The market has develop into defensive and danger urge for food has slowed, with Ethereum worth at the moment caught between a constructive every day setup and a softer intraday construction.

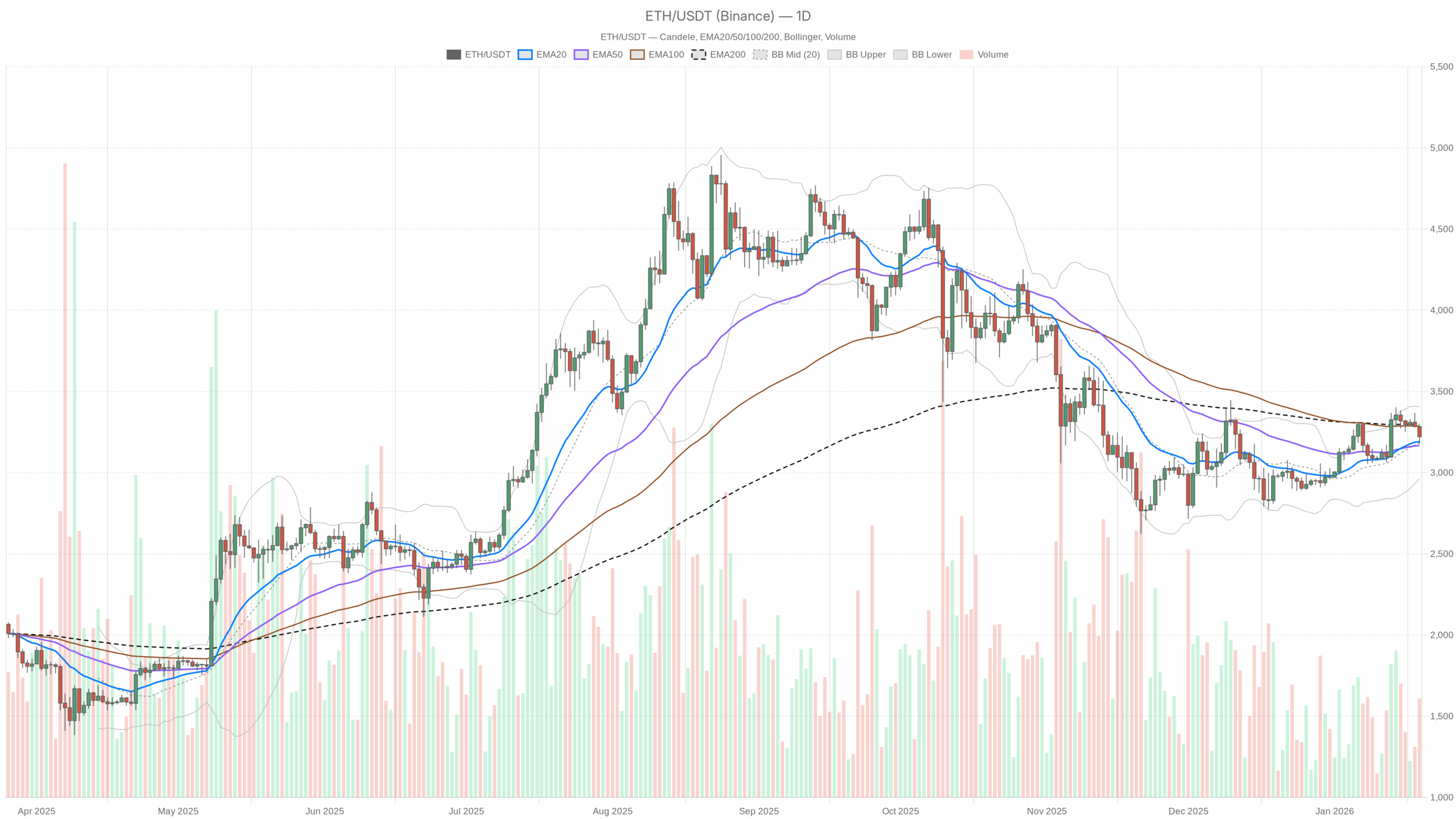

Ethereum/USDT Every day chart together with EMA20, EMA50, and quantity

Ethereum/USDT Every day chart together with EMA20, EMA50, and quantity

Loading=”lazy” />

Ethereum/USDT — Every day chart together with candlesticks, EMA20/EMA50, and quantity.

