In keeping with the on -chain information, the Ether Leeum community has seen a pointy rise within the weekly whale quantity.

Ether Leeum massive buying and selling quantity was the very best since 2021

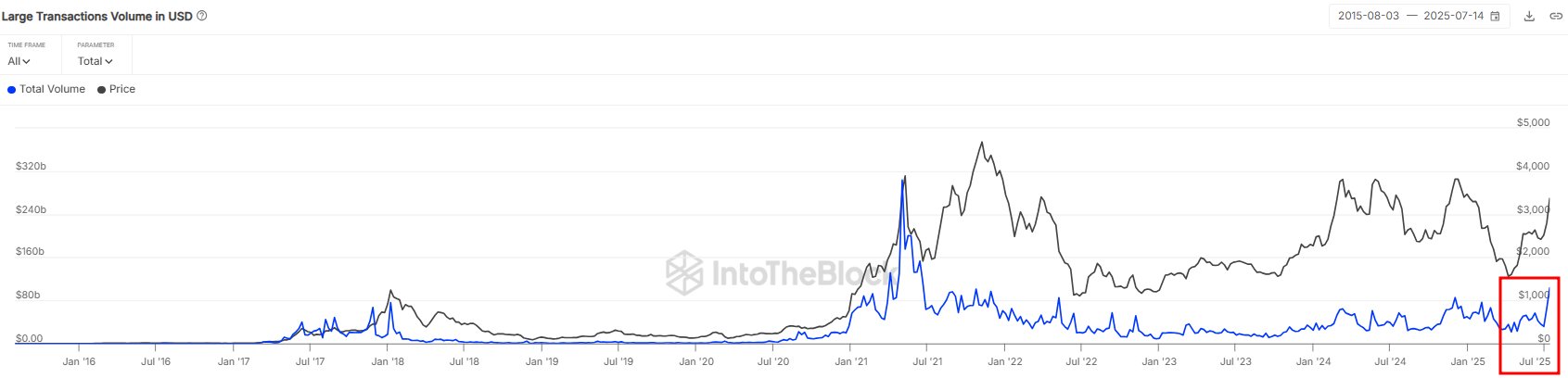

Within the new put up of X, Sentora (earlier INTOTHEBLOCK), an Institutional Defi Options supplier, talked concerning the newest developments in Ether Lee, a big buying and selling quantity.

Right here, the “massive buying and selling quantity” signifies an indicator of the quantity of complete quantity shifting from the ETH community by a transaction of $ 100,000 or extra.

Basically, solely whale -sized traders can transfer the quantity of a single switch, so the quantity related to this motion will be assumed as an expression of the actions carried out by a big sum of money traders.

If the worth of the metrics rises, it signifies that whales are rising their buying and selling actions. This pattern could also be a sign that curiosity in belongings is rising. Alternatively, if the indicator goes down, it signifies that a giant holder can lose curiosity in cryptocurrency.

Now there’s a chart that exhibits the pattern of Ether Leeum’s massive buying and selling quantity for the historical past of cash.

The worth of the metric seems to have been rising in current days | Supply: Sentora on X

As proven within the graph above, the Ether Leeum massive buying and selling quantity has just lately noticed some speedy development and means that whales have vastly elevated buying and selling actions.

Final week, this metrics’ worth is over $ 100 billion, the very best daytime degree for the reason that 2021 fireplace. The wave of this newest exercise of the whale has raised the present value to $ 3,000 with ETH’s brake out.

That is actually a sign that will increase the curiosity of the true actuality, however it’s troublesome to say whether or not it’s constructive. Since massive buying and selling quantity doesn’t comprise details about the division between purchases and gross sales actions, the spike doesn’t say something about which conduct is extra dominant, and these holders are making a type of motion.

