Ethereum’s spot worth was hovering at $3,087 per coin on Saturday, whereas derivatives merchants had been quietly piling up danger within the futures and choices markets. The information reveals that leverage has elevated whilst worth actions stay risky, and this setup tends to punish crowded positions.

Ethereum futures and choices sign dealer nervousness close to $3,100

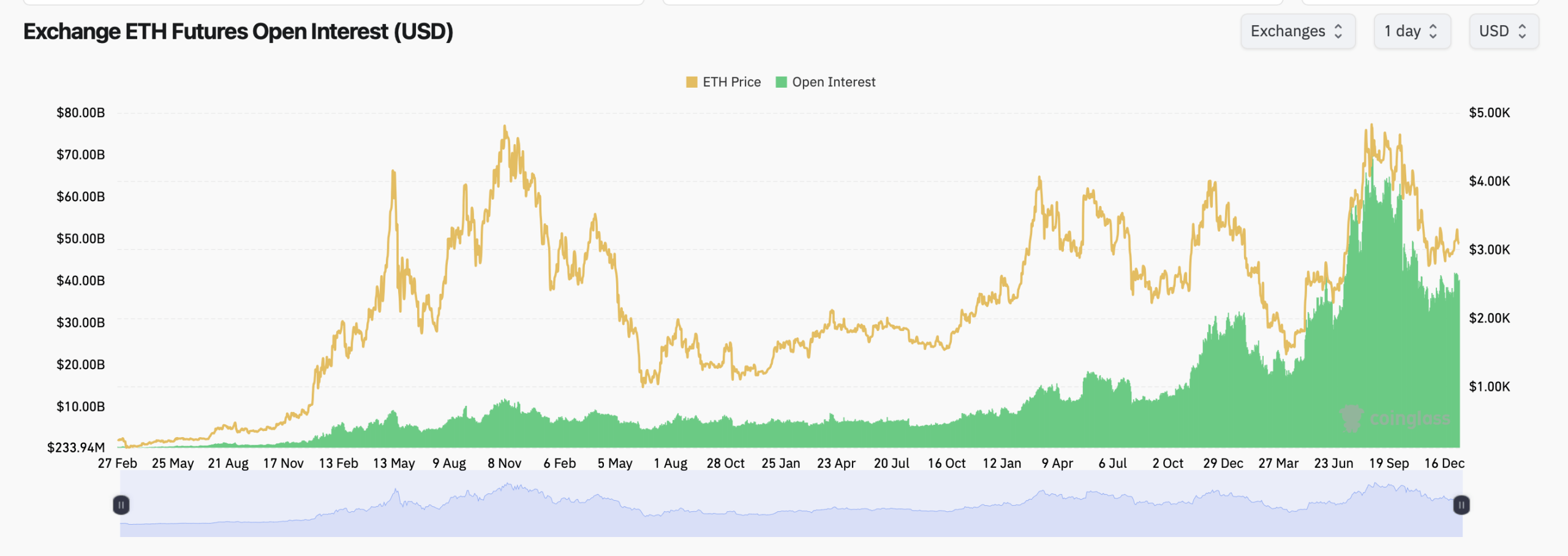

Ethereum futures open curiosity rises to 13.01 million Ethereumrepresenting a complete notional quantity of roughly $40.22 billion throughout main exchanges. Regardless of some pullbacks previously 1-hour and 4-hour home windows, open curiosity elevated by 0.69% over 24 hours, indicating that merchants are including publicity quite than exiting.

Binance stays the dominant participant in Ethereum futures, controlling 22.62% of the entire open curiosity, or roughly $9.1 billion. CME follows with $5.86 billion, a notable quantity that reveals the continued participation of institutional traders. Gate, Bybit, OKX, and Bitget spherical out the highest tier, every holding multi-billion greenback positions and collectively conserving leverage excessive.

Ethereum futures open curiosity through Coinglass on January 10, 2026.

Quick-term market tendencies seem uneven. Open curiosity on most exchanges declined barely within the first and fourth hours, suggesting tactical danger aversion. However a broader 24-hour image tells a distinct story. Gate is up 4.34% and OKX is up 2.47%, indicating selective accumulation quite than a panic exit.

