Ethereum’s value has fallen sharply over the previous 24 hours, dropping from round $4,300 to almost $3,400 earlier than partially rebounding to round $3,800. The transfer got here in tandem with about $19 billion in cryptocurrency liquidations, one of many greatest single-day drops this 12 months, led by a tariff dispute between China and america. The sudden flash worn out lengthy positions on main exchanges and despatched merchants scrambling to hedge in futures markets.

Ethereum is down about 13% on the time of writing, however early indicators from derivatives and technical charts recommend that the decline could have gone too far and {that a} rally could also be forming behind the scenes.

Though bearish positioning strengthens, derivatives trace at the potential for a rebound

A crash of this magnitude not often begins within the spot market. They begin with derivatives, the place each earnings and losses are magnified by means of heavy leverage.

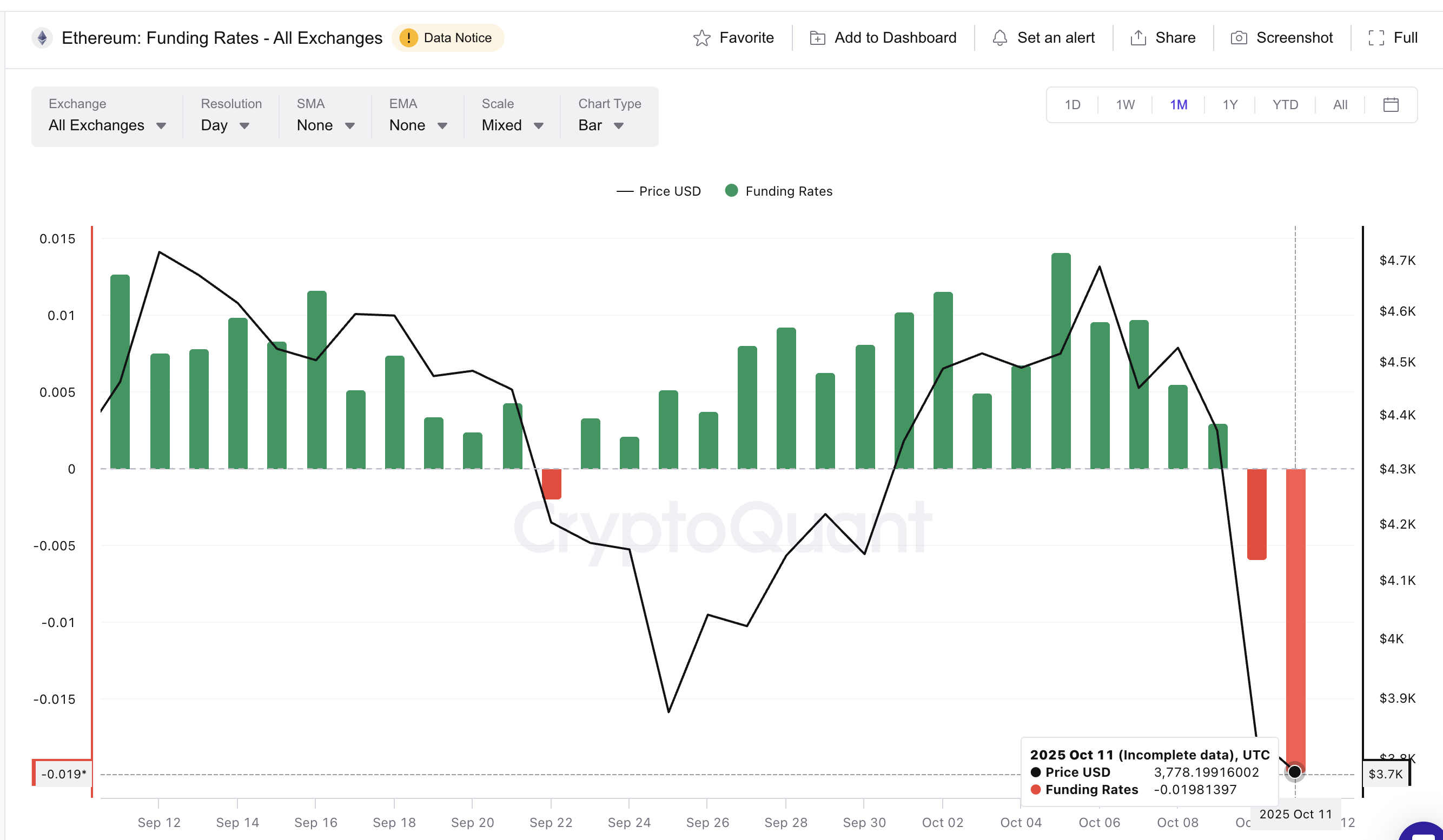

Ethereum’s funding fee (the price merchants pay or obtain for holding perpetual futures) reversed from +0.0029% on October ninth to -0.019% by October eleventh.

A unfavourable funding ratio means quick merchants are paying out lengthy merchants, indicating that a lot of the open curiosity is at the moment betting on additional draw back.

ETH funding fee turns unfavourable: CryptoQuant

Need extra token insights like this? Join Editor Harsh Notariya’s Every day Crypto Publication right here.

Whereas this imbalance is bearish on the floor, it might additionally create a setup for a pullback. When shorts change into overcrowded, even a small value pullback could cause a brief squeeze, forcing merchants to purchase again their positions and driving the value greater.

