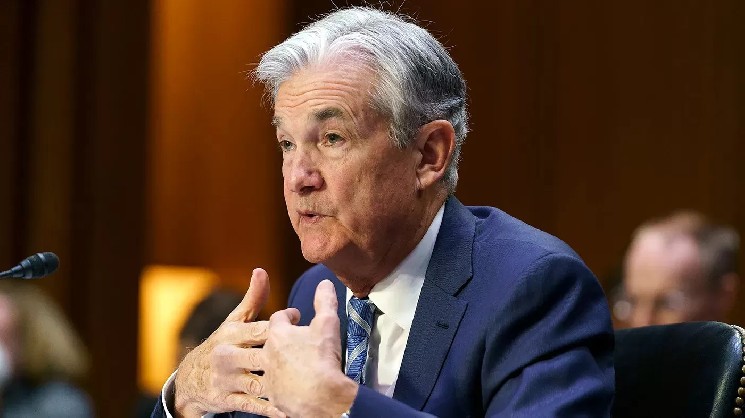

Jeremy Siegel, a finance professor on the Wharton College of Administration on the College of Pennsylvania, stated he expects the Fed to chop rates of interest at its assembly this week, however in a “hawkish” tone.

Mr. Siegel was a visitor on CNBC’s “Squawk Field,” the place he gave a crucial evaluation of the Fed’s much-anticipated selections, the nomination of the following Fed chairman, and the way forward for rates of interest.

Siegel stated he expects the Fed to chop rates of interest by 25 foundation factors this week, however the determination will not be unanimous. “I am calling this a ‘hawkish minimize,’ as a result of I feel there can be opposition from either side,” Siegel stated.

Mr. Mester, the Fed’s director, may push for a deep 50 foundation level minimize, however two or three Fed members may vote to maintain charges on maintain, he stated. Siegel added: “In that case, this may very well be probably the most dissenting opinion of Jerome Powell in his practically eight years as chairman.”

Mr. Siegel additionally talked concerning the candidate for brand spanking new Federal Reserve head, who can be introduced by new President Donald Trump early subsequent 12 months, noting that Kevin Hassett’s identify has been floated.

“The percentages that Kevin Hassett will develop into the following Fed chairman are at the moment about 70%,” Siegel stated. “Even when his identify isn’t formally introduced, Mr. Hassett’s rhetoric will begin to transfer the market way more than it has prior to now.” Mr. Siegel additionally famous that he and Mr. Hassett labored collectively on John McCain’s campaigns prior to now, calling him a “nice economist.”

Governor Siegel was cautious concerning the affect of fee cuts on the bond market, saying he didn’t count on long-term rates of interest to fall considerably.

Mr. Siegel elaborated on his evaluation: “In the event you take a look at the previous 75 years, we see that the federal funds fee has been about 100 foundation factors beneath the 10-year Treasury yield. Presently, the 10-year Treasury yield is 4.15%, which suggests the federal fee may fall beneath 3%. Nevertheless, this may occasionally not considerably decrease long-term charges and, by extension, mortgage charges.”

However, Siegel stated the speed minimize would assist the financial system: “Greater than $15 trillion in loans are tied on to the federal funds fee. Quick-term borrowings akin to auto loans, stock loans, and bank card charges are instantly affected. This may positively stimulate the financial system.”

Siegel added that regardless of considerations about tariffs, the financial system is at the moment holding up nicely and has not seen a big slowdown in gross sales.

*This isn’t funding recommendation.