Ethereum value has fallen over 6% up to now 24 hours and is at present down about 27% up to now 30 days. The break from the primary continuation sample opened the door to a fair deeper decline. On the similar time, on-chain alerts are flashing a 28% draw back window that could possibly be Ethereum’s subsequent cycle backside if situations worsen.

Taken collectively, these alerts counsel that the ETH correction might not be full but.

Do sure long-term indicators point out room for decline?

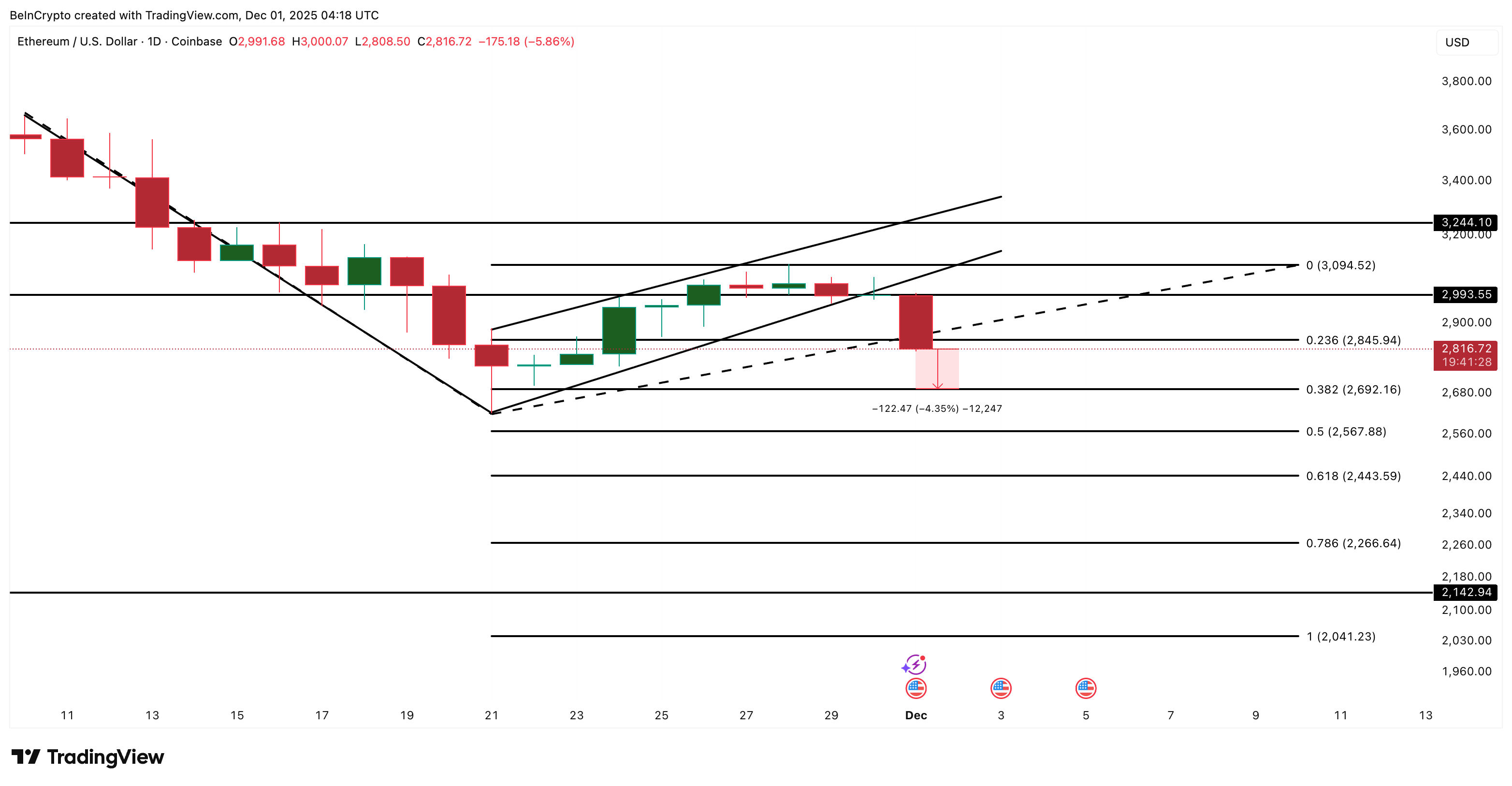

Ethereum not too long ago collapsed from a clear bear flag. The transfer started after ETH failed at $2,990, breaking out of the ascending channel it had been buying and selling in lower than per week. The preliminary decline created a “pole” with a 28.39% decline, and this breakdown prompts a measured goal close to $2,140, nearly precisely 28% beneath the breakdown stage.

Ethereum Breakdown: TradingView

Need extra token insights like this? Join Editor Harsh Notariya’s Each day Crypto Publication right here.

To see if this aim is sensible, let’s evaluate it to long-term holder NUPL. Lengthy Time period Holders NUPL measures how a lot revenue long run holders are making.

NUPL has been trending decrease since August twenty second, suggesting long-term holders are lowering unrealized positive aspects and tempering confidence. The latest short-term low was 0.36 on November twenty first, whereas the six-month low was 0.28 recorded on June twenty second, a distinction of about 22%.

On June twenty second, when NUPL reached 0.28, ETH traded round $2,230, inflicting a pointy market reversal. From there, Ethereum rose to $4,820, a rise of 116% from its backside.

Formation of a brand new backside zone: Glassnode

If NUPL retests its 0.28 cycle low band once more at the moment, the implied value drawdown from ETH’s current native excessive round $2,990 could be in the identical 20-25% vary, precisely matching the 28% bear flag goal of $2,140.

