On Friday afternoon, Ethereum traded above the $2,000 per coin vary amid a mixture of warning and congestion in derivatives markets throughout futures and choices. Futures open curiosity fell barely through the day, however choices information confirmed merchants concentrating round a significant strike, setting the stage for potential value compression.

Ethereum Choices Compression Level Placement Close to Most Ache Zone

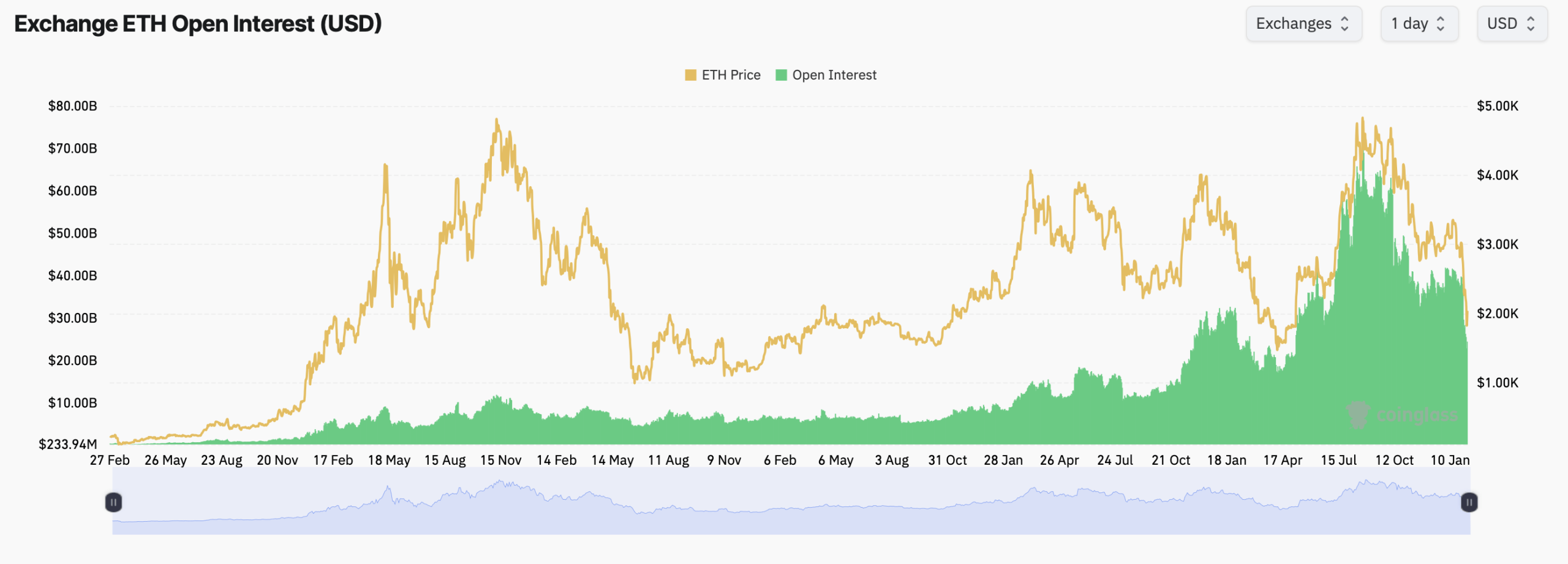

Ethereum was unstable yesterday, however issues have calmed down significantly on Friday. Ethereum futures open curiosity stays substantial throughout main exchanges, with CME main in greenback phrases at round $3.45 billion, representing round 14.1% of complete trailing publicity, in keeping with Coinglass.com statistics.

Binance adopted intently with round $5.53 billion in open curiosity, capturing the most important share by notional worth, whereas Gate, Bybit, OKX, and Bitget rounded out the second tier.

Ethereum futures open curiosity on February 6, 2026.

Nevertheless, short-term market conduct turned defensive. Most main exchanges, together with Binance, CME, OKX, ByBit, and BitGet, recorded an hourly drop in open curiosity, suggesting that merchants are lowering threat quite than pushing for directional bets. The 4-hour and 24-hour numbers inform a extra nuanced story, with CME, Binance, and Gate nonetheless exhibiting internet each day features.

Quantity-adjusted indicators bolstered that divergence. CME’s open interest-to-volume ratio hovers round 0.93, indicating deep institutional positioning, whereas Binance’s decrease ratio displays sooner buying and selling volumes and extra lively buying and selling. BingX and Bitget recorded a few of the highest ratios, indicating tight positions regardless of mild general flows.

