Based on Sharplink Gaming Co-CEO Joseph Chalom, if the market falls, corporations making an attempt to slim their holdings by buying ether are considerably extra dangerous if the market falls.

“There will probably be folks like conventional finance who need to get that final 100 foundation factors yield.

He mentioned there are methods to attain double-digit yields with ether (ETH), however there’s a severe danger.

“It comes with credit score danger, counterparty danger, period danger, sensible contract danger,” he mentioned, including that corporations making an attempt to make up the misplaced floor additionally pose actual dangers.

“I believe the most important danger is that people who find themselves far behind take dangers that I do not suppose are clever.”

The broader business may be contaminated by “uncommon” actions

Charom mentioned the sector might be “contaminated by individuals who do issues which might be impolite,” together with how they elevate capital and the way they differentiate themselves with the yields that stem from their holdings of ETH.

“When you’re overbuilt and there is a recession, how do you test your name construction in such a method that it builds on Ethereum’s highest worth?” he mentioned.

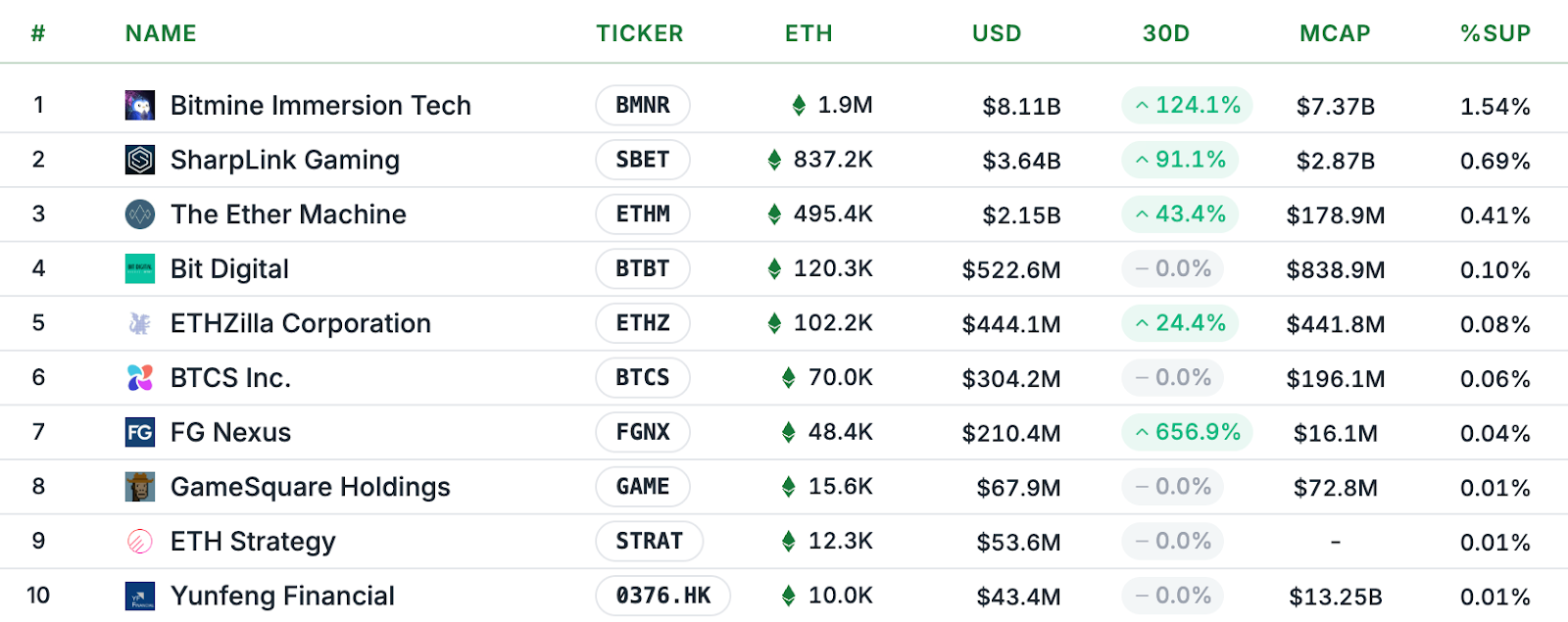

Sharplink Gaming is ETH’s second-largest public proprietor, price $3.6 billion and solely tracks after Bitmine Immersion Applied sciences, which holds $8.03 billion.

High 10 ether finance corporations by Holdings. sauce: Strategic

Based on StrategicEthReserve information, ETH Treasury corporations personal round 3.6 million ETH, price round $15.466 billion on the time of publication.

Some view fashions as disastrous penalties

Josip Rupena, CEO of lending platform Milo and former Goldman Sachs analyst, instructed Cointelegraph lately that Crypto Treasury Companies poses comparable dangers to secured debt, securitized baskets of mortgages and different varieties of debt that precipitated the 2008 monetary disaster.

In the meantime, Bitwise Chief Funding Officer Matt Hougan lately mentioned that the Ethereum Treasury and the holding firm solved the difficulty of the Ethereum narrative by packaging digital property in methods conventional buyers perceive and that may pull out extra capital and speed up recruitment.

Associated: Ether breaks underneath the “Tom Lee” development line: 10% in it?

Chalom mentioned the “stunning factor” about ETH finance corporations is that they are often expanded nearly infinitely. Based on CoinmarketCap, Ether was traded for $4,327 on the time of publication.

Issues a few broader cryptocurrency mannequin have lately elevated.

GlassNode lead analyst James Test mentioned in a July fifth X publish, “Intuition is that Bitcoin (BTC) monetary technique has a a lot shorter lifespan than most anticipated.”

On June 29, Enterprise Capital (VC) Company Breed mentioned just a few Bitcoin finance corporations will stand the take a look at of time and keep away from a vicious “loss of life spiral” that may have an effect on BTC holding corporations which might be near their web asset worth.

journal: Bitcoin to see “one other huge thrust” at $150K builds the strain of ETH: Company Secrets and techniques