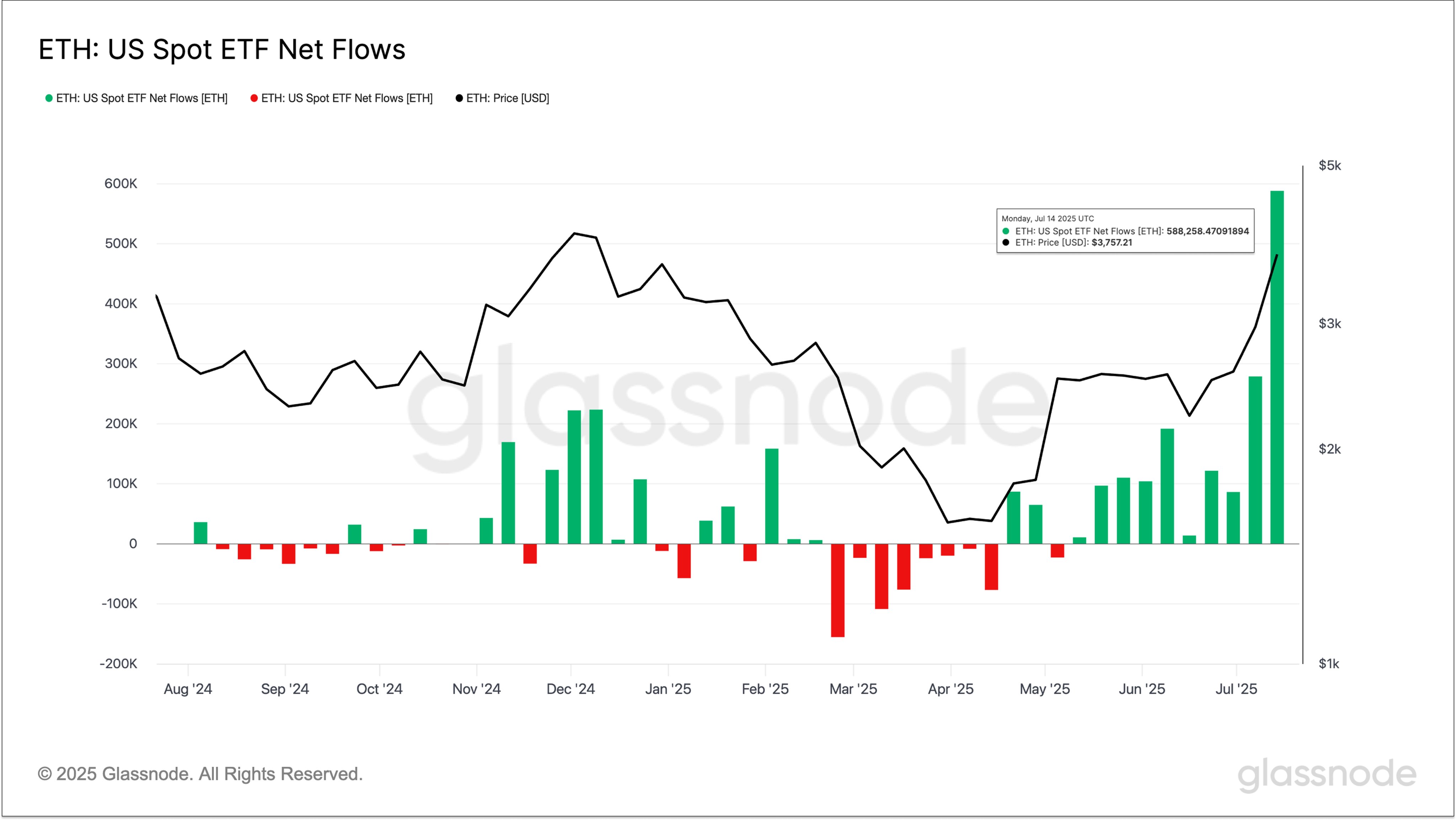

In different information, because the evaluation firm GlassNode identified within the X Put up, US Ether Rige Spot Alternate-Traded Funds (ETF) blocked the report week.

The pattern within the netflow related to the US ETH spot ETFs | Supply: Glassnode on X

On this chart, Etherrium Spot ETF has seen inexperienced states for some time, however the newest is noticeable on the measurement of the sighted influx.

GlassNode stated, “Final week, Etherum Spot ETF noticed the influx of 588K ETH.

ETH value

On the time of writing, Ether Lee is buying and selling about $ 3,730 final week.

Seems like the value of the coin has been climbing up just lately | Supply: ETHUSDT on TradingView

DALL-E, GlassNode.com, INTOTHEBLOCK.COM, TradingView.com