ether of ethereum Ethereum$3,197.03 A pointy decline from Thursday to Friday accelerated the market-wide decline in cryptocurrencies as Bitcoin fell beneath the $100,000 degree, dropping greater than 10% from excessive to low.

The second-largest cryptocurrency fell from $3,565 early Thursday to $3,060 by early Friday, erasing all of final week’s rebound. It has lately stabilized beneath $3,200, however remains to be down about 8% previously 24 hours.

The transfer coincided with a broader market decline within the U.S. market, with shares and bonds additionally falling in tandem with cryptocurrencies. The just-ended US authorities shutdown weighed on liquidity situations. Including to the stress is the rising chance that the Fed will depart rates of interest unchanged at its December assembly.

U.S.-listed spot ether ETFs have seen web outflows of $1.4 billion for the reason that Federal Reserve in late October, when Chairman Jerome Powell threw chilly water on a near-universally anticipated December rate of interest minimize, in line with information from Pharcyde Buyers. Thursday’s outflow of about $260 million was the most important single-day outflow of the month.

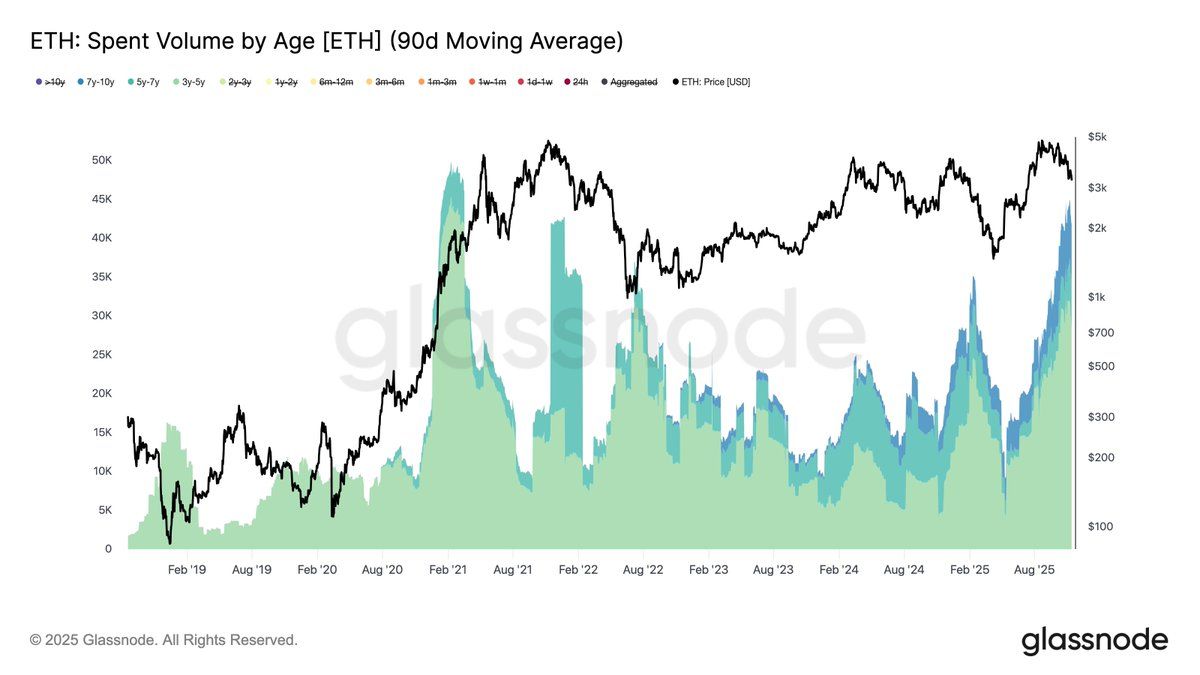

As well as, long-term holders are additionally heading for the exit. Based on Glassnode blockchain information, long-term holders of three to 10 years are accelerating gross sales to round 45,000 ETH (roughly $140 million at present costs) every day on a 90-day shifting common, the best tempo of circulation since February 2021.

Promoting by long-term Ether holders is accelerating. (glass node)

Blockchain information additionally suggests deteriorating fundamentals. Month-to-month lively addresses on the community fell to eight.2 million from greater than 9 million in September, whereas transaction charges over the previous month fell 42% to simply $27 million, in line with Token Terminal information.

Foremost technical ranges to concentrate on

Based on CoinDesk Analysis’s technical evaluation mannequin, ETH has damaged the important thing assist degree at $3,325 and established a transparent bearish development to new consecutive highs.

- Assist/Resistance: Main assist is at $3,080, with secondary flooring at $3,050 and $2,880. Key resistance ranges type at $3,330 (earlier assist), $3,500 (major pivot), and $3,650 (descending channel excessive).

- Quantity Evaluation: Gross sales peaked at 641,103 throughout a $3,325 breakdown, 71% above the 24-hour baseline. Buying and selling quantity subsequently declined to 80% of its 7-day common, indicating potential depletion.

- Chart Sample: ETH has damaged the April ascending channel, making a bearish construction with decrease highs. The consolidation vary between $3,077 and $3,146 suggests a attainable base formation.

- Goals and Danger/Reward: A breakout of the $3,050 assist exposes the draw back of $2,880, however bullish momentum requires a retake of $3,563. A decisive rise above $3,500 targets $3,650 to $3,800.

Disclaimer: Parts of this text have been generated utilizing AI instruments and reviewed by our editorial workforce to make sure accuracy and compliance with requirements. For extra data, please see CoinDesk’s full AI coverage.