Ethereum (Eth) Validators haven’t generated numerous Treasury Departments, however different teams are working into the ETH verification ecosystem. This imbalance might point out blended feelings in giant ETH pockets segments.

$7 billion packed within the Ethereum validator queue

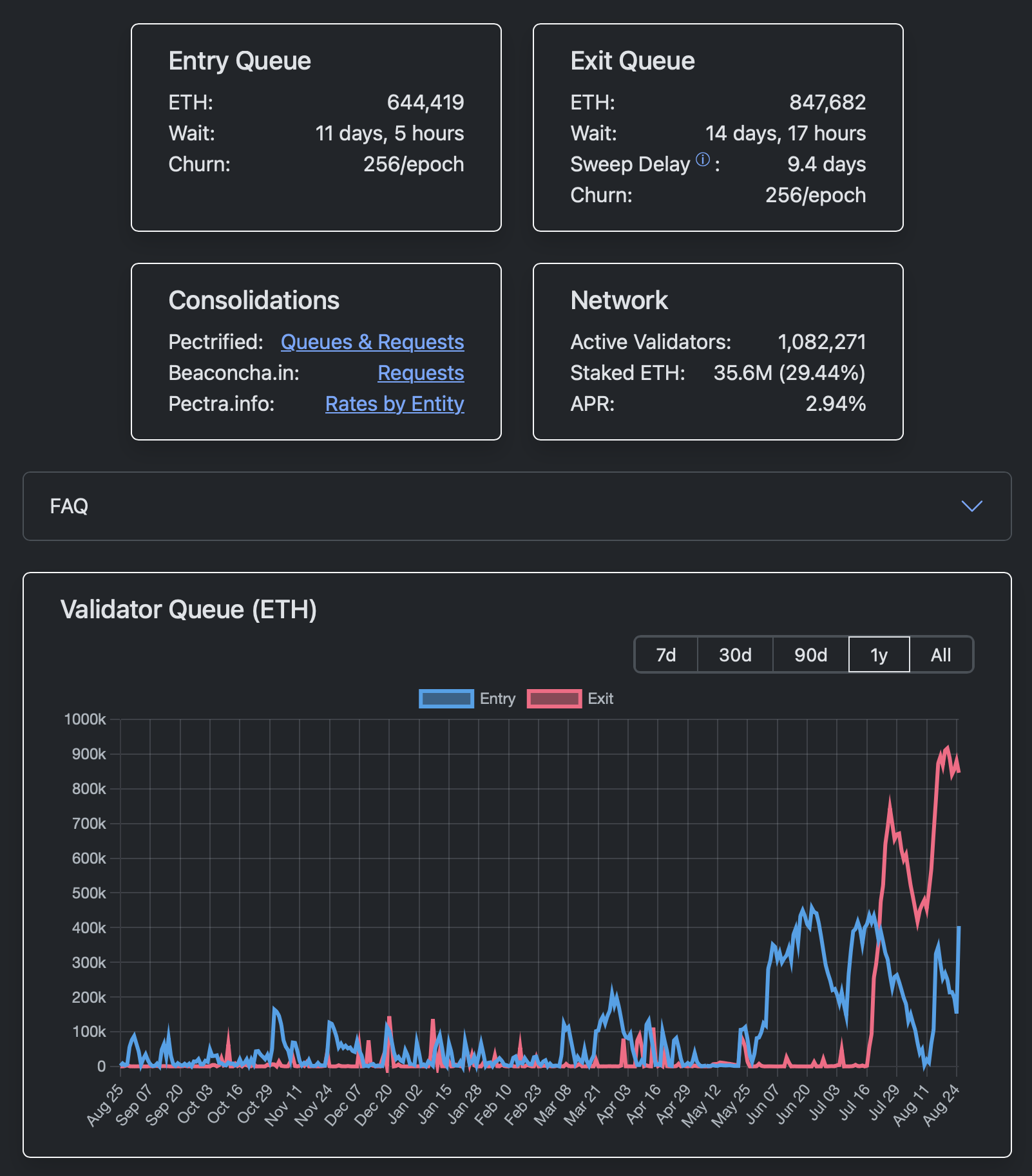

The Ethereum (ETH) Validation Entry Queue – a listing of potential validators considering staking shares to earn common rewards – started to surge quickly. In simply two days, it added over 400,000 ETH, reaching a excessive of over 644,000 ether.

In consequence, it at the moment takes greater than 11 days. Such a rise in staking interval was final noticed over two months in the past.

On the identical time, following its peak on August 20, 2025, the unstable line of Ethereum (ETH) started to settle.

In complete, about $7 billion in liquidity is ready to hitch or depart it within the ETH staking mechanism. It reveals blended expectations amongst giant ETH market individuals.

The Ethereum (Eth) group is optimistic after dialogue

Curiosity in withdrawal is most probably associated to alternatives to right income at present worth ranges. In distinction, curiosity in locking ETH to validators is a sign that they develop optimistically about their worth efficiency.

Because of the saturation of the ecosystem, the annual Etheric (ETH) staking reward was under 3% in comparison with the usually noticed 4%.

In some cryptocurrency exchanges, Ethereum (ETH) costs hit a brand new all-time excessive final Friday, as beforehand coated by U.Immediately.

On the identical time, Coingecko and Coinmarketcap don’t verify that the earlier ATH of 2021 has been destroyed at ether costs.