Decentralized utility exercise on the Ethereum blockchain may match or outperform final 12 months, regardless of rising competitors from “quicker and cheaper” options, in response to blockchain analytics platform Dappradar.

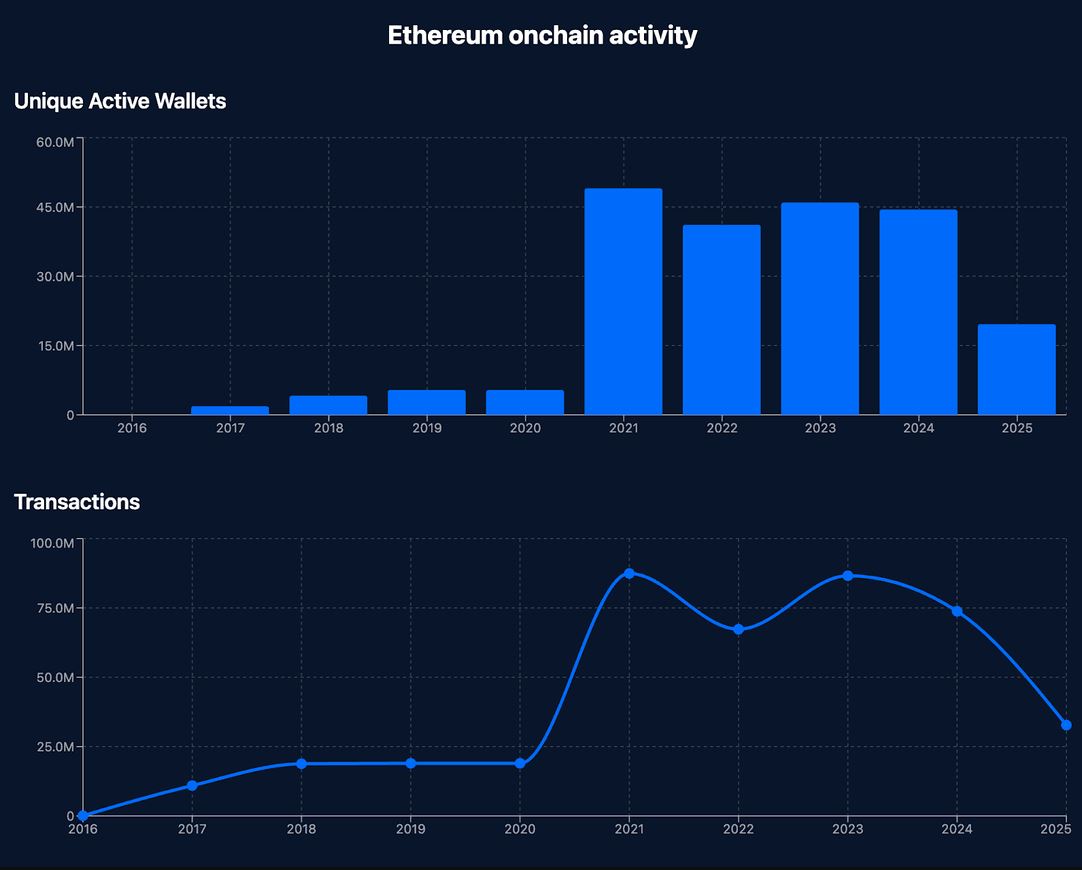

The height adoption at Ethereum was 2021, coinciding with the peak of the final Bull Run, and was additionally the 12 months of “Ethereum’s most original wallets and most transactions.”

In response to Gherghelas, exercise has since cooled, however in 2023 and 2024, a constant degree of engagement was seen by renewed curiosity in Unimaginable Tokens (NFTs), Layer 2 ecosystems, and experimental defi protocols.

This 12 months, “it should “come again on monitor and alongside 2024, suggesting that the present market momentum could possibly be sustainable,” she added, explaining it as “a cornerstone of Web3, particularly in excessive worth sectors resembling Defi and NFTS.”