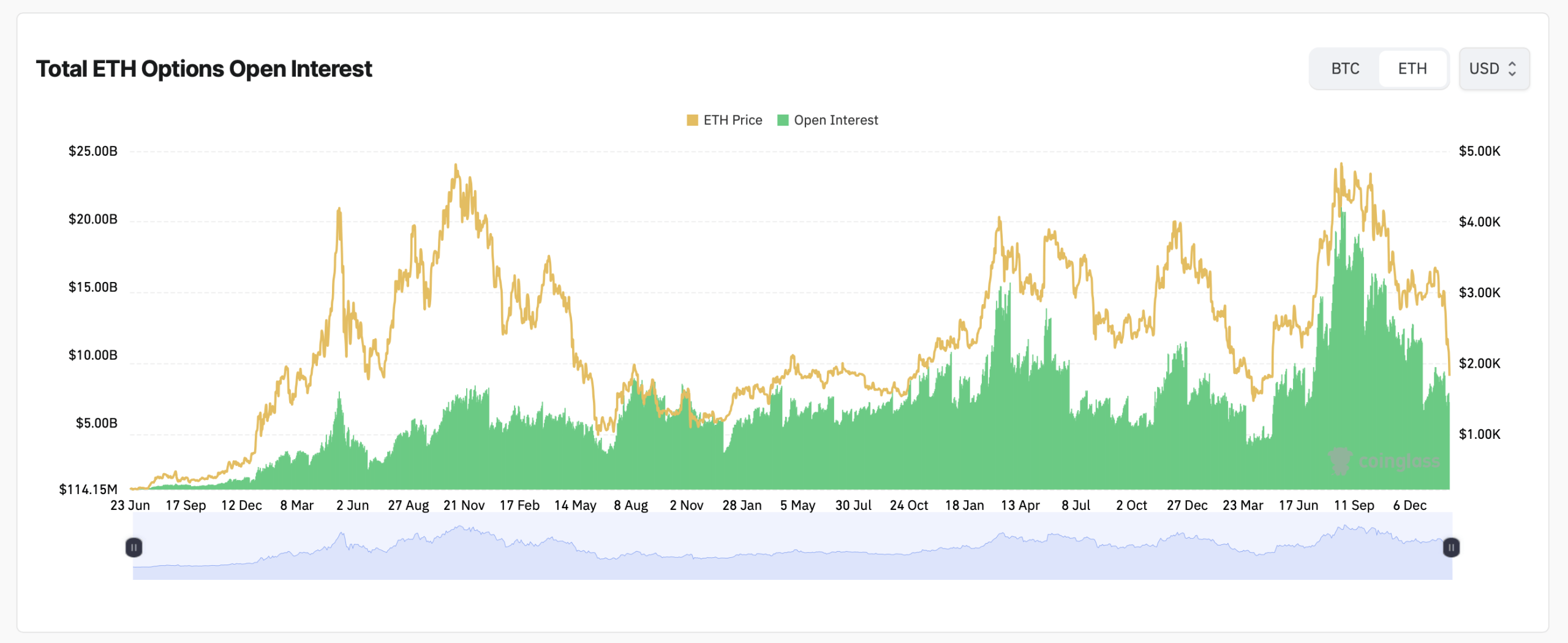

On the choices facet, Ether open curiosity remained concentrated in Deribit, with long-term name contracts dominating the leaderboard. The most important single contract by open curiosity is the $6,500 name on Deribit ETH-27MAR26, adopted by $5,500 and $6,500 calls expiring in late 2026, highlighting a sustained long-term upside place.

However that optimism got here with threat aversion. The $1,800, $1,500, and $2,200 put contracts additionally rank among the many largest open curiosity positions, revealing a market that wishes upside room however refuses to depart the draw back alone. In different phrases, choices merchants are sporting each seatbelts and helmets.

Ethereum choices open curiosity on February 6, 2026.

In keeping with combination choices information, calls account for about 58.2% of the overall open curiosity in Ether choices, whereas places account for 41.8%. Nevertheless, the 24-hour buying and selling cut up was near lifeless even, with calls and places every accounting for about half of the day’s quantity, indicating that confidence stays fragile.

When the ache stage is at its most, extra stress is added. On Deribit, most ache costs are clustered round $2,100 to $2,200 per Ethereum over the upcoming expiry, with notable notional values increase from late February to late March. Binance’s max ache estimate rose barely round $2,800, however then plummeted in direction of $2,200 heading into the expiration.

OKX presents a distinct image, with most ache pulling into the low $2,400 vary and subsequent contracts collapsing close to the $2,100 zone. A recurring theme throughout all three venues was the gravity in direction of the low $2,000 area, uncomfortably near Ethereum’s present spot value of $2,041 per coin.

Additionally learn: U.S. shares rise as inflation expectations ease and know-how stabilizes

Lengthy-term charts confirmed that message. Whole open curiosity in Ether futures and choices has elevated considerably over the previous yr, however latest declines in each value and open curiosity counsel that merchants are lowering leverage quite than doubling down. The derivatives market appears to be catching its breath.

Basically, the Ethereum derivatives market is exhibiting restraint quite than panic. With futures positioning easing, choices crowding round most ache, and costs hovering simply above $2,000, merchants seem content material to attend and see.

Regularly requested questions ❓

- What’s the present value of Ethereum?Ethereum is buying and selling at $2,041 per coin as of February 6, 2026, 1:30 PM ET.

- Which trade has probably the most Ethereum futures open curiosity?Binance leads when it comes to notional worth, and CME has a bonus in institutional fashion positioning.

- Are Ethereum choices merchants bulls or bears?Calls outnumber places when it comes to complete open curiosity, however each day buying and selling is sort of evenly cut up.

- What’s the most ache stage for Ethereum?Throughout Binance, OKX, and Deribit, the largest ache is centered across the low $2,000s.