Ethereum worth has been flat since late December 2025, struggling to determine a transparent pattern. ETH has been subjected to repeated resistance exams with out affirmation.

Regardless of the sluggish worth motion, sentiment amongst a number of investor cohorts has improved, suggesting that consolidation could also be nearing an finish as market confidence slowly returns.

Ethereum holders smile as 2026 arrives

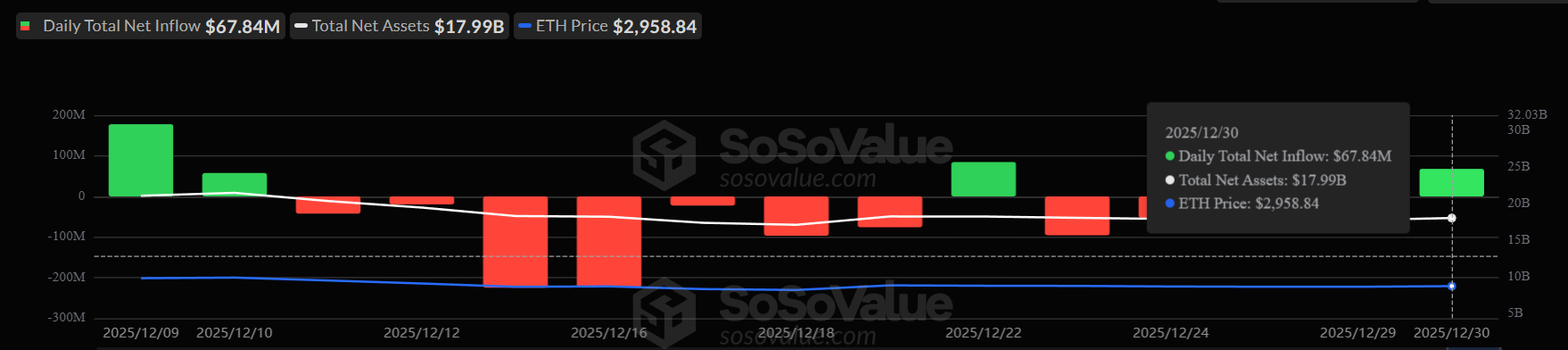

Ethereum ETF ended 2025 on a constructive observe after a risky December. Spot ETH ETFs recorded mixed inflows of $67 million, reversing regular outflows that had lasted for about two weeks. This shift indicators renewed curiosity from institutional traders after a interval of threat aversion resulting from macroeconomic uncertainty.

This influx suggests macro traders could also be repositioning heading into the brand new yr. Though sentiment remained cautious in December, developments in early 2026 recommend improved expectations for Ethereum’s worth efficiency. ETF exercise typically displays long-term conviction, reinforcing the view amongst a variety of market members that draw back strain could also be easing.

Need extra token insights like this? Join Editor Harsh Notariya’s Every day Crypto E-newsletter right here.

Ethereum ETF Circulate. Supply: SoSoValue

On-chain knowledge confirms the development in sentiment. Coin Days Destroyed (CDD) has solely had one noticeable spike all through December. Outdoors of this occasion, indicators stay subdued, indicating restricted distribution exercise amongst long-term holders.

CDD measures how long-held cash transfer on-chain and sometimes highlights promoting by skilled traders. Ethereum LTH seems reluctant to dump its place despite the fact that ETH has not been capable of get better $3,000 for over two weeks. This motion indicators confidence in future valuation good points and reduces near-term provide strain.

Ethereum HODLer place change. Supply: Glassnode

ETH worth will stay tense from 2025

Ethereum is buying and selling round $2,975 on the time of writing, slightly below the $3,000 resistance. This degree caps worth will increase for many of December 2025. A sustained break above this degree stays essential to verify the bullish construction as soon as once more.

Optimistic sentiment amongst holders might push Ethereum worth above $3,000 within the first week of 2026. Continued accumulation and regular ETF inflows might present sufficient momentum. If the breakout is confirmed, Ethereum worth might goal $3,131, per the earlier resistance turning into potential help.

ETH worth evaluation. Supply: TradingView

Nevertheless, with the market setting unsure, draw back dangers nonetheless exist. A broad decline available in the market might set off a correction in ETH worth to $2,902. Rising promoting strain might widen losses to $2,796, which might invalidate the bullish outlook and return the main focus to a defensive stance.

The submit Ethereum ETF Ends 2025, Worth Stagnates Beneath $3,000 With $67 Million Inflows appeared first on BeInCrypto.