Ethereum is powerful at almost $3,428, rising greater than 7% a day, breaking above vital resistance ranges.

It’s because knowledge from each on-chain and futures markets counsel that there are nonetheless footing on the gathering. A better take a look at Change Reserves, funding charges and pricing construction reveals that Ethereum could also be on observe with a 32% transfer to $4,541.

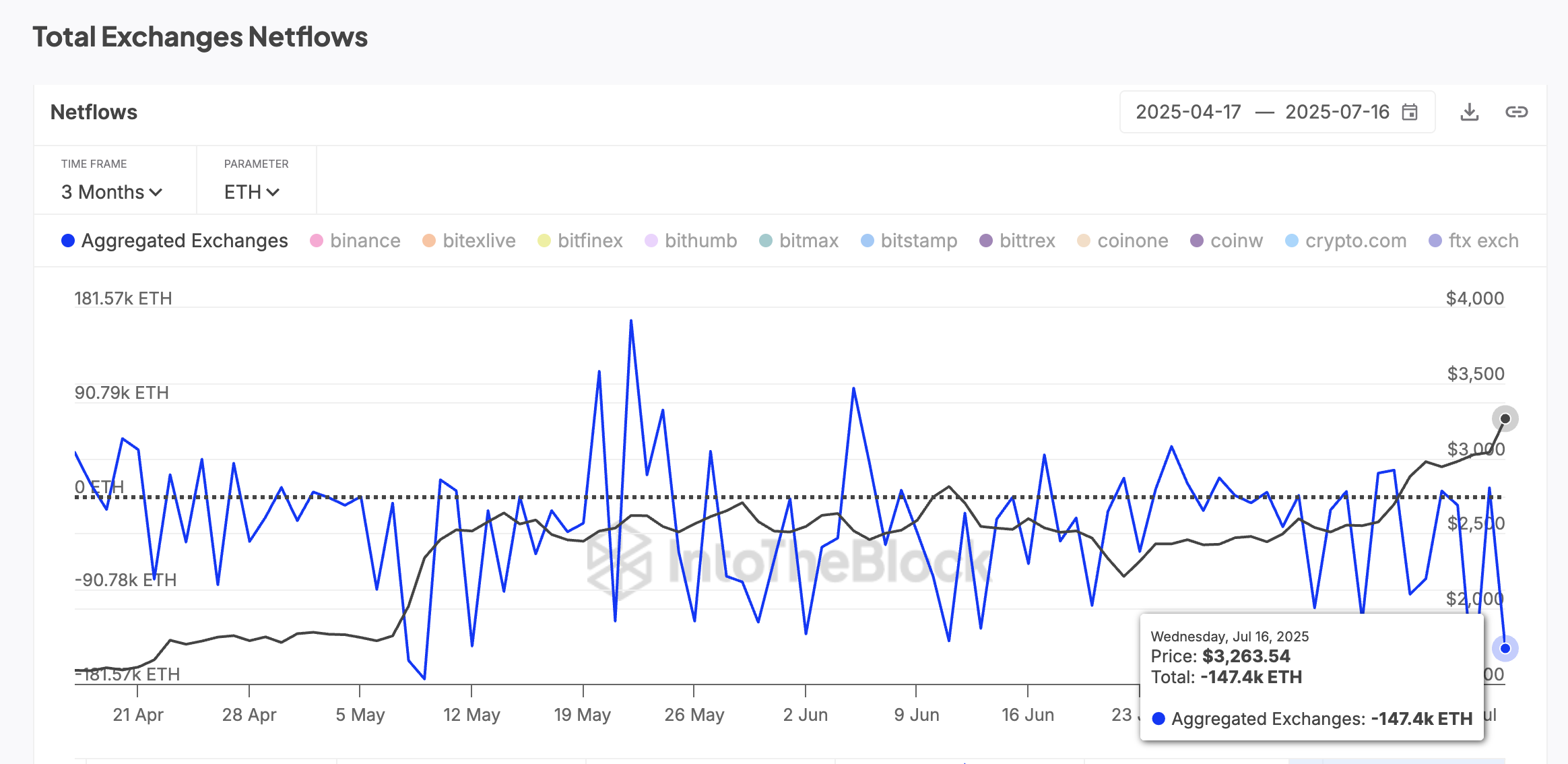

Change reserves and Netflows present comparable setups for the final main gathering

On July sixteenth, Ethereum’s complete change reserve was ETH of 19.7 million. This stage was roughly the identical as seen on October 9, 2024, simply earlier than Ethereum surged 75% over the following two months. The rally started at an identical reserve base and unfolded throughout a interval of constant spills.

Comparable alternative spare ranges have appeared beforehand, however the July-October correlation is smart.

For token TA and market updates: Need extra token insights like this? Join Editor Harsh Notariya’s every day Crypto e-newsletter.