Every day bias: Cautiously bullish however under 200-day restrict

in Every day time-frame (D1)Ethereum is traded on: $3,221barely above the short-term and medium-term transferring averages, however nonetheless under the long-term pattern line.

Transferring common (EMA 20/50/200)

– EMA 20: $3,190.9

– EMA 50: $3,167.2

– EMA200: $3,297.2

Worth is above the 20-day and 50-day EMA, however under the 200-day EMA. It is a textbook restore stage. Though the short-term pattern has turned constructive, the broader uptrend has not totally returned. This often signifies that a rebound could proceed, however we can’t name this a clear bull market. Ethereum Roughly capped by $3,300.

RSI (D1)

– RSI 14 (every day): 54.2

RSI is positioned simply above the midline. The momentum is constructive, however not euphoric. Patrons have the higher hand, however there may be loads of room in each instructions. Any such studying is usually higher fitted to vary buying and selling and gradual rallies fairly than vertical actions.

MACD (D1)

– MACD line: 62.93

– Sign line: 54.81

– histogram: 8.12 (constructive)

The MACD is above the sign with a small constructive histogram, supporting the concept of a gentle bullish section. The urge is constructing however not explosive, so consider a constructive restoration fairly than a runaway breakout. Nevertheless, if the histogram begins to shrink from right here, it might be a warning that this push is shedding momentum in opposition to the 200-day overhead.

Bollinger Bands (D1)

– Mid band: $3,183.8

– Higher band: $3,404.7

– Decrease band: $2,963.0

– worth: $3,221.6

Ethereum It trades simply above the mid-band and effectively contained in the envelope. Volatility is suppressed and costs don’t develop in both course. That is in step with a managed two-sided market the place a decline close to the center of the band may appeal to consumers, however we have now but to see any actual growth into the higher band round 10 meters. $3,400.

ATR(D1)

– ATR 14 (every day): $109.8

every day volatility $110 This implies a typical every day variation of about 3-4%. That is on the rise, however not excessive Ethereum. Place sizing ought to take this allowance under consideration. If you’re buying and selling a every day chart, inserting your cease tight close to the present worth may end up in churn.

every day pivot stage

– Pivot level (PP): $3,227.9

– Resistance 1 (R1): $3,278.2

– Assist 1 (S1): $3,171.3

Spot is buying and selling just under the every day pivot round $3,228. It is a small tactical benefit for intraday sellers, however the extra necessary ranges are R1 and S1. of $3,170–3,180 The realm is the primary decrease buffer, and in case you maintain down on it $3,280 This might recommend that consumers are regaining management heading into the 200-day. $3,300.

Conclusion of D1: The primary situation is cautiously bullishhowever there may be an higher restrict under the 200-day EMA. Bulls are answerable for short-term pattern indicators, however nonetheless have to get again into the tough $3,300 That is to show this right into a cleaner uptrend fairly than a rebound inside a broader sideways correction construction.

First half chart: Intraday momentum is weak and there’s a correction pattern

of hourly (H1) The chart doesn’t match the every day chart to some extent. This means a short-term common restoration relative to the emergence of every day power.

Transferring common (first half EMA 20/50/200)

– worth: $3,221.8

– EMA 20: $3,243.7

– EMA 50: $3,274.5

– EMA200: $3,259.9

In 1H, Ethereum It’s buying and selling under all three main EMAs. It’s a short-term downtrend construction. $3,240–3,260 At the moment, for intraday merchants, the band is a promote zone, not a purchase zone. Within the very brief time period, the trail of least resistance will probably be a sideways drop till the value recovers above the 200-hour EMA.

RSI (H1)

– RSI 14 (hourly): 36.9

The hourly RSI is weak however not washed out. This displays managed gross sales stress. Bears are counting on worth, however we have not but seen the sort of panic or exhaustion that sometimes causes a spike briefly masking.

MACD (H1)

– MACD line: -26.7

– Sign line: -26.24

– histogram: -0.45 (barely unfavorable)

The MACD is unfavorable and barely under the sign, coinciding with a cooling section after earlier power. Though the sellers have the benefit of intraday momentum, the weak histogram signifies that this can be a drop inside a bigger decline fairly than a robust pattern leg.

