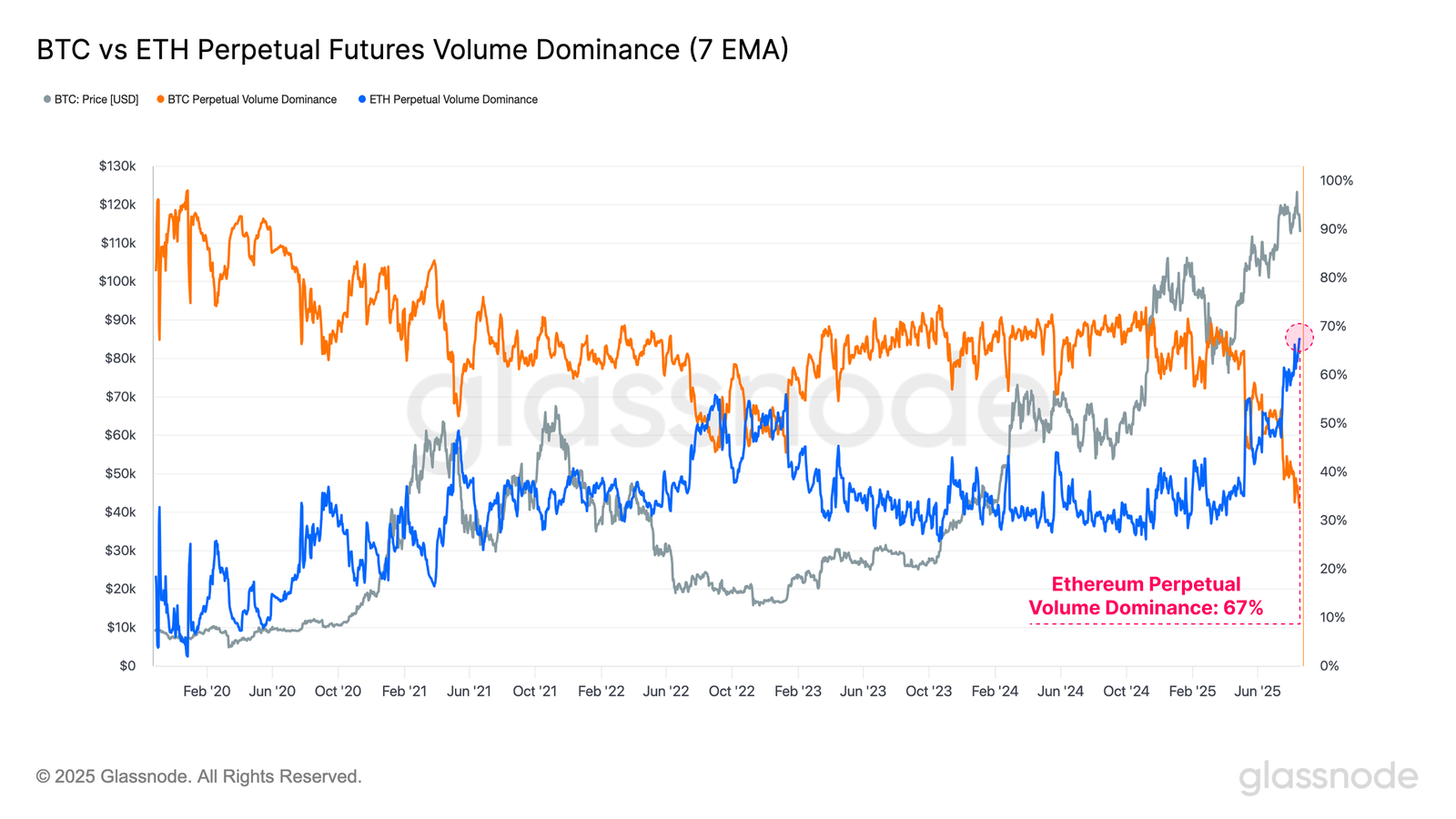

Ethereum’s everlasting futures buying and selling quantity share reached a historic excessive of 67% up to now week. In different phrases, two-thirds of all crypto-permanent futures transactions have been associated to Ethereum.

This reveals that crypto traders abnormally favor high-risk investments, even amid a downward pattern available in the market, prompted primarily by considerations over rising US inflation.

BTC-ETH may be very near open curiosity

GlassNode launched its weekly report, “Derivatives-Pushed Markets” on Wednesday. Bitcoin costs lately reached new all-time highs earlier than revising, however defined that the crypto derivatives market has primarily pushed market course.

Regardless of the revision, GlassNode famous that market members nonetheless think about this a bullish market.

As of Thursday morning UTC, the spot dominance hole between Bitcoin (59.42%) and Ethereum (13.62%) is about 4 instances extra. Nevertheless, the helpful benefit is way nearer, with Bitcoin at 56.7% and Ethereum at 43.3%. This means that exploited traders have proven appreciable curiosity in ETH.

This pattern is much more pronounced in buying and selling volumes. Ethereum’s everlasting futures buying and selling share reached an all-time excessive of 67%.

BTC vs ETH Everlasting Futures Quantity Domination (7 EMA). Supply: GlassNode

GlassNode defined that these numbers spotlight the excessive stage of traders’ curiosity within the Altcoin sector, indicating that traders are keen to imagine higher funding dangers than they’re now.

So will ETH costs rise even additional and function a stepping stone to the “Altcoin season”? In the end, the important thing seems to lie within the attitudes and rate of interest selections of US Federal Reserve officers.

One of many major causes for current crypto value revisions is the uncertainty surrounding the Fed’s rate of interest cuts as US inflation has been up to date. If Fed Chairman Jerome Powell’s speech at Jackson Gap assembly on Friday reveals a shift in the direction of rate of interest cuts, ETH is predicted to rise a lot sooner than BTC.

Put up ETH Open Curiosity reached ATH, and the potential of additional earnings first appeared in Beincrypto.