$Ethereum is being traded $3,030regained the necessary $3,000 psychological degree after a decisive rebound from the help. New ETF inflows, elevated whale accumulation, and improved technical momentum all contributed to the rebound. ETH is presently consolidating slightly below a significant resistance degree, and merchants are maintaining a tally of whether or not ETH can set off a breakout in the direction of increased ranges.

Beneath is a whole breakdown of why ETH is rising and the place the worth might go subsequent primarily based on the chart.

Why is the worth of Ethereum rising?

1. ETF demand return (bullish affect)

overview

After going through one another Web outflows have been $1.4 billion By way of November, the Ethereum ETF turned constructive. $368 million influx in the course of the last week. This transformation coincided with a decline in geopolitical tensions and a decline in ETH’s long-term efficiency in comparison with Bitcoin.

What this implies

The establishment seems like this Return to ETHIt is going to be handled as catch up recreation. ETF inflows cut back promoting strain; $3,000 help space is mainly supported By institutional calls for.

Please watch out

Will the inflow proceed till early December?

If ETH ETF demand exceeds BTC for the primary time in current weeks

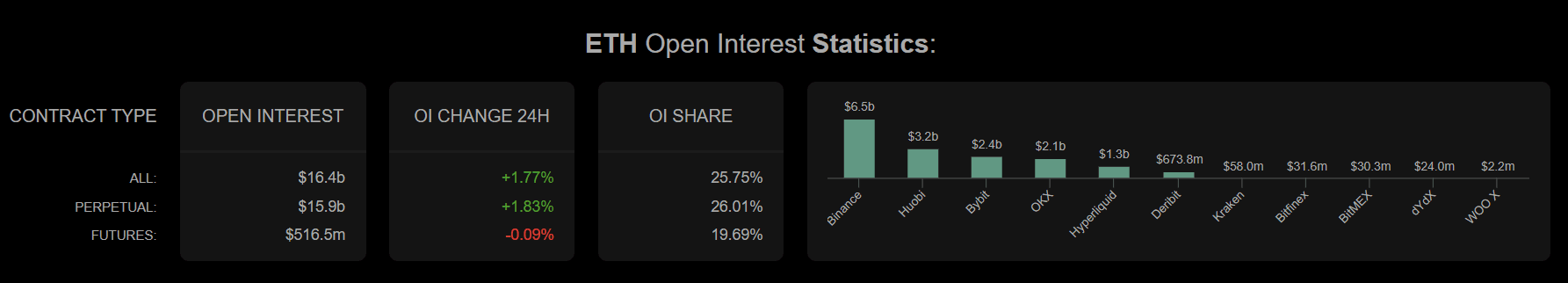

2. Whale and spinoff actions (combined results)

overview

On-chain information reveals whale added 14,618 ETH (roughly $185 million) Late November. On the identical time, the open curiosity of ETH derivatives additionally elevated. 700 million {dollars}and Lengthy dominates quick 2:1 Practically $2,960.

What this implies

The large gamers are actively defending the $2,960-$3,000 zone. Nevertheless, elevated leverage — 3.97 million open contracts — If ETH fails to interrupt out, liquidation threat will happen $3,100 resistance.

Please watch out

Lengthy-term liquidation if ETH declines between $3,100 and $3,200

Make the most of resets that may trigger volatility spikes

3. Technical momentum (bullish within the quick time period)

overview

ETH is 20-day EMA ($2,968) and printed bullish MACD crossover has a robust histogram +37.73. zone between $2,960 and $3,000 Presently functioning as Verified Help.

What this implies

If ETH maintains its day by day closing worth above $3,000, merchants will see main Fibonacci ranges, particularly 38.2% retracement at $3,270. nonetheless, 200 day transferring common and $3,520 It stays a significant barrier to resistance.

