Decentralized bodily infrastructure (DePIN) protocol Peak has signed a memorandum of understanding with Dubai’s Digital Property Regulatory Authority (VARA) to develop a regulatory framework for on-chain robotics and tokenized machines.

In line with Thursday’s press launch, the memorandum focuses on peaq’s Machine Financial system Free Zone and in addition contains extra areas of cooperation corresponding to steerage for tasks searching for VARA licenses, joint coaching efforts in expertise and compliance, and knowledge sharing to help analysis and regulation.

The Machine Financial system Free Zone, which opened in July, is a managed surroundings to check how robotics and AI work inside a decentralized community.

Peaq co-founder Max Teke stated the settlement “represents a major dedication from either side to allow the machine financial system in a compliant method, enabling individuals to take part in, construct, and revenue from completely new financial sectors.”

Man and machine on the height. sauce: peak.xyz

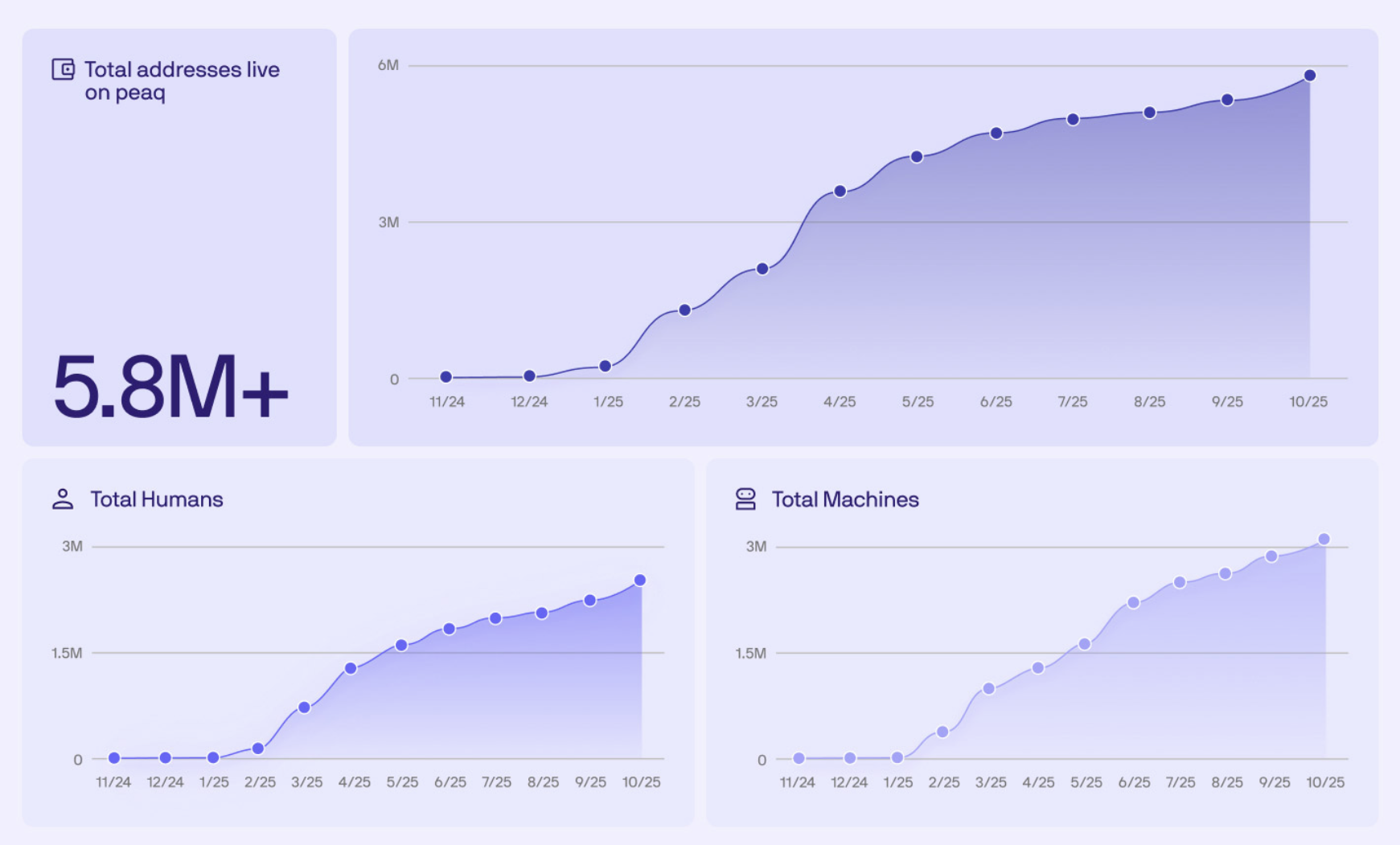

Peaq is a layer 1 blockchain for the machine financial system, a community the place related units and robots can personal belongings, share knowledge, and earn earnings. Powering DePIN and tokenized real-world belongings.

VARA is Dubai’s cryptocurrency and digital belongings regulatory company. Established in 2022, it oversees licensing, compliance and coverage for digital asset companies throughout the emirate.

The announcement comes a few week after VARA entered right into a strategic partnership with DMCC, Dubai’s government-backed commodity and enterprise free zone, to develop a regulatory framework for tokenized merchandise.

Matthew White, CEO of VARA, stated the company goals to “place Dubai as a worldwide benchmark for secure and sustainable progress on this subsequent technology asset class”.

Associated: Singapore and UAE are the “most crypto-obsessed” nations: report

Cryptocurrency promotion in Dubai and UAE

Since VARA was established in March 2022 to supervise the regulation of cryptocurrencies and Web3, it has helped rework Dubai and all the UAE into one of many world’s main digital asset and blockchain innovation hubs.

On Could 19, VARA up to date its rulebook for home digital asset service suppliers (VASPs) to make clear the issuance and distribution of RWAs. In line with UAE-based regulation agency NeosLegal, the brand new guidelines will permit individuals to problem RWAs and listing them on the secondary market.

In August, VARA and the UAE Securities and Commodities Authority (SCA) entered right into a strategic partnership to synchronize regulatory approaches for digital belongings. Beneath the settlement, the Dubai-based license will apply throughout the UAE.

On September 22, the UAE signed the Multilateral Competent Authority Settlement below the Crypto Asset Reporting Framework (CARF) to ascertain automated tax info sharing on crypto belongings amongst member states. The Ministry of Finance stated the framework will come into pressure in 2027, with the primary knowledge change scheduled for 2028.

Dubai and the UAE’s strategy to digital belongings is understandably attracting high-net-worth crypto buyers to relocate. The UAE has turn into a serious vacation spot for millionaires, with round 9,800 individuals anticipated to maneuver there in 2025.

Chase Ergen, director of crypto funding agency DeFi Applied sciences, predicts that the crypto sector will develop to turn into the UAE’s second-largest trade inside 5 years.

journal: Crypto Metropolis: Dubai Information