Ether Spot Change-Traded Funds (ETFs) have grown steadily since their debut within the US in July 2024, however the Treasury Division of Tokens has additionally elevated.

Based on the Cryptocurrency Analysis Platform, inflows into Ether (ETH) funds rose 44% this month, up from $9.5 billion on August 1 to $13.7 billion on August twenty eighth. Market individuals say new institutional demand is driving momentum.

“After a protracted interval of unperformance in comparison with bitcoin and bitter buyers’ sentiment, Ethereum has lately skilled a big revival, recognising each its adoption charge and worth proposition,” Signum’s chief funding officer, Fabian Dori advised Cointelgraf.

ETH ETF web influx. sauce: sosovalue.com

Behind buyers’ appetites, increasingly more corporations are adopting ETH-based Ministry of Company Treasury. Bitcoin (BTC) is the cryptocurrency most related to finance corporations, however the etheric treasury between corporations is rising steam.

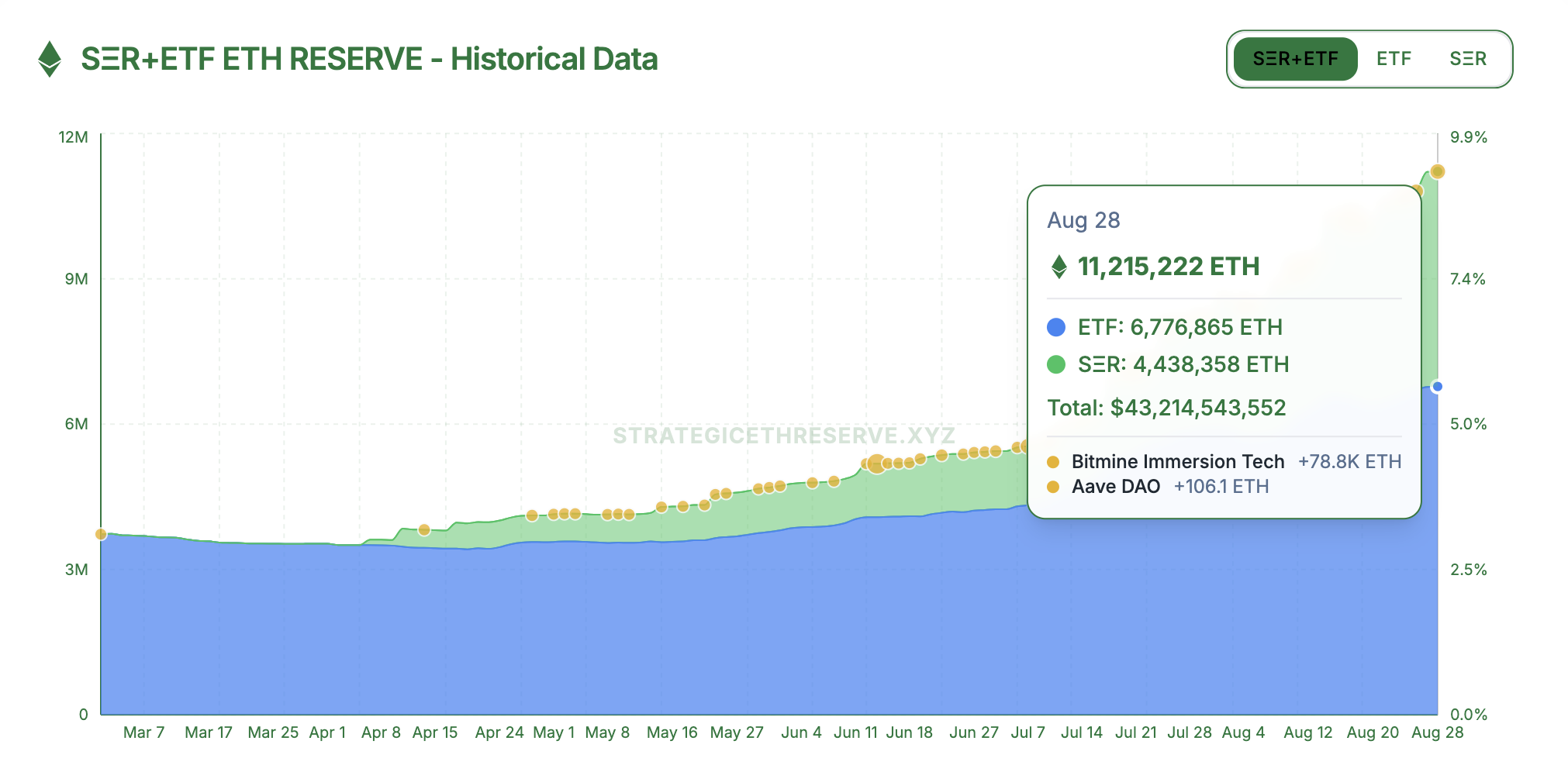

Based on StrategyEthreserve, the corporate presently owns 4.4 million ETH or 3.7% of its provide, price $191.8 billion on the time of writing.

“A strong issue for that’s regulation such because the genius that gives conventional buyers with the consolation of constructing infrastructure and use instances with this new know-how,” Dori mentioned.

Ether costs rose practically 27% in August to $4,316 on Friday, from round $3,406 on August 1st, supported by investor demand by means of Ether’s Treasury Division and ETFs, in line with Cointelegraph Markets Professional.

“Treasury corporations are giant patrons,” Jeffrey Kendrick, Head of Digital Asset Analysis at Commonplace Chartered, advised Cointelegraph. “They will not promote, so sure, the impression will stay.”

As of Thursday, the Ministry of Company Finance mixed with ETF ETH holdings. sauce: Strategic

Associated: It may most likely be bullish for years, with megaphone patterns at $10,000: Analyst

Ethereum roadmap enter “essential inflection factors”

Trade watchers are optimistic concerning the Ethereum outlook, however say the approaching months will probably be necessary to the community’s ecosystem. “The Ethereum roadmap is at a essential inflection level,” a Bitfinex analyst advised Cointelegraph.

” Future upgrades are set to considerably enhance the effectivity and enabled usability of good contracts.

“Then again, reopening and development of L2 rollup actions by way of Eigenlayer have generated actual protocol revenues and convey developer consideration again to the ecosystem.”

Ethereum is steadily transferring ahead with its improve cadence, with key milestones in the direction of scalability and long-term world utilities.

The Might Pectra improve launched the expanded Validator Caps and Account Abstraction on November fifth, with Fusaka Arduous Fork configured with Fusaka Arduous Fork, which implements Peerdas to mitigate node workloads and enhance information availability.

In the meantime, Ethereum’s income era has not but saved as much as momentum. Over the previous 30 days, the community has generated $41.9 million in the identical interval with a small charge income of $433.9 million from Tron.

journal: Dummies’ Information: Ethereum’s Roadmap to 10,000 TPs utilizing ZK Tech