Ethereum has suffered a pointy correction, with the worth falling practically 29% over the previous week and falling beneath the $2,000 milestone. $ETH is presently buying and selling at ranges final seen 9 months in the past, reflecting the extreme weak point throughout the market.

The scenario is worsening attributable to a decline in purchaser assist, and on-chain information confirms that Ethereum holders are underneath growing stress.

Ethereum holders return to sale

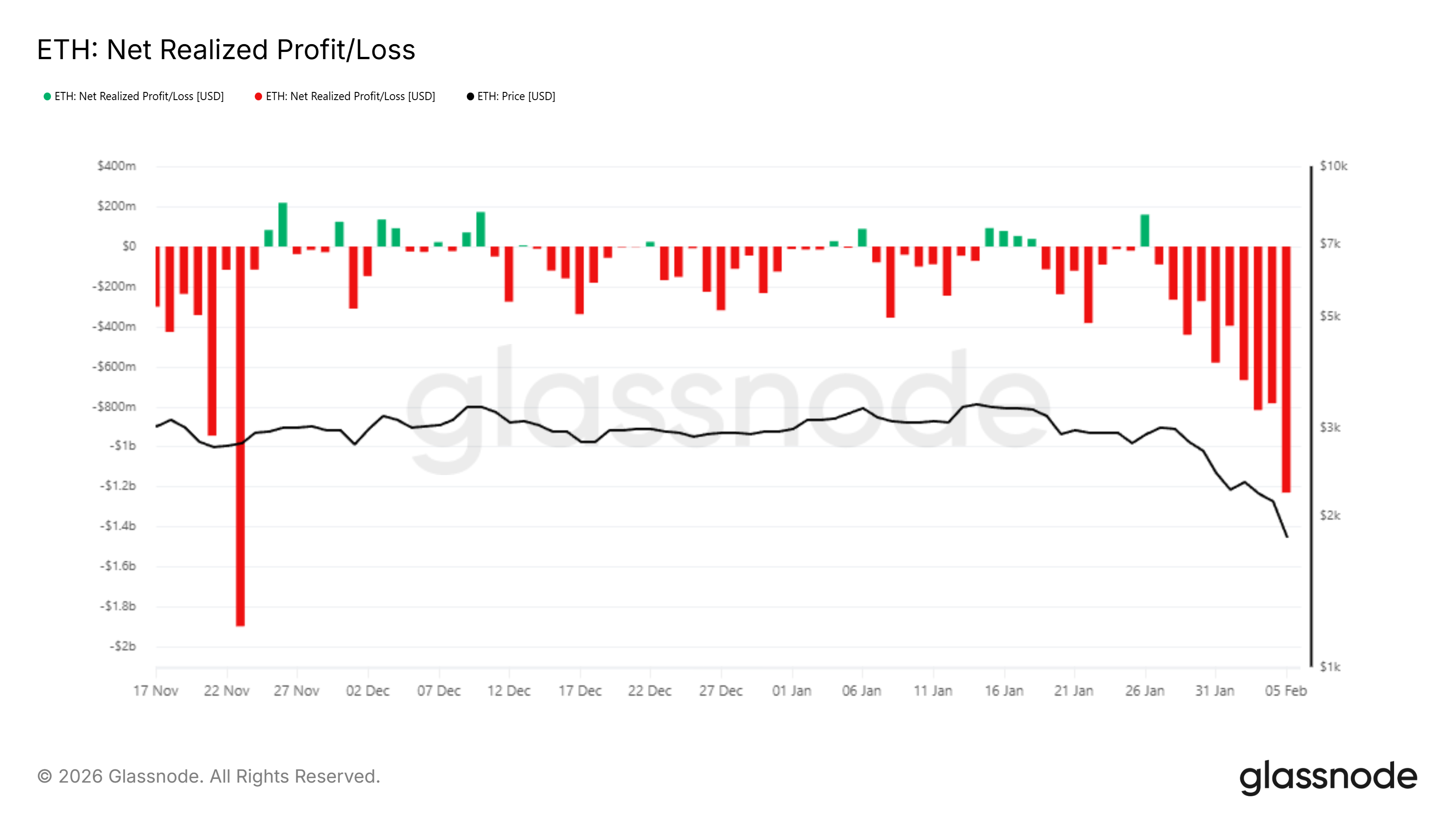

Ethereum holders are more and more resorting to panic promoting as broader market situations worsen. On-chain information on realized revenue/loss indicators reveals that buyers are promoting behind the scenes. Realized losses soared to greater than $1.2 billion in lower than 24 hours, highlighting widespread capitulation as holders prioritize danger mitigation over restoration.

This improve in realized losses typically strengthens the adverse momentum and widens the decline. furthermore $ETH If bought at a loss, the worth will face additional downward strain. This conduct means that belief stays fragile, limiting Ethereum’s skill to stabilize till gross sales exercise meaningfully subsides throughout the community.

Need extra token insights like this? Join Editor Harsh Notariya’s Day by day Crypto E-newsletter right here.