That is the clearest overlap in your complete evaluation. Each the worth sample and long-term holder indicators level to the identical decrease zone.

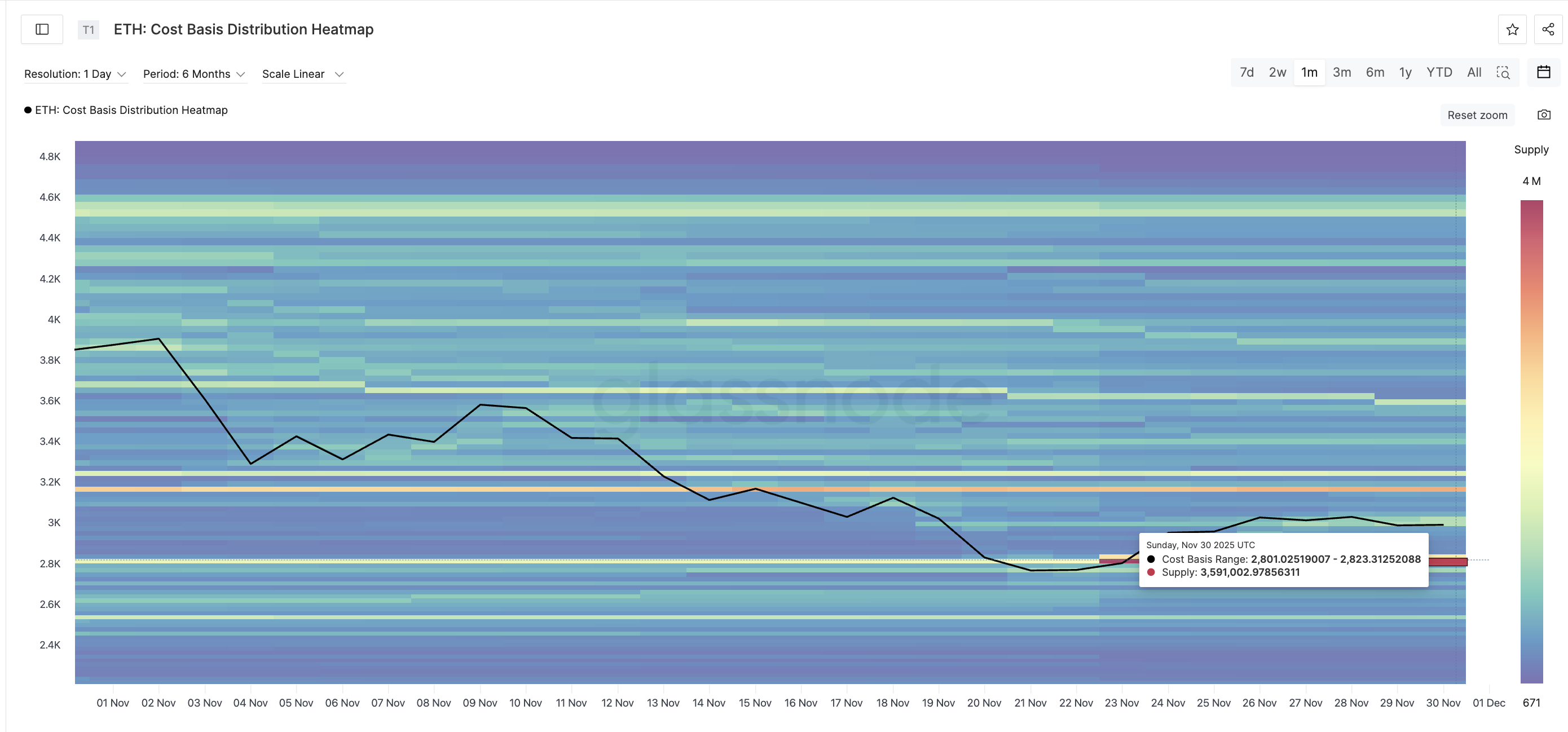

Ethereum value is on the strongest wall on a value foundation

The following step is to see if the Ethereum value chart helps the identical conclusion. A price-based distribution heatmap exhibits the place giant ETH clusters have not too long ago accrued. The heaviest band is between $2,801 and $2,823, with 3,591,002 ETH bought in that zone. That is the strongest help Ethereum at present has.

Final provide wall: Glassnode

ETH has already fallen beneath the $2,840 value stage, rising stress on this cost-based wall. Sellers stay in full management even when ETH value is unable to get better $2,840 shortly and shut above $2,990 once more.

Because the weak point continues, the subsequent stage of trend-based extensions emerge one after the opposite. The primary level is $2,690, about 4.5% lower than the present value. If that fails, the decline may widen to $2,560 (an extra 4.6% decline), $2,440 (one other 4.8%), and $2,260, simply 2% above June’s NUPL backside of $2,230.

Beneath all of this can be a full breakdown goal of $2,140, about 28% beneath the breakdown zone and completely consistent with the flag’s prediction.

Ethereum Value Evaluation: TradingView

If ETH falls beneath $2,266, a bear flag goal turns into probably the most reasonable state of affairs.

There may be nonetheless a nullification path, however it requires a number of layers of power. ETH must regain $2,840, then break above $2,990, after which safe an in depth above $3,090. The general bearish sample will solely lose which means if ETH breaks by $3,240, which is a few 15% improve from present ranges.

For now, ETH is buying and selling beneath the strongest cost-based wall, long-term holders are nonetheless lowering unrealized positive aspects, and the continuation construction is clearly declining. If these situations maintain true, the $2,260-$2,140 space is the place Ethereum is more than likely to kind its subsequent cycle backside.

The article Ethereum breaks down from main sample, paving the way in which for 28% crash appeared first on BeInCrypto.