At this level, the 2025 Ethereum DAPP exercise shall be on monitor and surpassing 2024. supply: Dappradal

Ethereum is the inspiration of Web3: Dappradar

Over the previous decade, Dappradar mentioned it has recorded over 234 million distinctive energetic wallets that Defi drives and interacts with Dapps on the community the place NFTs and video games proceed.

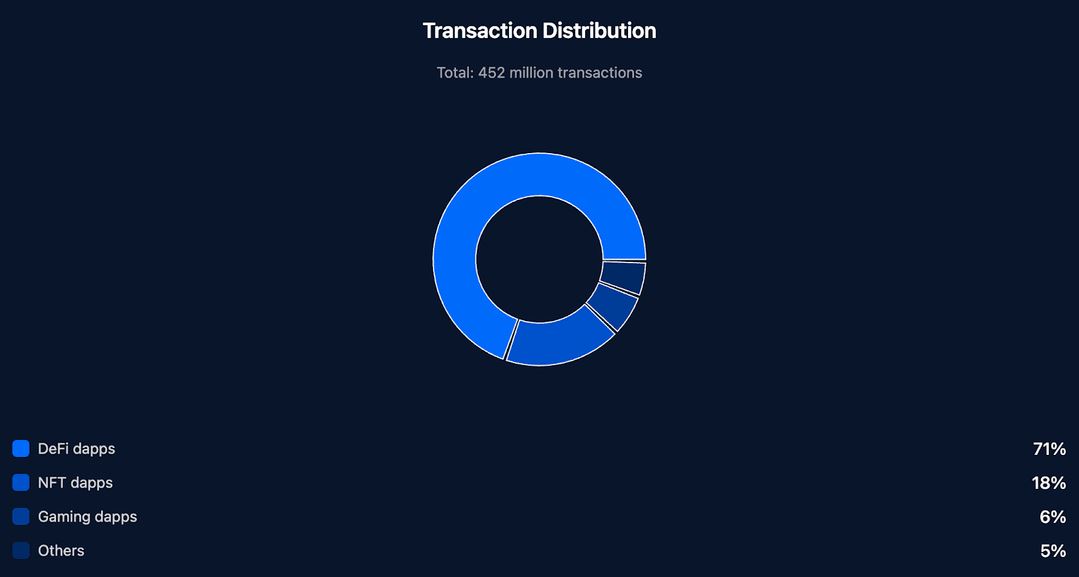

On the identical time, it tracked over 452 million DAPP-related transactions at Ethereum, with DEFI main, NFT second, and the sport rounded out the highest three.

Dappradar tracked 452 million DAPP-related transactions on Ethereum. sauce: Dappradal

“These numbers acknowledge their function not solely as the primary good contract platform, however as engines that proceed to drive innovation and use throughout the DAPP ecosystem.”

Ethereum costs could also be on the breakout disaster

Some analysts consider ether costs are prepared for breakout primarily based on document curiosity of $58 billion on Tuesday and future open curiosity, which is up 7.2% over the previous 30 days.

Others, however, are a bit cautious as the prices of borrowing enclosed ether (WETH) are skyrocketing and technical indicators level to doable overestimation.

Costs have been shifting between $3,530 and $3,933 over the previous seven days, buying and selling at $3,862, up 5.8% over the identical time-frame.

Ethereum Treasury firms are thriving greater than 2.73 million ether

Additionally, extra firms are starting to amass cryptocurrency as monetary belongings. Presently, 65 strategic reserves (ETH) are held in 65 strategic reserves (2.26% of complete provide is equal to $10.56 billion), in response to strategic reserves.

Associated: Ethereum 2035: What the following decade will appear like

The strategic ether reserves present Bitmine as the most important ether financing firm, adopted by Sharplink video games, adopted by ether machines.

“The growth should go nicely with ETH flows and value actions much like MicroStrategy’s influence on Bitcoin,” mentioned David Grider, accomplice at Enterprise Capital Agency Finality Capital, in an X publish on Monday.

journal: Tradfi is constructing Ethereum L2 to tokenize trillions of rwas – Inner Story