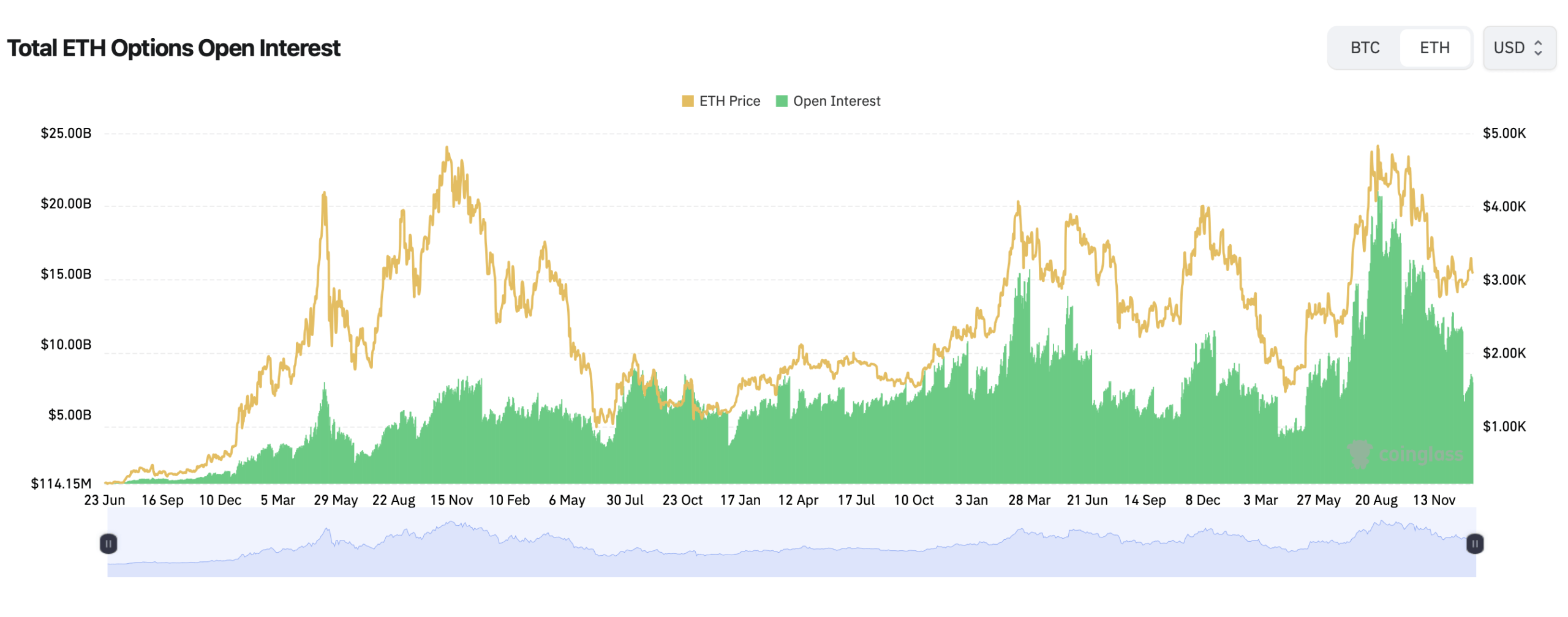

The choices market is unquestionably leaning towards optimism. The whole open curiosity in Ethereum choices is roughly 1.29 million, with calls accounting for 60.40% in comparison with 39.60% for places. Ethereum Variety of calls vs. 843,794 Ethereum With a put. Quantity over the previous 24 hours displays that bias, with calls accounting for 52.83% of contracts traded.

Ethereum choices open curiosity through Coinglass on January 10, 2026.

Probably the most crowded choice strikes are positioned a lot greater than the spot. At Deribit, the biggest open curiosity contracts embody: EthereumThe -$6,500 name expires on March 27, and the $5,500 name expires on March 27 and June 26, suggesting merchants are betting on an prolonged rally later this 12 months quite than quick fireworks.

However the peak ache information has an added twist. On Deribit, Ethereum’s most ache stage is centered round $3,100, uncomfortably near the present spot worth. Binance and OKX exhibit related profiles, with most ache curves descending in the direction of the $3,000-$3,100 vary, a zone that has traditionally acted like a magnet as expiration approaches.

Additionally learn: “Working Bitcoin”: BTC holds $90,000 on seventeenth anniversary of Hal Finney’s iconic tweet

That stress creates a clumsy confrontation. Futures merchants are including leverage, choices merchants are loading calls, and the largest ache is quietly lurking beneath the most well-liked bull strikes. It is a setting the place persistence often wins over bravado.

Traditionally, durations the place futures open curiosity rises sooner than spot costs are likely to precede extra fast actions. Route isn’t assured, however crowded areas cut back the margin for error. When everybody leans in the identical path, the market tends to check your resolve.

For now, the Ethereum derivatives market displays unconfirmed confidence. Leverage is growing, there may be optimism, and danger is delicately balanced round psychologically loaded worth ranges. Whether or not merchants are rewarded or washed out will depend on who blinks first.

Regularly requested questions ❓

- What’s the present open curiosity in Ethereum futures?

Open curiosity in Ethereum futures is roughly $40.22 billion throughout main exchanges. - Are Ethereum choices merchants bulls or bears?

Choices information reveals a bullish pattern, with calls accounting for about 60% of open curiosity. - What’s the most ache stage for Ethereum?

On Binance, OKX, and Deribit, the largest ache is centered across the $3,000-$3,100 vary. - Which exchanges dominate Ethereum futures buying and selling?

Binance leads with over 22% of whole open curiosity in Ethereum futures.