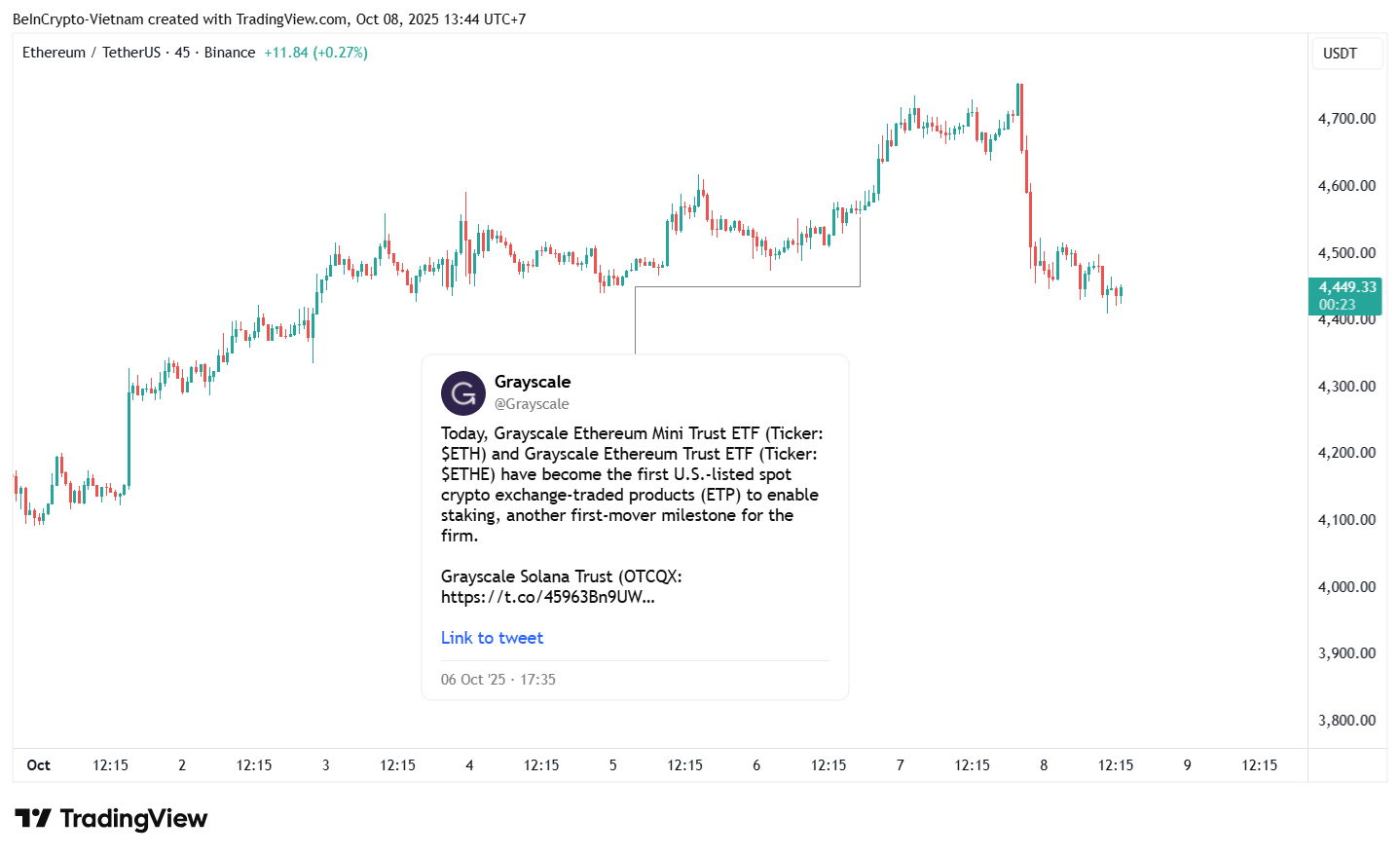

Grayscale’s announcement that the Grayscale Ethereum Belief ETF has turn out to be the primary US-listed spot crypto ETF to allow staking helped push the value of ETH above $4,700 in October.

Nonetheless, Grayscale’s ETH staking exercise was not sturdy sufficient to maintain the value at that stage for lengthy.

Grayscale has staked over 300,000 ETH, however promoting strain is bigger

On October 6, Grayscale introduced that its Ethereum Belief ETF (ETHE, ETH) and Solana Belief (GSOL) now enable buyers to earn staking yield straight by way of conventional brokerage accounts.