Bollinger Bands (H1)

– Mid band: $3,255.5

– Higher band: $3,381.3

– Decrease band: $3,129.8

– worth: $3,221.8

Costs are transferring under the mid-band, within the decrease half of the time vary. This often means the market is searching for help fairly than attacking resistance. There may be nonetheless loads of distance to the close by decrease band $3,130So Ethereum It may possibly slide additional through the day with out stretching statistically.

ATR (H1)

– ATR 14 (hourly): $26.8

ATR per hour $27 level to $25 to $35 That is the vary of a standard 1 hour swing. 1H stops near entry are typically clipped by noise, particularly initially of a session or round news-driven spikes.

Pivot stage by hour

– Pivot level (PP): $3,222.5

– R1: $3,224.0

– S1: $3,220.3

Worth is mainly on the hourly pivot, just some {dollars} above S1, reinforcing the concept of a impartial to smooth tape on this timeframe. Nevertheless, the true battleground for intraday merchants is greater, close to the cluster of mid-term EMAs. $3,240–3,260 space.

Conclusion for H1: The intraday bias is Barely bearish to impartialacts as a headwind to a constructive every day setup. This pressure between timeframes is usually resolved over time by a sideways chop or a fast wash to stronger every day help earlier than consumers intervene once more.

15m chart: execution context, brief bounce vs larger drag

of quarter-hour (M15) The chart supplies microstructure relating to the present worth and is primarily associated to timing entries fairly than defining bigger biases.

Transferring common (M15 EMA 20/50/200)

– worth: $3,221.8

– EMA 20: $3,215.3

– EMA 50: $3,228.1

– EMA200: $3,276.5

At 15 meters, Ethereum That is an illustration of a short-term pullback inside a broader intraday downtrend. Micro consumers are lively however buying and selling in opposition to the bigger resistance band of the primary half.

RSI(M15)

– RSI 14 (15m): 56.5

Brief-term momentum has turned constructive, in step with a localized rebound from earlier lows. That is helpful for entry whenever you wish to fade Panicwick, however it doesn’t by itself override the weak 1H construction.

MACD (M15)

– MACD line: 1.72

– Sign line: -1.16

– histogram: 2.87 (plus)

The MACD turned constructive at 15m and confirmed a good constructive histogram. Very short-term flows are transferring again to the purchase facet, which frequently occurs when costs stabilize close to intraday pivots. For scalpers, this favors long-side alternatives on the push, however they’re nonetheless buying and selling in opposition to overhead resistance.

Bollinger Bands (M15)

– Mid band: $3,212.5

– Higher band: $3,227.7

– Decrease band: $3,197.2

– worth: $3,221.8

Ethereum is within the higher half of the 15 meter band, leaning in the direction of the higher edge however not breaking out. This suits a reasonable reduction bounce fairly than a recent pattern leg. Brief-term merchants usually deal with this as a spot to be extra cautious about chasing longs with out affirmation from greater time frames.

ATR(M15)

– ATR 14 (15m): $6.4

A typical 15 minute bar is simple to swing 5-8 {dollars}. For those who do, it is noise that you have to see past earlier than you resolve the transfer has that means.

15m pivot stage

– Pivot level (PP): $3,222.5

– R1: $3,224.0

– S1: $3,220.3

As soon as once more, the spot is actually glued to the micropivot and a short-term equilibrium zone is recognized. From right here, a small burst above R1 or under S1 is extra related to a rise in liquidity than a structural break, except corroborated by a 1-hour or 4-hour affirmation.

Market setting: Ethereum As a terrifying beta play, BTC-led market

The broader image is necessary for the present Ethereum worth. The market capitalization of digital foreign money is roughly $3.23 trillionroughly under 2.4% in 24 hourswhereas the quantity is considerably elevated, the encircling +94%. This mix of declining market cap and growing gross sales signifies risk-off culling by way of lively repositioning fairly than quiet accumulation.

BTC predominant in about 57.5% and concern The studying (44) signifies that capital is hidden within the benchmark. Ethereumhas a market capitalization share of simply over 12% and trades as a excessive beta. They might outperform in reduction rallies, however will probably be relied upon sooner if danger sentiment deteriorates.

