The worth of Ether (ETH), the native cryptocurrency of the Ethereum Layer 1 blockchain community, will backside out in April 2025, and its worth pattern mirrors the 2019 cycle, in accordance with market analyst Michael Van de Poppe.

Van de Poppe stated the proliferation of stablecoins, tokenized real-world property (RWA), that are conventional or bodily property represented as tokens on the blockchain, and developer exercise on the Ethereum community are causes to be bullish on Ethereum’s worth.

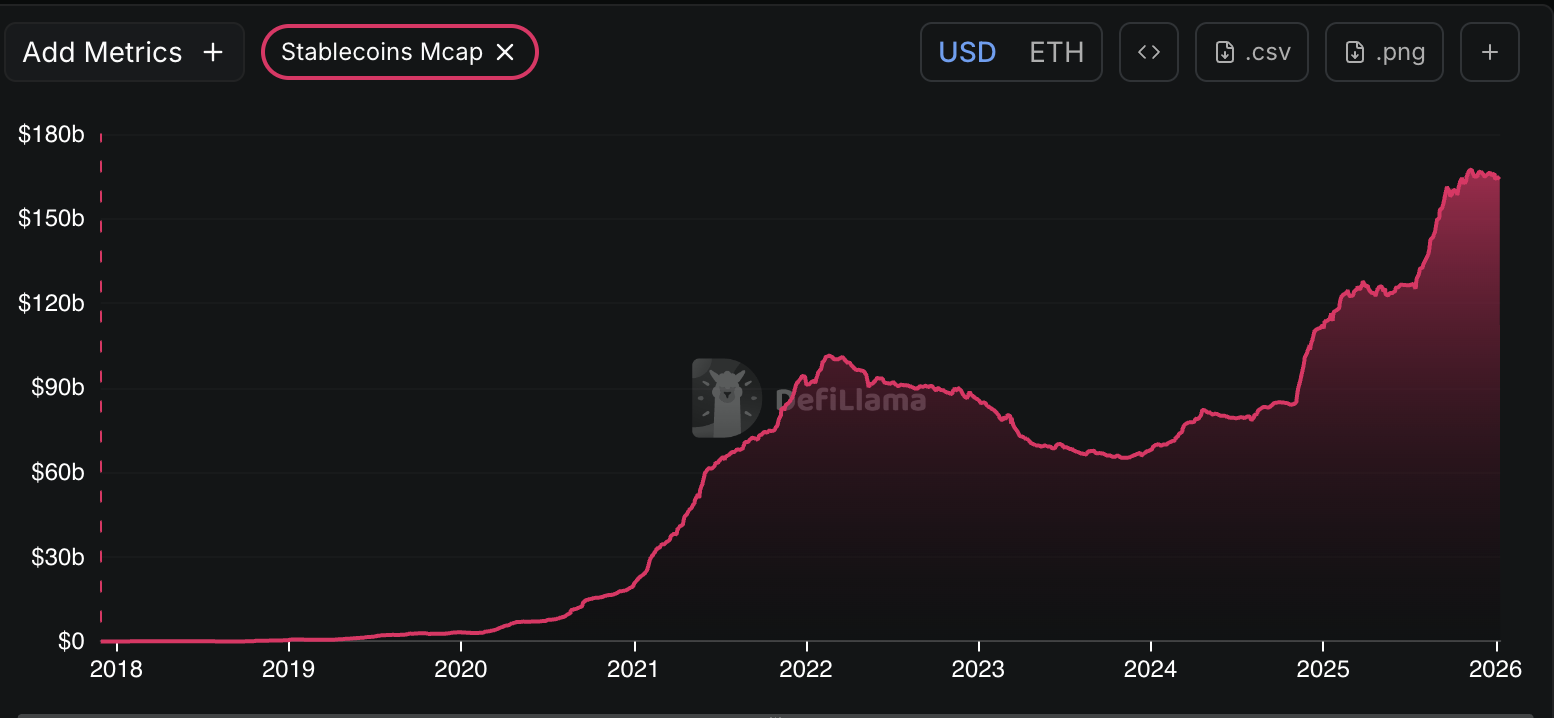

“Ethereum stablecoin provide elevated by over 65% in 2025, doubling from its peak in 2021,” he wrote in a submit on Sunday X.

Ethereum stablecoin market capitalization. sauce: Defilama

In line with DeFiLlama, Ethereum’s stablecoin market capitalization exceeds $163.9 billion, with roughly 52% of the market capitalization accounted for by stablecoin issuer Tether’s USDt (USDT) dollar-pegged stablecoin.

In line with Token Terminal, Ethereum processed roughly $8 trillion in stablecoin switch quantity within the fourth quarter of 2024 alone.

Contrarian evaluation of investor sentiment that ETH is useless or dying led ETH to briefly surpass $3,300 and above its 365-day shifting common, however has since fallen to round $3,100, the value on the time of publication.

ETH rose above the 365-day EMA earlier than returning to the $3,100 degree. sauce: TradingView

Associated: Will ETH worth attain $5,000 subsequent? Final time this occurred, Ether recovered 120%

ETH-BTC ratio displays the 2019 cycle

“ETH is alleged to be useless as a result of it has been in a downward pattern for 4 years towards Bitcoin (BTC). However it has bottomed out since April 2025 and we’re already within the Ethereum market,” Van de Poppe stated.

He shared a chart of the Ethereum-Bitcoin (ETH-BTC) ratio, an indicator that tracks the value and energy of ETH towards BTC, which bottomed at round 0.017 in April and rose to an area excessive of 0.043 in August 2025.

The ETH-BTC ratio bottomed out in April 2025 and has since recovered. sauce: michael van de poppe

Following the market-wide crash in October, which disrupted the upward pattern in costs within the crypto market, this ratio rose to its present degree of 0.034 on the time of writing.

In line with crypto market evaluation agency Santiment, present investor sentiment in the direction of Ethereum is just like the investor sentiment sample earlier than earlier worth will increase.

journal: Ethereum’s Fusaka fork defined to freshmen: What precisely is PeerDAS?