Business leaders expressed optimism concerning the information, calling it a bullish sign for ETH and the broader Ethereum ecosystem.

“It’s nice information that Grayscale’s ETH ETF can now stake $ETH. This can be a big milestone for the ecosystem and is bullish for Ethereum as an entire. Having labored on BlackRock’s Bitcoin ETF and Ethereum ETF, I’ve seen how highly effective these autos are for institutional entry and adoption,” stated Joseph Chalom, co-founder of Sharplink (SBET).

However, the value of ETH fell beneath $4,500, decrease than it was on the time of the information announcement.

ETH worth efficiency since early October. Supply: TradingView

Based on on-chain analytics account EmberCN, Grayscale has staked 304,000 ETH value over $1.3 billion since receiving approval for staking.

This transfer demonstrates Grayscale’s sturdy dedication to supporting the Ethereum community. Decreasing the circulating provide might additionally assist stabilize the value of ETH.

Nonetheless, present Ethereum community information means that this effort might not be sufficient to supply a powerful constructive influence.

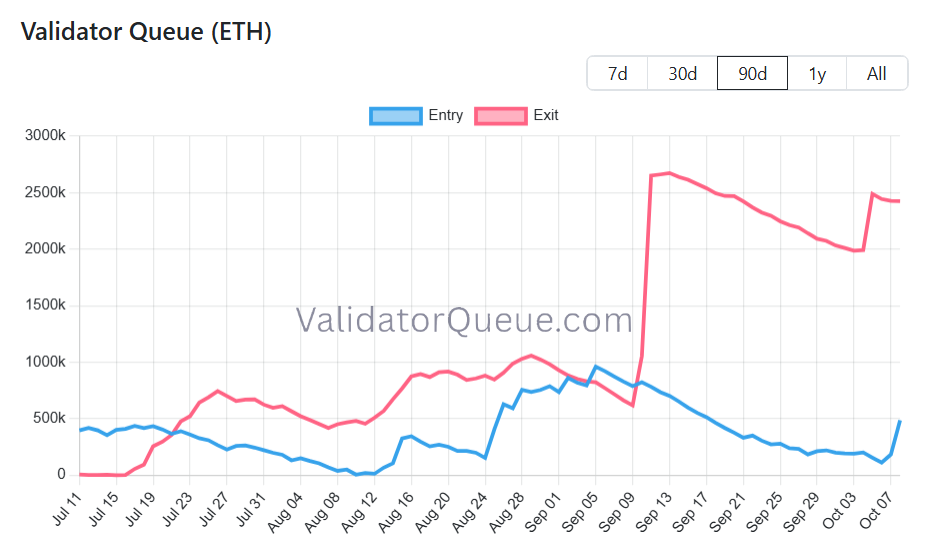

Quantity of ETH in staking and unstaking queues. Supply: ValidatorQueue

Based on ValidatorQueue information, roughly 489,000 ETH is ready to be staked, most of which belongs to Grayscale. In distinction, the quantity of ETH awaiting de-staking is far larger and has been growing since early October, with over 2.4 million ETH ready for withdrawal.

This massive imbalance signifies potential promoting strain, which might enhance the circulating provide of ETH and put downward strain on the value.

Ethereum’s long-dormant whale has woke up, including to the promoting strain

In the meantime, a number of long-time Ethereum whales have moved on and began promoting their holdings.

- Based on Lookonchain, one whale pockets awoke after 4 years of inactivity and bought 1,800 ETH for a revenue of roughly $8.12 million. 4 years in the past, this pockets was withdrawing 5,999 ETH from Kraken for simply $2,523 per ETH.

- Equally, SpotOnChain reported that one other dormant whale transferred 15,000 ETH (equal to roughly $68.2 million) to Bitfinex after being inactive for 5 years.

The same sample is rising with Bitcoin OG wallets, reflecting a typical profit-taking mentality amongst long-term and large-scale buyers.

The mixture of a reactivated Ethereum whale and a rise in unstaking queues in October might weaken the constructive influence of Grayscale’s staking efforts.

Though staking extra ETH helps strengthen community safety and generate staking rewards, promoting strain from unstaking exercise and whale actions can outweigh these advantages, making it troublesome for ETH worth to keep up upward momentum.

The put up Ethereum drops beneath $4,500 regardless of Grayscale 300,000 ETH staking appeared first on BeInCrypto.