After Ethereum (ETH) touched on the all-time excessive of $4,878 final week, the chain movement revealed a extreme disparity in habits earlier than it returned to about $4,448. It means that retailers are in panic, however establishments are quietly stocking up.

Bitcoin and ether each cooled down after final week’s excessive. BTC costs fell about 5% from recent ATH of over $124,400 to the $117,000 zone. This has introduced the cumulative crypto market to print the pink index on Saturday morning, dropping under the $4 trillion restrict. 24-hour buying and selling quantity fell 32% to $180 billion.

ICO whales pay money

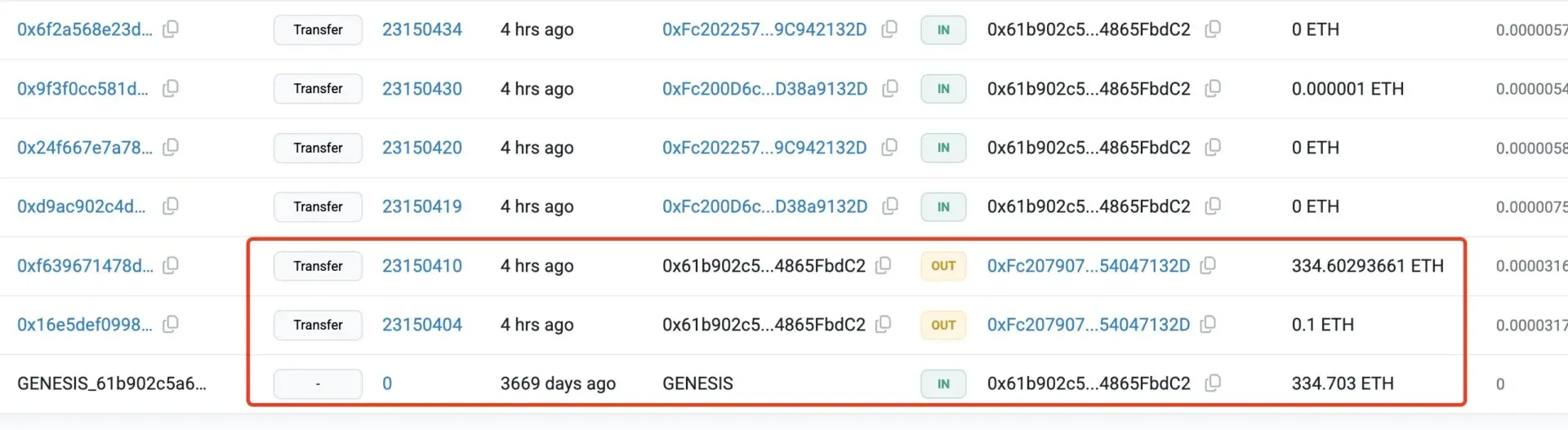

On-chain information exhibits that the whales are transferring in another way behind the pink candle. One ICO attendant, who spent simply $104 in 2015, lastly moved 334.7 ETH (well worth the day, about $1.48 million) after practically a decade of dormant. That is 14,200 instances the return.

However corporations like Bitmine have doubled whereas early buyers are cashing out. The corporate has scooped up one other 106,485 ETH (value roughly $470 million) over the previous 24 hours. The transport will carry the Treasury to 1.29 million ETH, value practically $5.8 billion. One other non-public institutional purchaser has additionally been actively accumulating, pulling 92,899 ETH (value round $412 million) from Kraken in simply 4 days together with his newly created pockets.

Supply: Ethereum ICO contributors: “0x61B9”.

On the identical time, some giant non-public funds use dips to regulate their positions. The Lengthy Ring Capital-linked pockets bought 7,000 ETH, value $31.8 million in the course of the pullback, however nonetheless holds $352 million value of ether. This restructuring means that sentiment metrics like Santiment’s greed index have peaked retail vitality at Bitcoin ATH, whereas establishments are treating ETH dips as their entry level.

Hackers earn money on Ethereum run

Larry has additionally became an surprising stairwell for hackers. The exploit of glowing capital, mentioned to be linked to North Korea, bought round $44 million in ETH this week. This has elevated the stolen funds to over $100 million, nearly double the worth of the unique distance. The attacker ran out of $53 million final October, then flipped a few of his booty into Stablecoins, pocketing greater than $48 million in earnings.

Equally, Infini and Torcane attackers are exploits that make the most of ETH surges. Infini hackers stole round $49.5 million in USDC in February and bought 17,696 ETH at a value of $2,798. Along with washing 5,000 ETH by way of twister since July, hackers have bought 3,540 ETH for 133.18 million DAI, with a median value of $3,762.

Ethereum Value recorded a pullback after a brief assembly. It fell 5% during the last 24 hours, however nonetheless rose 29% during the last 30 days. ETH trades at a median value of $4,455 at press time. The market capitalization is over $537 billion.