Ethereum’s worth is as soon as once more attempting to interrupt via the long-standing $3,000 barrier, however its efforts have stalled. After briefly rising, ETH moved again towards this assist vary, indicating that the market stays fragmented.

Though bullish momentum is slowly returning, investor impatience may weigh on the restoration until a transparent course emerges quickly.

Ethereum buyers could possibly promote ETH

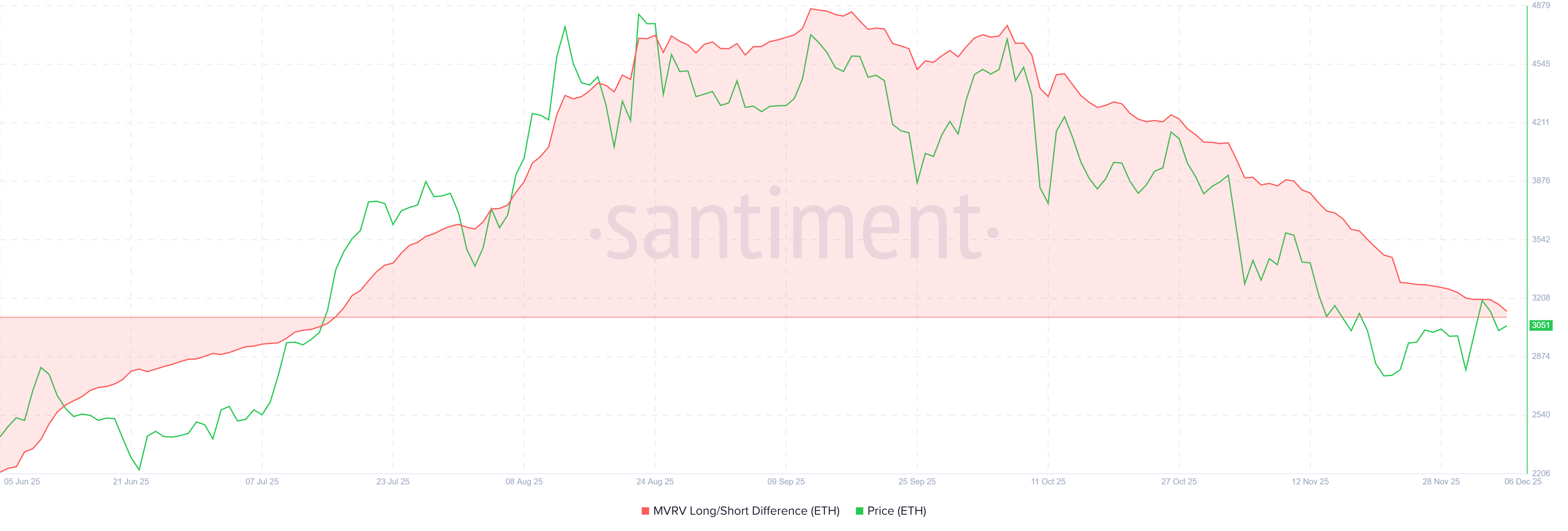

The MVRV lengthy/quick differential is approaching the impartial line, indicating that the revenue benefit might shift between long-term and short-term holders. This indicator tracks whether or not long-term holders (LTH) or short-term holders (STH) understand extra income. Within the case of Ethereum, a drop under the impartial line implies that STH holds a lot of the unrealized good points.

This alteration is vital as a result of STH has traditionally been bought off on the first signal of weak spot. If they begin taking income close to $3,000, ETH may face recent promoting strain. This motion has usually delayed earlier restoration makes an attempt and left sentiment susceptible regardless of widespread bullish indicators.