Ethereum internet realized revenue or loss. Supply: Glassnode

$ETH Lengthy-term buyers change stance

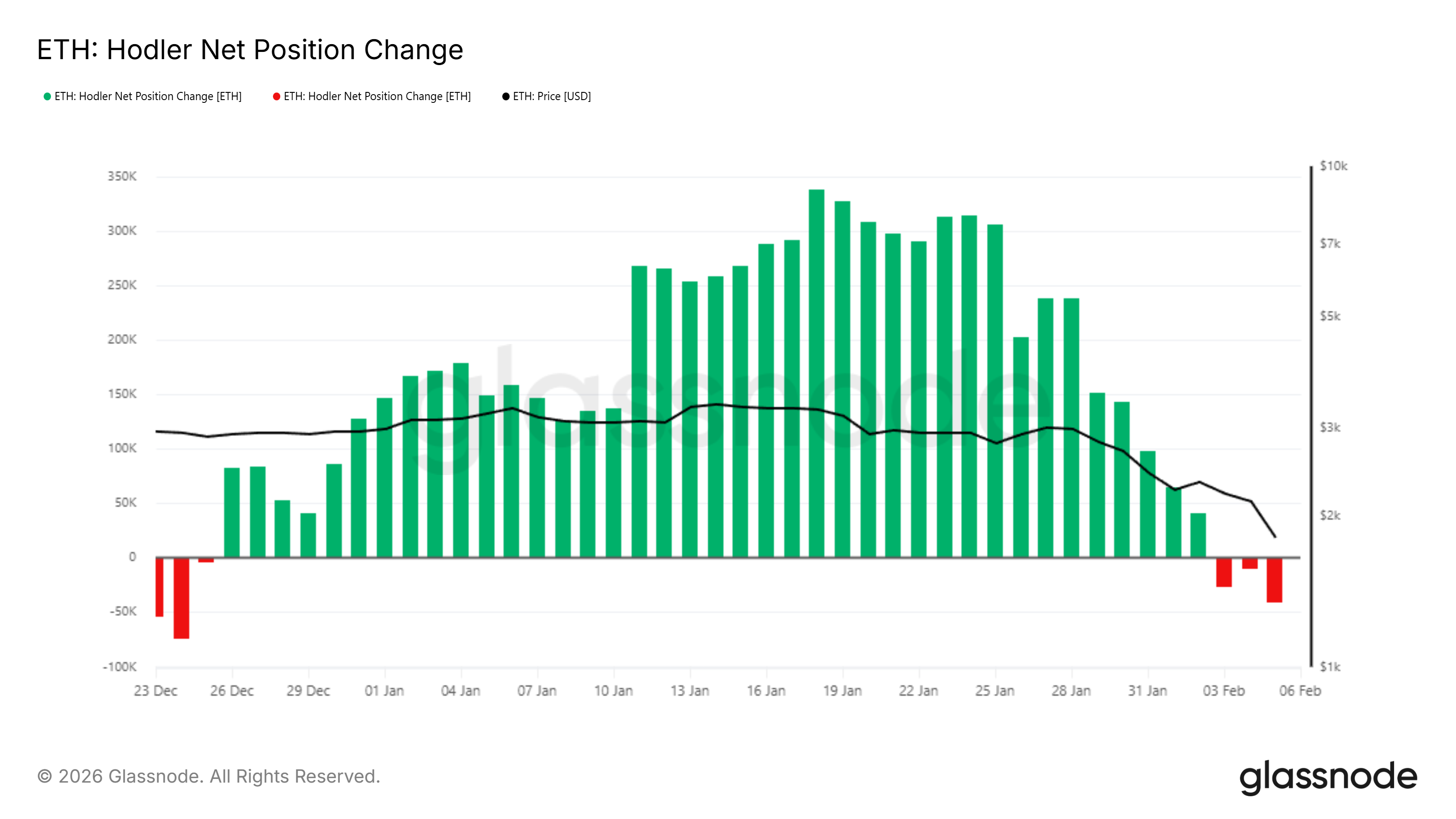

The conduct of long-term holders displays related stress. The HODLer’s internet place change has decreased and the bar has turned crimson, indicating a internet outflow from the long-term pockets. This modification is noteworthy as long-term holders are usually thought of to be the spine of Ethereum’s market construction and value stability.

When long-term holders distribute reasonably than accumulate, it typically signifies deep concern. The choice to promote amid mounting losses is an indication of rising panic even amongst principled buyers. This improvement provides macro-level strain and will increase the danger of Ethereum’s decline deepening earlier than a significant restoration begins.