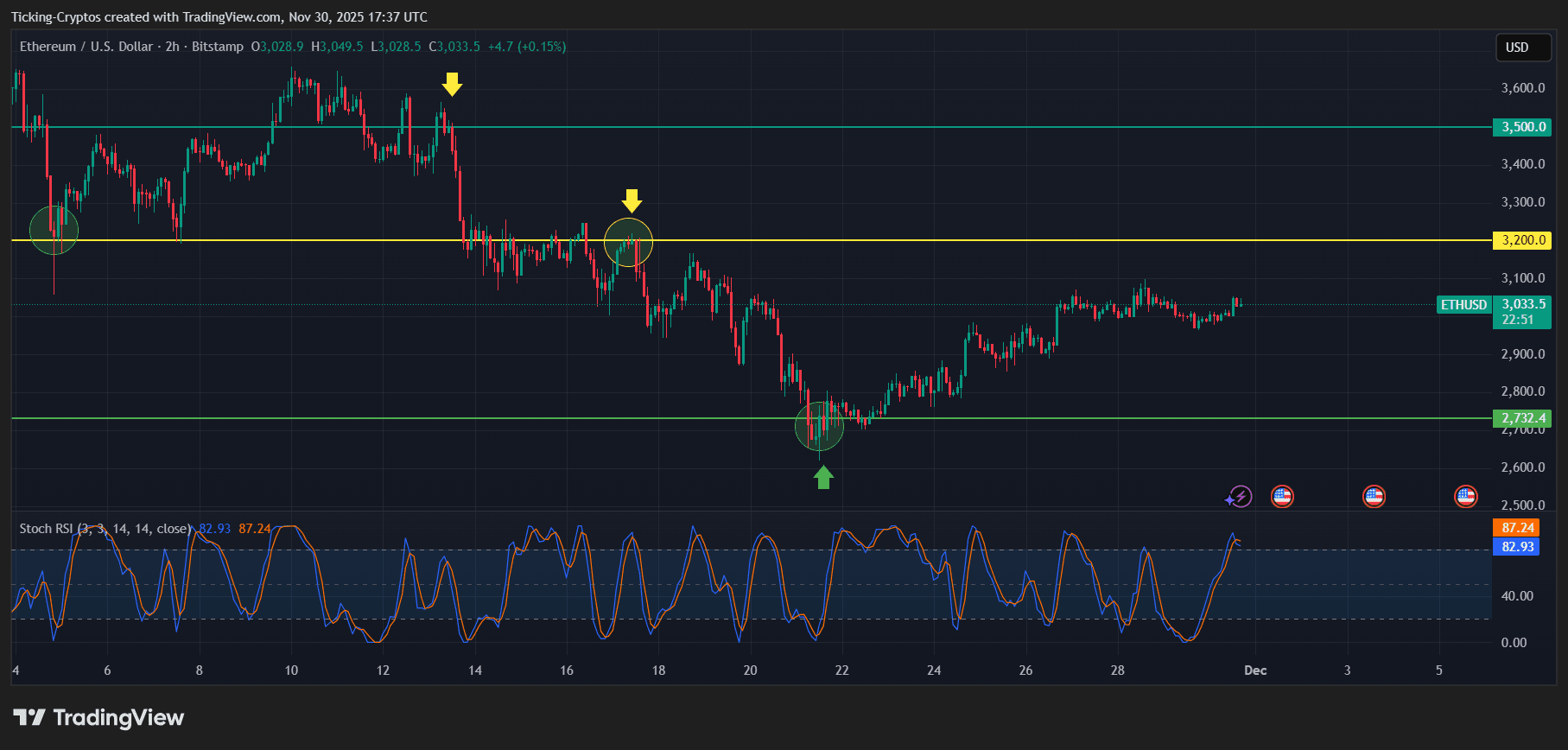

Ethereum chart evaluation: what occurred

In the event you take a look at the hooked up graph, you will see a transparent sample.

ETH/USD 2 hour chart – TradingView

1. ETH repeatedly rejected at $3,200 (yellow line)

The graph reveals a number of rejections at: $3,200marked with a yellow arrow and a circle. This zone acted as intermediate-range resistance for a number of weeks.

2. Robust rebound from $2,732 help (inexperienced line)

ETH has utterly bottomed out $2,732 Structural HelpRight here, the inexperienced arrow confirms a considerable amount of reuse. Every historic contact at this degree induced a robust reversal.

3. Present flat consolidation is round $3,030

ETH is presently stabilizing in a slim band slightly below resistance, which frequently precedes a breakout try.

4. Stoch RSI signifies overbought momentum

The present Stoch RSI is:

- 82.93(Blue)

- 87.24 (orange)

Since ETH is overbought within the quick time period, there could also be a brief cooldown earlier than continuing.

Ethereum Worth Prediction: The place Will Ethereum Land Subsequent?

Based mostly on present chart construction, momentum alerts, and market fundamentals:

Bullish situation (probably if ETH is above $3,000)

ETH will rise as a result of present consolidation.

Upside worth goal

- $3,200 (first main breakout zone)

- $3,270 (38.2% Fibonacci degree)

- $3,500 (sturdy resistance)

- $3,520 (200 day transferring common – main development reversal degree)

If ETH ends above $3,500–$3,520the subsequent macro goal opens. Over $3,800.

Bearish situation (if ETH can not maintain $3,000)

If rejected at $3,200, ETH might make a corrective transfer.

Draw back worth goal

- $2,960

- $2,850

- $2,732 (Essential help zone)

A break under $2,732 will shift the development to a medium-term bearish section.