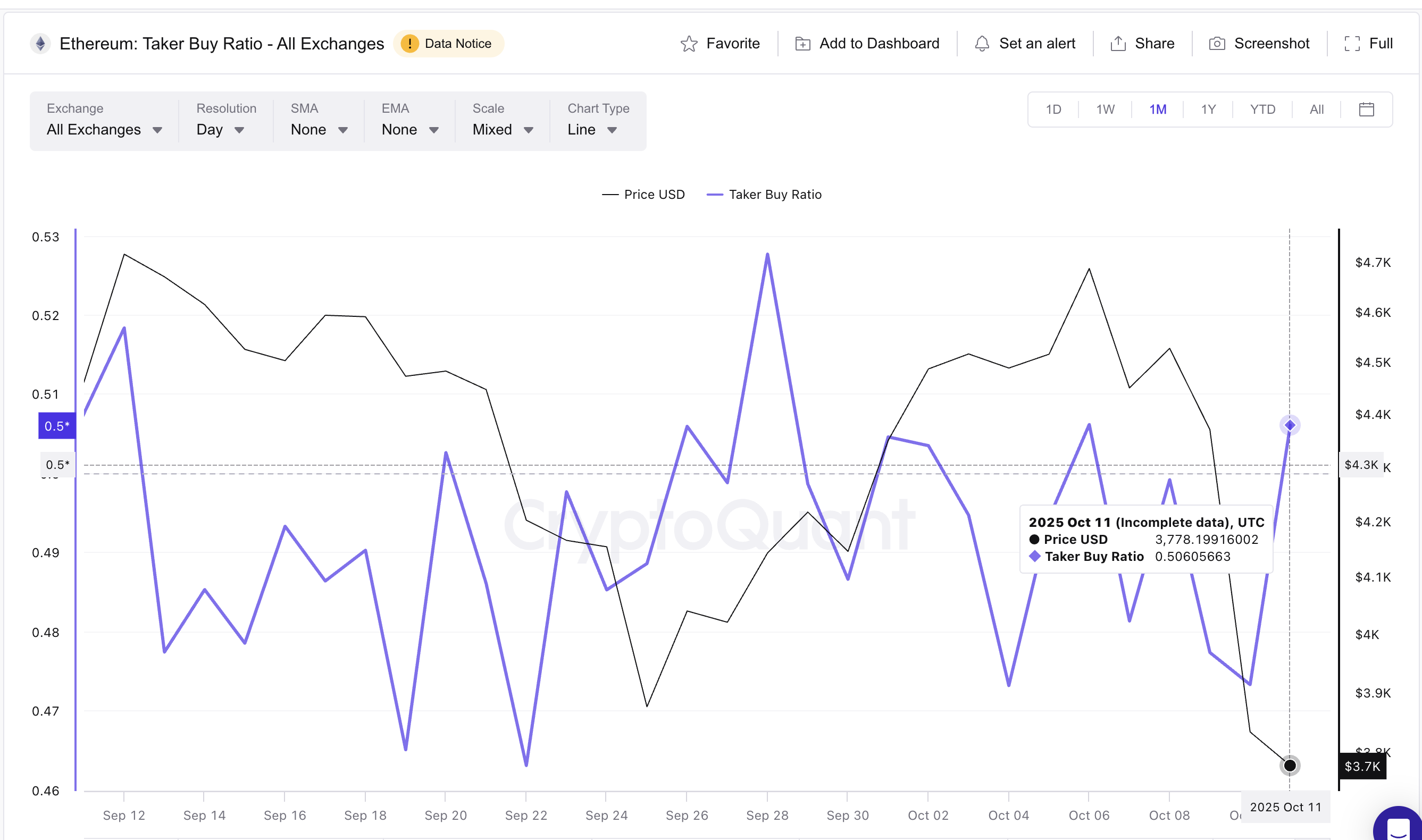

The second by-product metric helps this view. The taker-buy ratio, which measures whether or not energetic trades favor shopping for or promoting, has rebounded from 0.47 to 0.50 prior to now 24 hours.

This modification means consumers are actually matching sellers in quantity, an early signal {that a} sell-off could also be close to.

Suggesting rising buying intent amongst Ethereum takers: CryptoQuant

The final time this ratio reached an analogous degree (native peak) was on September twenty eighth, when Ethereum rose by 13%, rising from $4,140 to $4,680.

Taken collectively, these knowledge recommend that the market’s bearish positioning may very well be setting the situations for a rebound slightly than a deep crash. Technical charts ought to reveal extra.

Hidden divergence strengthens case for Ethereum value restoration

Ethereum’s value chart lends additional weight to this concept. On the every day time-frame, Ethereum is exhibiting a hidden bullish divergence. It is a sample shaped when value makes greater lows however the relative energy index (RSI) makes decrease lows.

RSI measures momentum from 0 to 100. This deviation from value signifies that sellers are shedding energy, even when value has not but absolutely recovered.

Ethereum value divergence: TradingView

This identical configuration appeared between August 2nd and October tenth. The final time Ethereum outputted this sign was from August 2nd to September twenty fifth, when it rose virtually 25% inside a couple of days.

If Ethereum is above $3,430 (main help), the present rebound setup stays in impact. A breakout of $3,810 (one other necessary help) and $4,040 might affirm a short-term restoration and set a goal close to $4,280, about 13% greater than present ranges.

Ethereum Value Evaluation: TradingView

Nevertheless, a break beneath $3,350 will invalidate that construction and momentum will change again to the bears. For now, the collapse in Ethereum costs could have created its personal rebound zone.

With heavy shorting and a quiet return to technical energy, a restoration in direction of $4,280 is trying more and more probably if consumers maintain onto key helps. All that’s wanted to regain energy is a every day candlestick shut above $3,810.

The article Ethereum crash might create a rebound zone with upside alternatives appeared first on BeInCrypto.