Ethereum value and change reserves: encryption

Along with this parallel, the aggregated exchanged Netflow stays adverse. On July 16, 147,400 ETH had been internet withdrawn from the change. This means that extra customers are transferring their Ethereum to their freestanding pockets or chilly pockets.

ETH Costs and Netflows: IntotheBlock

Take it house? Ethereum costs present indicators of absorbing income whereas sustaining demand. Change provide nonetheless reduces fast gross sales strain.

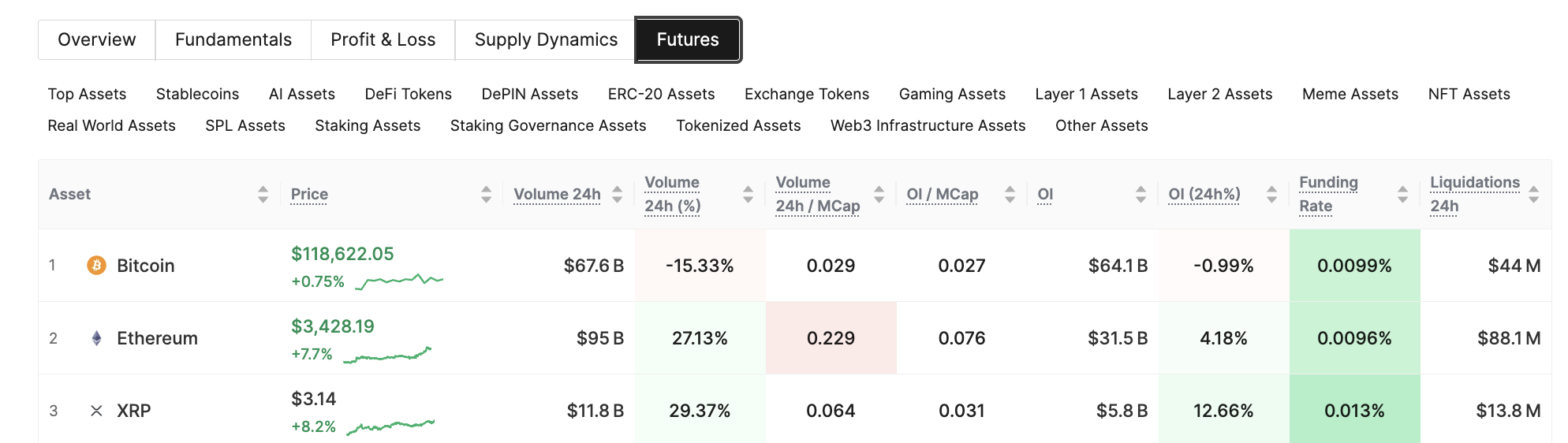

Futures markets are rising, however feelings are balanced

The spot market exhibits energy by constant outflows and hard provide, whereas the derivatives market quietly displays its optimism, however not overruns. Over the previous 24 hours, Ethereum’s futures buying and selling quantity has skyrocketed 27.13%, open curiosity has risen 4.18%, and new positions are opening as merchants start to lean in direction of gatherings.

ETH futures knowledge: GlassNode

However right here it turns into fascinating. Regardless of the elevated publicity, the funding price stays at 0.0096%, suggesting that the market just isn’t overly biased in direction of lengthy. Funding price refers back to the recurring funds between lengthy and brief merchants.

If it stays near impartial, it signifies that each side are suppressed. This sample makes the rally sustainable with out worry of brief or lengthy apertures.

ETH Value clears essential resistance. A $4,541 goal for imaginative and prescient

The change decline, everlasting outflows and impartial funding phrases are starting to be mirrored immediately in Ethereum costs. The ETH is damaged above $3,298 resistance, which is in shut settlement with the 0.786 Fibonacci growth stage. This violation suggests the energy of the spot market and confirms the consistency of exercise on the chain with value momentum.

Ethereum Value Evaluation: TradingView

This present trend-based Fibonacci setup begins at about 1,388 ranges (low manufactured in early April), strikes to the earlier swing excessive of almost $2,870, and follows the following swing low of almost $2,130. This bull projection-specific setup charts the following doable leads in ETH costs.

The present gathering displays the situations seen in October 2024 when ETH traded at an identical reserve stage and attracted over 75%. When you’re rhyming historical past, Ethereum’s subsequent goal is at $4,541.88, marked on the 1.618 FIB stage. Potential 32% upside from present ranges. If that occurs, it might be doable to march in direction of the 75% stage and a brand new all-time excessive.

Ethereum costs will rise from October 2024 to December 2024: TradingView

Nonetheless, bullish papers are solely held when the ETH value is above $3,047. This stage has served as a powerful help over the previous week.

Breakdown of underneath $2,870. 0.5 Fibonacci stage disables bullish setup. Moreover, if that DIP coincides with a reversal in rising inflows and alternative spare tendencies. Every thing exhibiting up to date gross sales strain and probably rising momentum.