One thing attention-grabbing is occurring on the Ethereum chart. Ethereum worth seems to be caught round $4,700 after weeks of regular positive aspects, however this isn’t an indication of weak point. Somewhat, the information and sample counsel that ETH may want a small decline earlier than it rises once more.

A drop to $4,410, a decline of round 6%, might full a basic reversal setup that’s usually seen earlier than an enormous rally. However first, on-chain information reveals why merchants must be cautious within the brief time period.

Foreign money flows ease as whales stay cautious

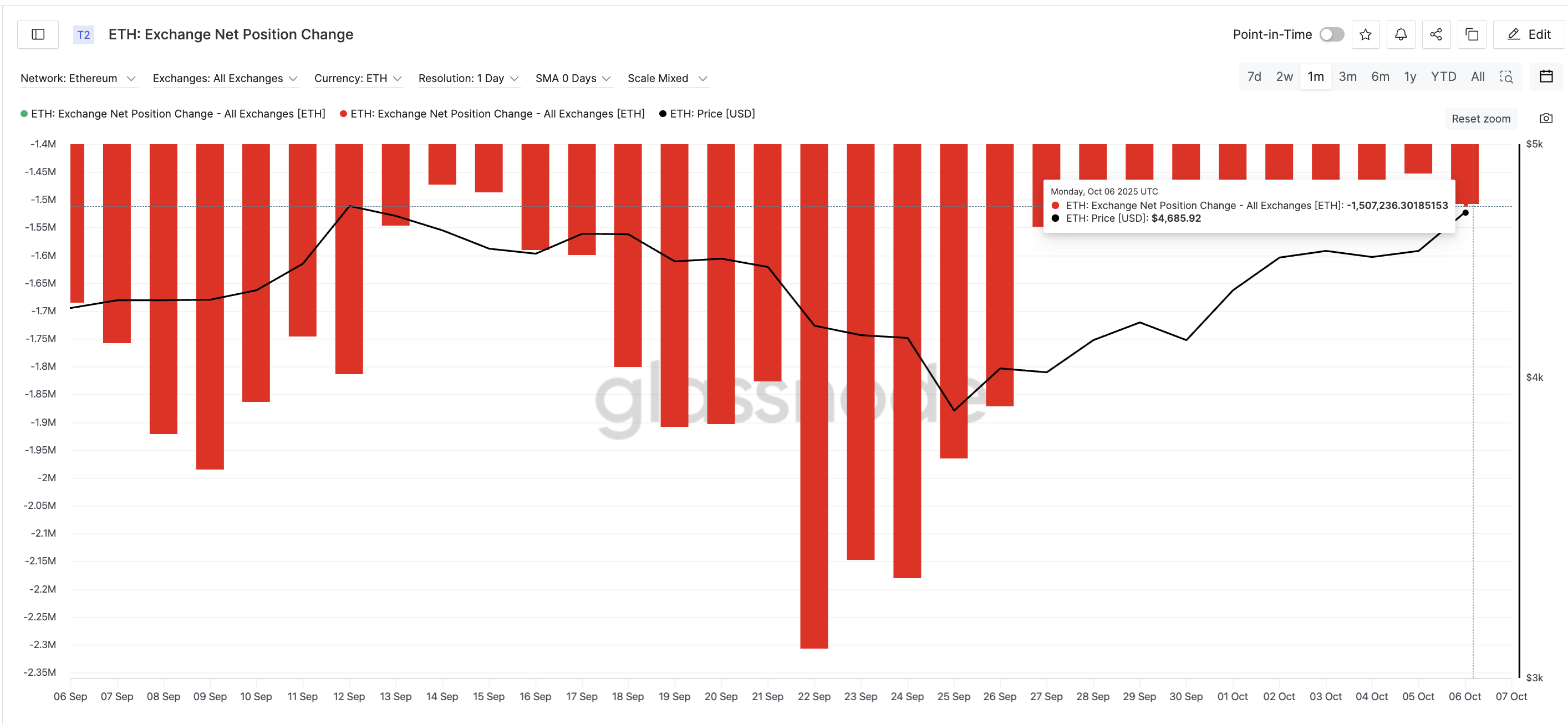

Adjustments in Ethereum trade web positions, which measure the variety of cash getting into and exiting centralized exchanges, point out a slowdown in buying exercise. When this quantity turns into massive and detrimental, it means extra cash are being withdrawn and held by traders. Because the negatives turn into much less, merchants will normally ship extra cash to the trade in an effort to make a revenue.

As of October sixth, ETH’s web place change is -1.5 million, up from -2.3 million on September 22, with 35% shifting to promoting strain. A smaller detrimental worth means fewer withdrawals and barely extra deposits, indicating that some merchants could also be thinking about taking earnings after the latest rally.

Ethereum vendor positive aspects floor: Glassnode

Need extra token insights like this??Join Editor Harsh Notariya’s Each day Crypto Publication right here.

Nevertheless, whale wallets holding massive quantities of ETH stay assured. Over the previous two days, their mixed holdings have elevated from 99.16 million ETH to 99.26 million ETH (roughly $470 million), based on Santiment information.

It is a gradual however regular signal of confidence, regardless that some merchants are in all probability recording positive aspects on the retail aspect.

Ethereum whales proceed to purchase: Santiment

This mixture of sunshine retail promoting and cautious whale shopping for normally signifies the market is ready for a greater entry, and infrequently comes proper earlier than a short-term worth correction.

Ethereum worth chart alerts short-term decline forward of subsequent rally

On the every day chart, Ethereum is buying and selling inside an inverted head-and-shoulders sample, and this construction usually types earlier than a bullish breakout. The “head” is situated low, with the neckline lining up round $4,740.

For this sample to finish, Ethereum might must fall in the direction of $4,410 to type a proper shoulder, which might symbolize a 6% decline from present ranges. The Relative Energy Index (RSI), which tracks shopping for momentum, helps this setup. From September twelfth to October seventh, the RSI made new highs and the value made new decrease highs. This usually reveals a hidden bearish divergence previous to a correction.

Ethereum Value Evaluation: TradingView

If a pullback happens, a rebound close to $4,410 might result in a breakout for Ethereum above $4,740. A confirmed every day candle above this stage opens the door to $4,950 (close to the earlier excessive) and probably new highs above it.

Conversely, if Ethereum skips the correction and closes above the present $4,740 stage, the speedy decline principle could be invalidated and continued power could be confirmed. Nevertheless, a extra bearish situation would unfold provided that Ethereum worth falls beneath $4,270, delaying the bullish sample and prolonging the consolidation.

Both means, Ethereum’s broad uptrend stays intact. This pause might be a lull earlier than one other robust rally.

The put up Ethereum (ETH) Value May Fall 6% Earlier than Rising to New Highs — This is Why appeared first on BeInCrypto.