Ethereum’s current worth actions mirror the market shifting from impulsive promoting to a possible short-term stabilization part. After plummeting in direction of the $1,750 demand zone, $ETH Though the market has responded with a gradual rebound, fluctuations are anticipated to proceed within the brief time period.

Ethereum Worth Evaluation: Each day Chart

On the each day chart, $ETH continues to commerce inside a descending channel, with highs and lows nonetheless holding. The current impulse sell-off pushed the value sharply into the $1.8,000 demand space, the place consumers reacted and brought on a rebound in direction of the $2.1,000 space.

Nonetheless, the asset remains to be beneath the 0.5 Fibonacci stage at $2,4,000 and nicely beneath the 0.618 stage at $2,5,000, confirming that the present transfer is a correction quite than a confirmed development reversal.

The $2.7,000 vary, which coincides with the 0.702-0.786 retracement stage, exists as a serious provide zone and might be a key resistance space if a stronger restoration develops. just for $ETH The broader construction favors sellers because it stays beneath $2.5,000, however the $1.7,000 stage stays an necessary help to carry.

$ETH/USDT 4 hour chart

On the 4-hour chart, after a pointy rebound from $1.7,000, the value motion is forming a short-term contract construction. The market is at the moment shifting between an ascending short-term help development line and a descending native resistance development line, compressed round $2.1,000. A breakout of $2.1,000 may pave the way in which to the following main resistance stage at $2.5,000.

Conversely, a lack of intraday help at $2,000 may re-expose the $1.8,000 zone. For now, $ETH Following the current spike in volatility, there seems to be a short-term consolidation part between $1.8,000 and $2.1,000.

sentiment evaluation

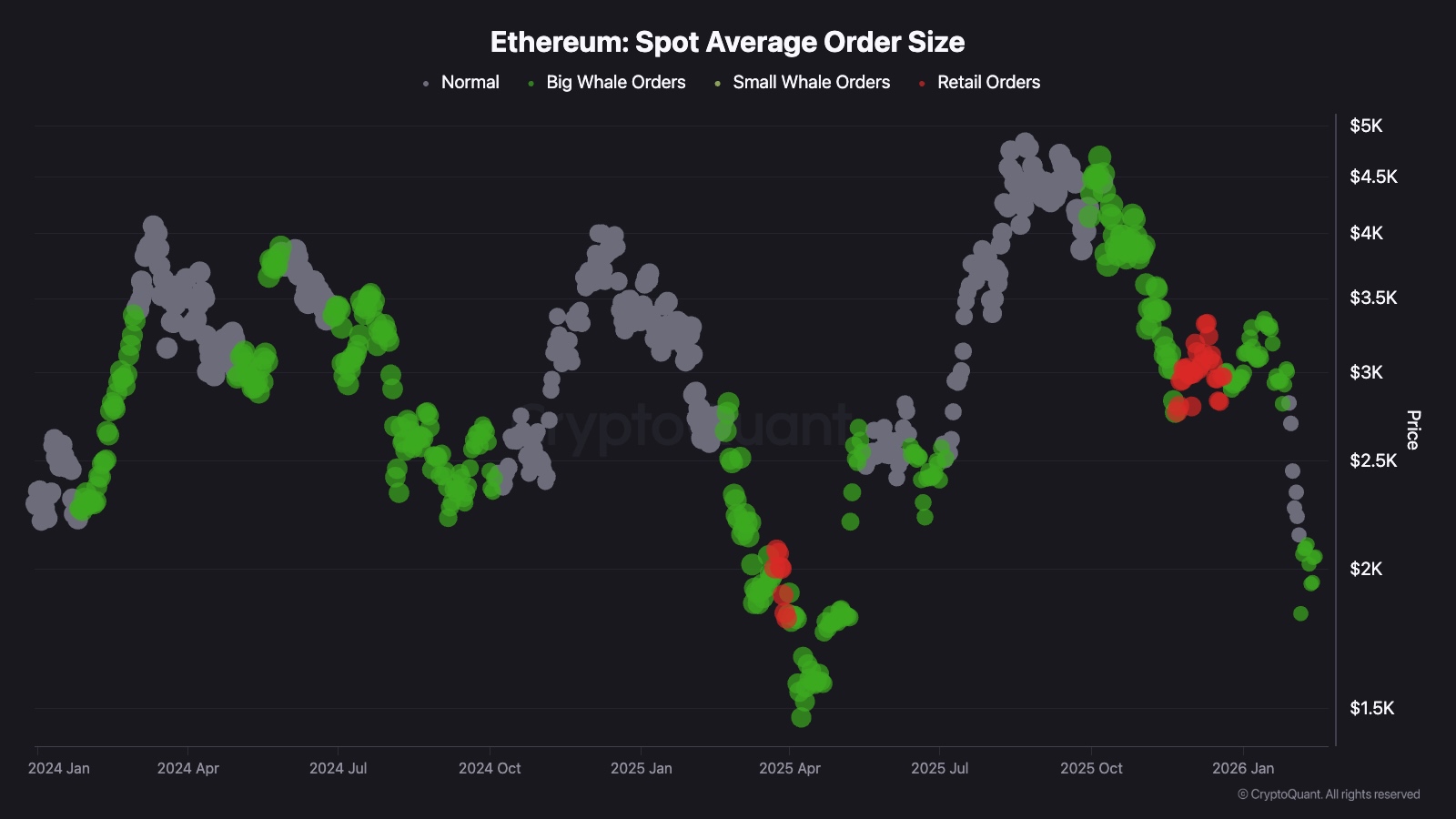

Ethereum’s spot common order measurement chart exhibits a noticeable enhance within the inexperienced dot through the current decline in direction of the $1.8,000 space. These inexperienced clusters signify massive, whale-sized spot orders that entered the market as costs traded decrease. This motion suggests that enormous corporations could accumulate throughout a panic-driven selloff.

Whereas this doesn’t point out an instantaneous development reversal, the focus of whale exercise round $1.8,000 strengthens this zone as a structurally necessary demand space. If the buildup continues and the value stabilizes above $2,000, the probability of a broader restoration in direction of larger resistance ranges will step by step enhance.