TL; PhD

- Ethereum will repeat its 2020 breakout setup to boost expectations for potential main gatherings.

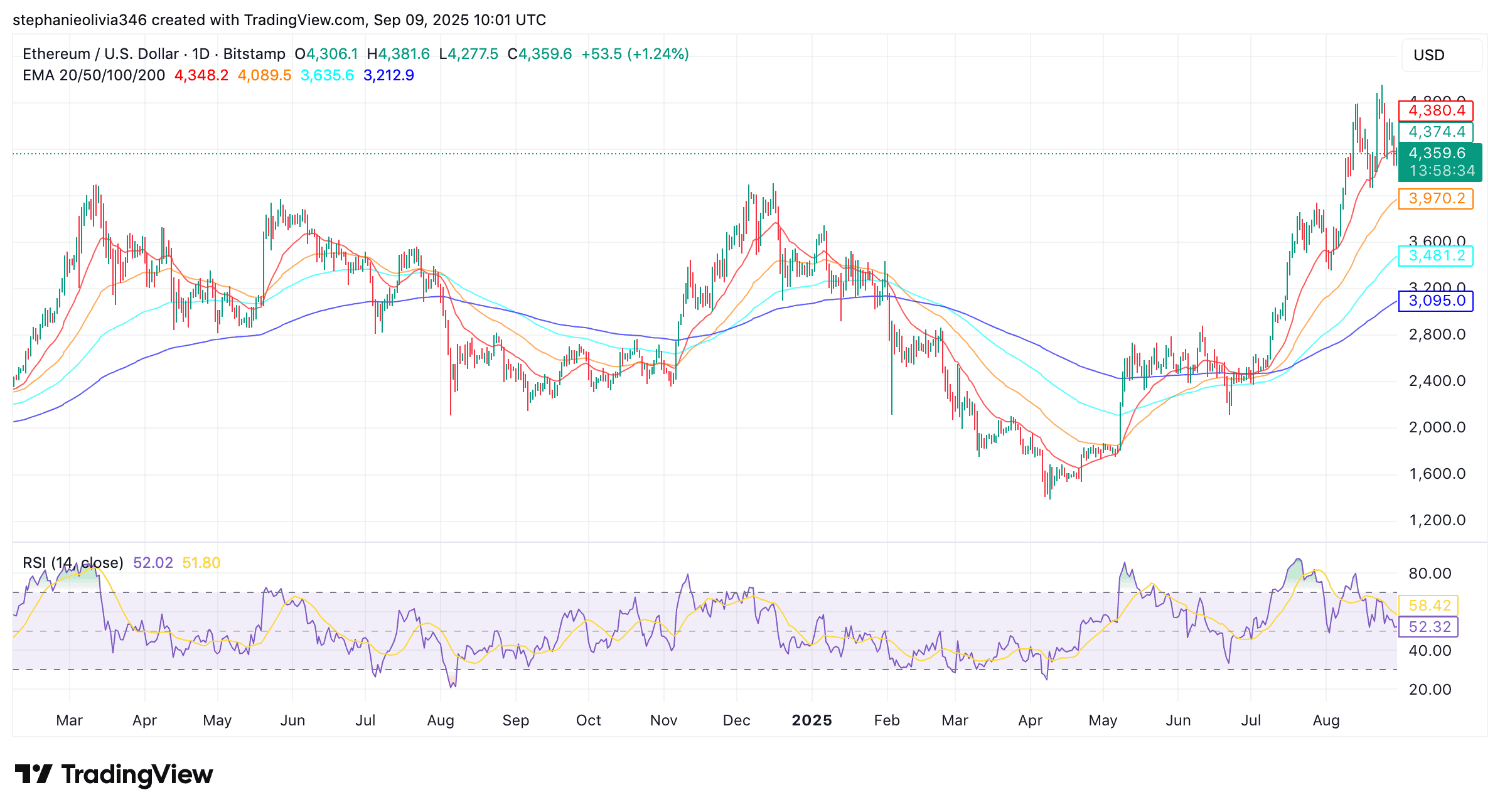

- RSI close to the month-to-month MACD crossover and 52 reveals ETH might have extra room to climb.

- ETH defends the 50-day EMA for $4,164 and maintains robust help throughout all main transferring averages.

Ethereum reveals month-to-month MACD crossovers

Ethereum (ETH) printed contemporary crossovers on their month-to-month MACD indicators. Some market analysts see it as a possible turning level. Crypto Dealer Merlijn merchants known as the transfer “monster ignition” and pointed to the completion of the multi-year integration section.

Ethereum is charging monster strikes

Contemporary MACD crossover.

The height is three years’ shortened.

The month-to-month candles scream robust.Break $4,450, $eth would not stroll…it rips.

Do not name it Hopium. Name it ignition. pic.twitter.com/kkgug4l34p-merlin the Dealer (@merlijntrader) September 8, 2025

Surprisingly, month-to-month chart MACD crossovers are thought-about uncommon, particularly after three years of aperture. This final occurred earlier than the 2020-2021 rally, with Ethereum rising sharply in a couple of months. ETH is presently buying and selling close to a crucial stage of $4,450, marking the highest of its long-standing vary of resistance.

Ethereum’s current breakouts and pullbacks look much like value motion in the course of the 2020-2021 cycle. On the time, ETH broke out from a protracted downtrend, retesting breakout ranges, after which started steep climbs to new highs.

Chart merchants shared by Merlijn present that Ethereum has as soon as once more damaged previous the downtrend line and is again to check earlier resistances of practically $3,650-4,000. The dealer stated, “2021 has given us a sample. 2025 offers us an opportunity.”

Ethereum repeats historical past

2021 confirmed a sample.

2025 reveals us alternatives.Retest is the place legends purchase it.

A breakout is the place property is created. $eth isn’t full. I’ve simply began. pic.twitter.com/81tvrnlp70-Merlin The Dealer (@merlijntrader) August 29, 2025

Comparisons with previous cycles present a perspective, however Ethereum must see an extra depth above $4,450.

ETH turns into stronger as momentum builds

ETH has just lately bounced again from its 50-day exponential transferring common and is now serving as help for round $4,164. Capacity past this stage signifies that the client remains to be energetic and is defending the important thing zone.

Specifically, costs are positioned higher than all different main EMAs (20, 50, 100, and 200), supplying you with a powerful technical basis. Holding these ranges typically displays the steadiness of the development and supplies a construction for future actions.

In the meantime, the every day relative power index (RSI) is situated at 52. This impartial zone reveals that the market is properly balanced and there’s no robust buying and selling strain. In earlier market cycles, comparable RSI ranges throughout uptrends allowed for a gradual value enhance with out the necessity for deep corrections.

On the time of reporting, the worth of Ethereum was round $4,360. It has elevated by 1% over the past 24 hours, displaying a slight weekly decline. Previous every day buying and selling volumes had been $30.36 billion.