The drift tokens driving the Solana-based Perpetuals Change Drift protocol surged greater than 40% on Monday after the platform surpassed $1 billion for $1 billion over the weekend.

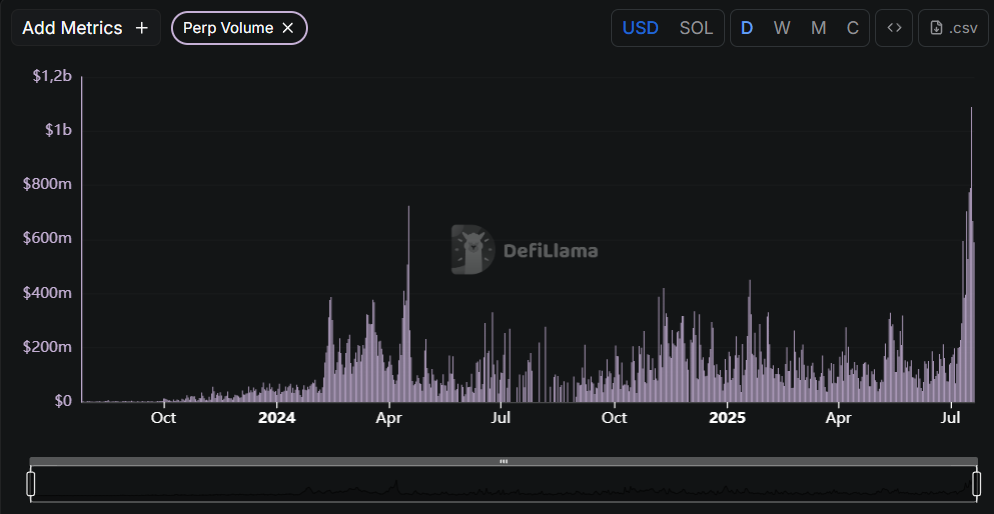

In accordance with Defillama information, the token rally launched after Drift quickly turned the second largest Perpetuals Dex in all chains, changing into the second largest everlasting Dex in quantity in all chains, taking Solana’s high spot. The quantity spike on July 18 reached $1.089 billion, beating earlier all-time highs from April 2024, with Drift seeing a PERPS deal of about $720 million in sooner or later.

Drift Protocol Every day Purge Quantity. Supply: Defilama

Nevertheless, on the time of reporting, the protocol ranks fourth in perpetual each day buying and selling volumes throughout the chain, monitoring solely Edgex, Jupiter and excessive lipids. Hyperliquid leads the pack with greater than $13 billion Parp volumes, then the biggest Jupiter, wanting slightly below $1 billion.

Amid this inflow of on-chain buying and selling, drift rose above 40% to peak at $0.73 right this moment, and now it has risen over 33%, however token buying and selling quantity has grown by greater than 2800% to $323 million based mostly on Coingecko information.

Drift Protocol TVL. Supply: Defilama

Drift’s Complete Worth Locked (TVL) presently sits at round $1.13 billion. A lot of this might come from a drift acquisition program.

The newest wave of exercise seems to be linked to the motion drift that came about earlier this month. On July tenth, the protocol launched Zero Price ETH Perpetual with as much as 101x leverage. Which means that merchants had been in a position to open massive positions with out paying buying and selling charges.

For days after the rollout, the amount of everlasting futures buying and selling throughout Solana elevated by 234%, and drift seems to have picked up a good portion of that exercise, indicating that merchants are actually accommodating zero-fee, high-leverage setups.