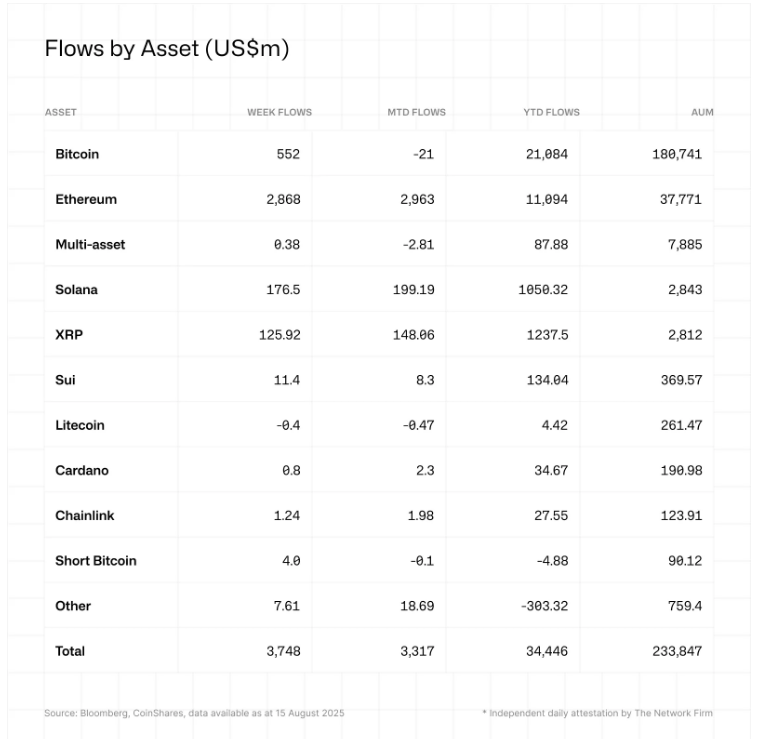

Digital Asset Funding merchandise attracted $3.75 billion final week, elevating its managed property to $244 billion on August thirteenth.

Coinshares information exhibits the overall ranks of one of many largest weekly inflow seen not too long ago. Costs have risen, however the primary driver was cash that strikes into funds somewhat than a large retail rush.

Focus circulation from a single product

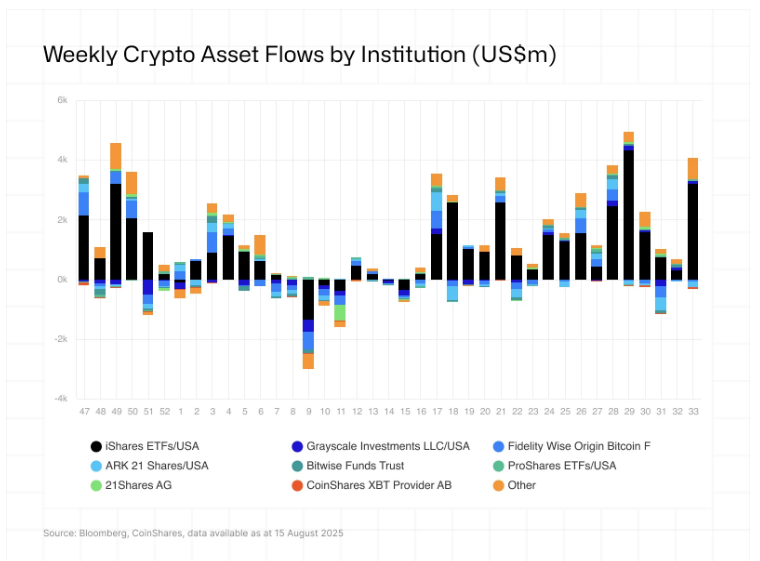

Based mostly on a report from Coinshares, virtually all the inflow got here by way of one supplier. The US accounts for $3.73 billion, which is sort of every week’s complete.

Canada added $33.7 million, Hong Kong added practically $21 million, and Australia added $12 million. In distinction, Brazil and Sweden recorded $10.6 million and $50 million outflows.

Market members say that almost all of the money was poured right into a single iShares product. This helps clarify how a comparatively slim set of flows has made the AUM very sharp general.

Ethereum withdraws most cash

Ethereum attracted the vast majority of final week’s inflow to $2.87 billion, or 77% of its complete. This can end in an annual web influx of roughly $11 billion to ETH.

Ethereum presently accounts for nearly 30% of its managed property, in comparison with 11.6% of Bitcoin. My weekly consumption of Bitcoin was $552 million.

Different strikes embrace Solana getting $176.5 million and XRP including $126 million, whereas Litecoin and Ton exhibiting small outflows of $400,000 and $1 million, respectively. These figures present a transparent change in the place institutional funds are parked this week.

Company Holding and Provide Notes

In keeping with Cryptoquant, greater than 16 corporations have reported including Ethereum to their stability sheets.

Collectively they’ve round 2.45 million ETH, valued at round $11 billion, and these cash are successfully out of circulation whereas being trapped within the Treasury or refrigerated state.

It’s value noting that Ethereum doesn’t have a hard and fast provide like Bitcoin. It was added final yr to produce round 1 million ETH, and the provision dynamics may change with community exercise.

Take a look at futures and huge homeowners

Open curiosity on futures is near $38 billion. It is a substantial quantity that will increase the chance {that a} fast value will transfer when a place is closed.

A sudden shift in giant, concentrated holders and futures positions signifies that costs might be pushed sharply in both path.

For now, it is a flow-driven occasion that has greater than an enormous retail spike. If the identical product continues to devour giant quantities, it should proceed to extend the upward strain.

On the identical time, skinny liquidity and huge positions can quickly invert earnings into losses. Buyers and merchants ought to concentrate on weekly capital flows, open curiosity in futures, and on-chain actions to see if traits unfold past the small variety of main patrons.

Meta featured pictures, TradingView chart