On the DeFi facet, Uniswap V3 and different main DEXs have seen one-day payment spikes, however the sharp 7-30 day declines point out that speculative exercise is uneven and nonetheless effectively under the frenzied ranges of a real alt season. This additionally reveals the necessity for selective and tactical buying and selling. Ethereum Relatively than an setting the place every little thing goes collectively.

Present Ethereum worth situation

bullish situation

For the every day bullish bias to actually present itself, bulls want to show this from a mean-reverting pullback right into a pattern.

What bulls wish to see:

1. Ethereum Maintains stage above every day EMA 20 $3,190 and defend $3,170–3,180 A help zone that mixes every day S1 and short-term construction.

2. Hourly worth recovers and maintains H1 EMA 200. $3,260reversing the intraday construction from a short-term downtrend to a impartial or uptrend.

3. Every day closing worth above the pivot $3,228 and on high $3,280 (R1), paving the way in which for retesting $3,300 – $3,320 The band the place the 200-day EMA is positioned.

If these circumstances are met, the following upside magnet would be the every day higher Bollinger Band. $3,400. In that situation, $3,190–3,220 The zone acts as a buyable pullback throughout the rising leg.

What invalidates the bullish case?

Clear failure of every day help. Particularly, the next every day closing costs $3,170Beneath S1 and the 20-day and 50-day EMAs, I might argue that this rebound has rolled over and the market is returning to a broader correction mode. A pointy drop within the every day RSI under 45 would affirm that momentum has reversed in favor of the sellers.

bearish situation

At the moment, the bears have the benefit within the intraday time-frame, however we’re nonetheless getting into a supportive every day construction. Their job is to show this short-term weak point right into a extra critical failure.

What bears wish to see:

1. Rejection from $3,240–3,260 Zone, hourly EMA cluster. H1 RSI stays under 50 on bounce.

2. The next decisive break $3,170flip the every day pivot space into resistance and drag the value in the direction of the center of the every day vary. $3,050 to $3,100.

3. The every day MACD reversed, the histogram narrowed in the direction of zero, turned unfavorable, and the RSI returned to the low 40s.

In that case, Ethereum Most likely transferring in the direction of the decrease half of the every day Bollinger Bands. $3,000 – $2,960 Set the world across the decrease band as a possible draw back goal throughout a deeper risk-off stage. That is particularly probably if the general market continues to cut back its market capitalization below growing quantity.

What invalidates the bearish case?

if Ethereum Could be closed on higher days $3,280 and take it again $3,300 – $3,320 Above the 200-day EMA, the bearish intraday construction loses credibility. In such an setting, the hourly EMA ought to flip to help, and a sustained shut above the every day pivot may point out that sellers have misplaced tactical management.

What do you consider the positioning right here?

From a buying and selling logic perspective, Ethereum worth is at the moment at a crossroads between a every day restoration improvement and a gradual and considerably corrective intraday tape. D1 says it’s constructive with overhead resistance, H1 says short-term stress remains to be current, and M15 is solely displaying a slight rebound in opposition to that background.

That is an setting like this:

- chase the breakout $3,260 – $3,320 Bands with out affirmation are typically weak to imply reversion given the 200-day EMA overhead and the backdrop of anxious sentiment.

- panic fades $3,170–3,190 The help space works for merchants who respect the every day ATR. $110measurement positions with the understanding that volatility remains to be rising.

- Adjusting the timeframe is necessary. Earlier than getting too biased in the direction of a bullish every day outlook, loads of the noise will be reduce out by ready for the 1H downtrend to cease, the EMA to flatten, and worth to regain its 200-hour mark.

The volatility measured by the ATR over the timeframe is excessive sufficient that danger administration is extra necessary than the precise entry worth. In a market of concern, excessive BTC management, and Ethereum For those who keep just under an necessary long-term transferring common, you are not in a set-it-and-forget-it setting. As an alternative, you are in a market the place endurance, clear disablement ranges, and respect for either side of the tape are rewarded.

This part comprises sponsored affiliate hyperlinks. We could earn commissions at no further value to you.

Disclaimer: This market evaluation is for informational and academic functions solely and is predicated solely on the information offered. This doesn’t represent funding, buying and selling or monetary recommendation and doesn’t keep in mind your private goals, monetary scenario or wants. Buying and selling cryptocurrencies includes important dangers, together with doable lack of capital. All the time do your individual analysis and contemplate consulting a professional monetary skilled earlier than making any buying and selling choices.