Ethereum HODLer place change. Supply: Glassnode

$ETH Costs could reverse

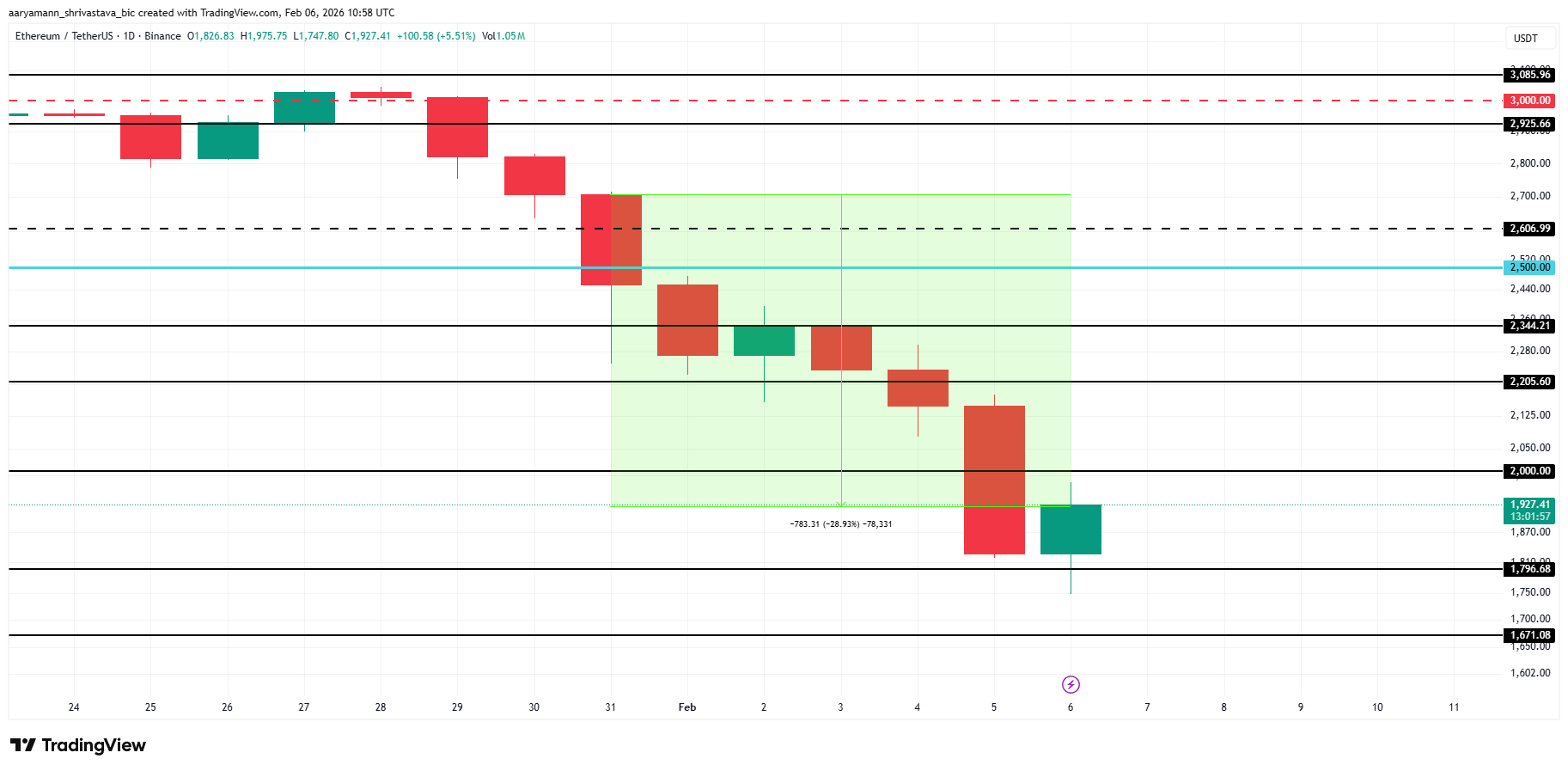

Ethereum’s value is buying and selling round $1,920 on the time of writing after falling 29% in per week. The transfer beneath $2,000 strengthened the bearish construction throughout a number of time frames. Contemplating widespread on-chain indicators and sentiment indicators, $ETH Additional draw back remains to be doubtless within the quick time period.

$ETH It’s presently holding above the $1,796 assist stage. If this stage fails, the worth might fall beneath $1,671. Ethereum has already reached a nine-month low since Could 2025, and the danger of additional liquidation-driven promoting will increase if assist breaks.

Ethereum value evaluation. Supply: TradingView

A restoration situation remains to be doable if promoting strain eases. Ethereum might regain $2,000 on the again of oversold situations. The cash move index is properly beneath the reference worth of 20.0, indicating that promoting strain is probably going saturated. Traditionally, such readings have preceded short-term reduction rallies.

Ethereum MFI. Supply: TradingView

An analogous rebound might happen if buyers chorus from additional promoting. This may very well be doable by suspending the provision of exchanges. $ETH To regain momentum. Beneath this situation, Ethereum might advance above $2,000 and in the direction of $2,500. If this motion is secured, bearish theories might be invalidated and market confidence might be restored.

The article “Ethereum crashes 29% in a single week, however reversal indicators begin to emerge” was first printed on BeInCrypto.