal marks a change from Tuesday’s shut, when the Dow Jones Industrial Common set a three-year report of fifty,188.14. Nevertheless, the S&P 500 and Nasdaq closed decrease, reflecting strain from weak retail gross sales knowledge and selective profit-taking in tech shares.

Earnings season added additional cross-currents. Vertiv Holdings rallied sharply after reporting a constructive outlook associated to knowledge heart demand, whereas Lyft, Robinhood and Mattel fell after weak earnings and outlooks. Inventory-specific reactions widen sector efficiency disparities, and volatility stays elevated regardless that index-level actions seem modest.

Expertise shares and communications companies shares that led the latest advances within the synthetic intelligence (AI) craze have confronted new scrutiny. Monetary shares had been comparatively resilient as rising yields supported internet curiosity margins, whereas power shares had been supported by robust oil costs amid geopolitical tensions.

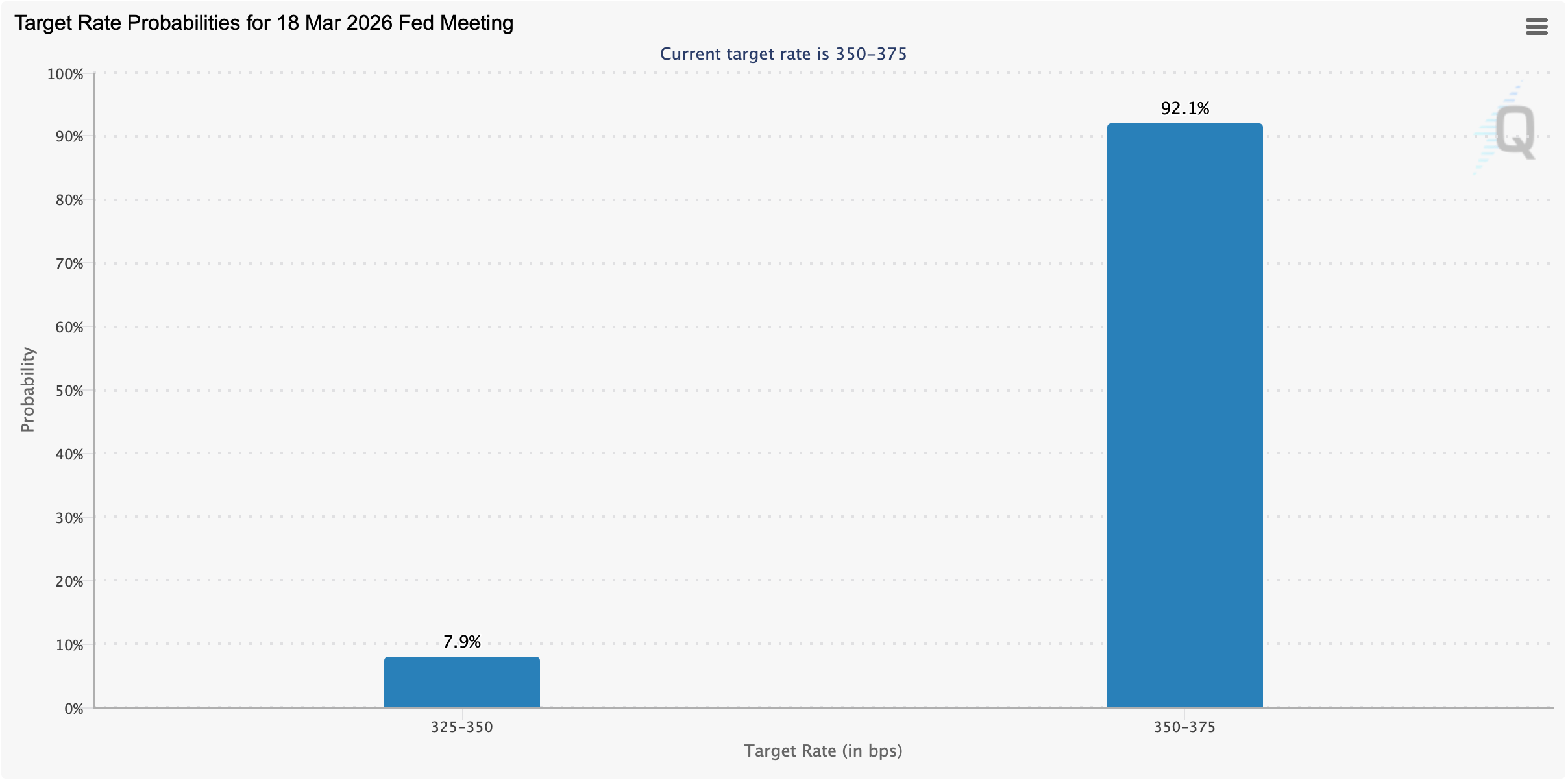

As of Wednesday, February 11, the US Federal Reserve is extensively anticipated to maintain the federal funds price unchanged when policymakers reconvene in 35 days.

Valuable metals similar to gold and silver rose on Wednesday, with gold rising 0.66% to above the $5,000 degree. Silver was buying and selling at $83 per ounce, up 2.43% from the day gone by. Like U.S. shares, the cryptocurrency financial system has fallen, with the sector falling 3.2% to $2.28 trillion by noon. Bitcoin has fallen 3.8% in opposition to the greenback over the previous seven days.

Wanting forward, Friday’s Client Worth Index (CPI) report will seemingly be the spotlight occasion of the week. Inflation knowledge may both strengthen the “long-term excessive” narrative or reopen the door to early rate of interest easing. evaluationsts expects fourth-quarter earnings progress for the S&P 500 index to be near 12%, with forecasts for 2026 anticipated to be within the mid-teens, however these assumptions are topic to secure inflation and secure demand.

For now, the market message is evident. Sturdy financial knowledge is welcome, however not if it complicates the Fed’s path. With the CPI on observe and income nonetheless beginning to roll in, Wall Avenue seems poised for extra intraday whiplash earlier than the week ends.

Steadily requested questions 📉

- Why did US shares fall at midday on February 11, 2026?U.S. Treasury yields rose after January’s better-than-expected jobs report, denting expectations for the Federal Reserve’s short-term rate of interest cuts.

- How do authorities bond yields have an effect on the inventory market?Rising yields improve borrowing prices and weigh on inventory valuations, particularly for growth-oriented shares.

- Which indexes are underperforming at the moment?The Nasdaq Composite has fallen far behind the Dow and S&P 500.

- What would be the subsequent main catalyst for the market this week?Friday’s Client Worth Index (CPI) knowledge may form expectations for inflation and Federal Reserve coverage.