Ether Lee Rium went to unstable phases in 2021 final week, and was excited all through the market. After quickly, ETH retired to defend assist by the customer returning and testing vital demand ranges. Bulls is elastic, and analysts identified the potential of Ether Lee within the brief time period over $ 5,000.

Nonetheless, the deeper danger of orthodontics weighs nice weight, inflicting uncertainty between merchants and buyers. Concern started to understand as a result of I used to be questioning if Ether Lee’s rally was sustainable or one other fullback was on the horizon.

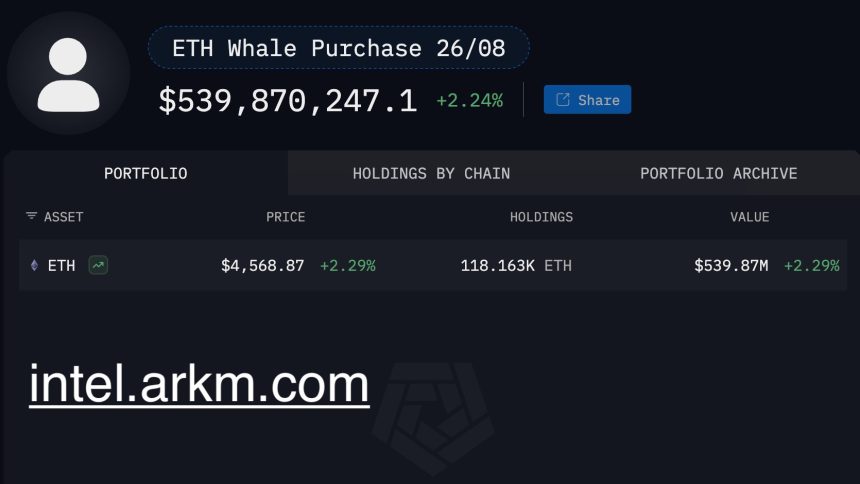

However on this setting, one irreversible pattern is noticeable. Whales are gathered. Arkham Intelligence has discovered that 9 whale addresses are about $ 450 million in Etherrium yesterday to announce the belief of the biggest market contributors. The wave of this accumulation emphasizes how the bone buyers use the restoration and probably put together the following leg upwards.

Ether Leeum Whale is a sign confidence

In keeping with Arkham Intelligence, Ether Leeum Whale is making a decisive motion to kind the following step of the market. In keeping with the info, 9 massive addresses have collectively bought $ 488 million a day. 5 of those have been straight launched from Bitgo, a significant establishment supervisor, and the opposite 4 acquired their place by means of the OTC (Over-The Cround) desk of Galaxy Digital. This transaction displays the rise within the function of the institutional score platform in selling not solely particular person whale confidence but in addition massive -scale Etherrium accumulation.

The surge in whale actions emphasizes vital market epidemiology. Deep pocket buyers are on their very own concerning the following legs on the worth cycle of Ether Leeum. Traditionally, throughout the volatility interval, the buildup of whales has given a robust basis for a robust story, over a big upward momentum. ETH has already examined the demand space after 2021, which might help to stabilize worth behaviors and construct momentum for unknown territory.

Past whales, public corporations are additionally in portray. Firms comparable to Bitmine and Sharplink Gaming lately launched Ethereum positions to additional confirm the function of ETH as an institutional grade asset. Their participation displays what Bitcoin has skilled within the early phases of adoption.

Taken collectively, the mixture of whale accumulation, institutional OTC purchases, and adoption of public corporations draw a transparent image. Ether Leeum’s confidence within the lengthy -term trajectory is being strengthened. Brief -term dangers stay, however this pattern strengthens the robust case the place ETH can transfer to cost and probably surpass $ 5,000. The market is carefully watching, however whales and establishments appear to guide the declare.

Ether Lee has the bottom with Bulls Eye $ 5,000

Ether Lee is buying and selling about $ 4,592 after rebounding from a fast retreat at $ 4,850. The 4 -hour chart exhibits ETH restoration energy above 50 and 100 days shifting common. This motion restores belief in brief -term uptrend, even when volatility doesn’t have a dealer within the superiority.

A wider image continues to be supportive. Ethereum has a 200 -day transfer to $ 4,119, and Ethereum has a snug cushion that emphasizes elasticity regardless of the latest swing. Sustaining a quicker common not solely stabilizes the quantity of train, but in addition units the steps for an additional try to withstand. The longer term vital obstacles are $ 4,800, the place the vendor has beforehand blocked the rally. The decisive relaxation might help analysts to be a milestone, $ 5,000, which believes that the analysts will trigger recent ardour and probably begin a brand new worth discovery bridge.

Nonetheless, there’s a danger of one other fullback. The autumn of lower than $ 4,400 can return ETH to $ 4,200, the place pre -purchase stress occurred. However now emotions are fastidiously optimistic. Whales proceed to build up, expertise stays constructively, and Ether Lee is able to take a look at increased ranges when momentum is delivered.

DALL-E’s predominant picture, TradingView chart