Ethereum MVRV lengthy/quick distinction. Supply: Santiment

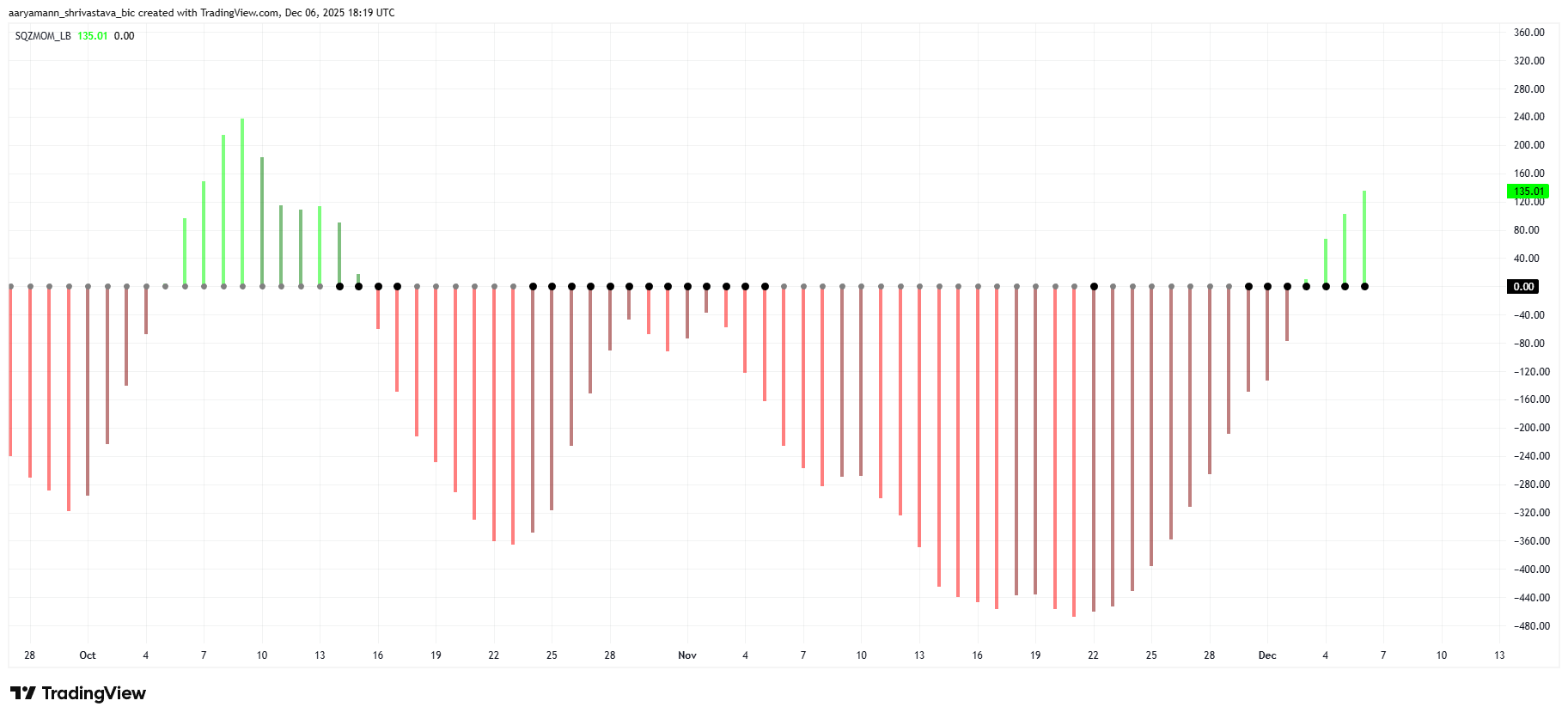

The squeeze momentum indicator provides additional complexity. ETH is at present experiencing a squeeze build-up that happens when volatility contracts and momentum is compressed.

That is often accomplished earlier than a transfer in a robust course. The histogram reveals bullish momentum rising, suggesting that costs may speed up as soon as the tightening is lifted.

If the bullish momentum continues to construct throughout this era, ETH may gain advantage from an upward enlargement in volatility. This setup was made previous to the early cycle rally, however affirmation relies on market participation and whether or not patrons intervene at $3,000.

ETH Squeeze Momentum Indicator. Supply: TradingView

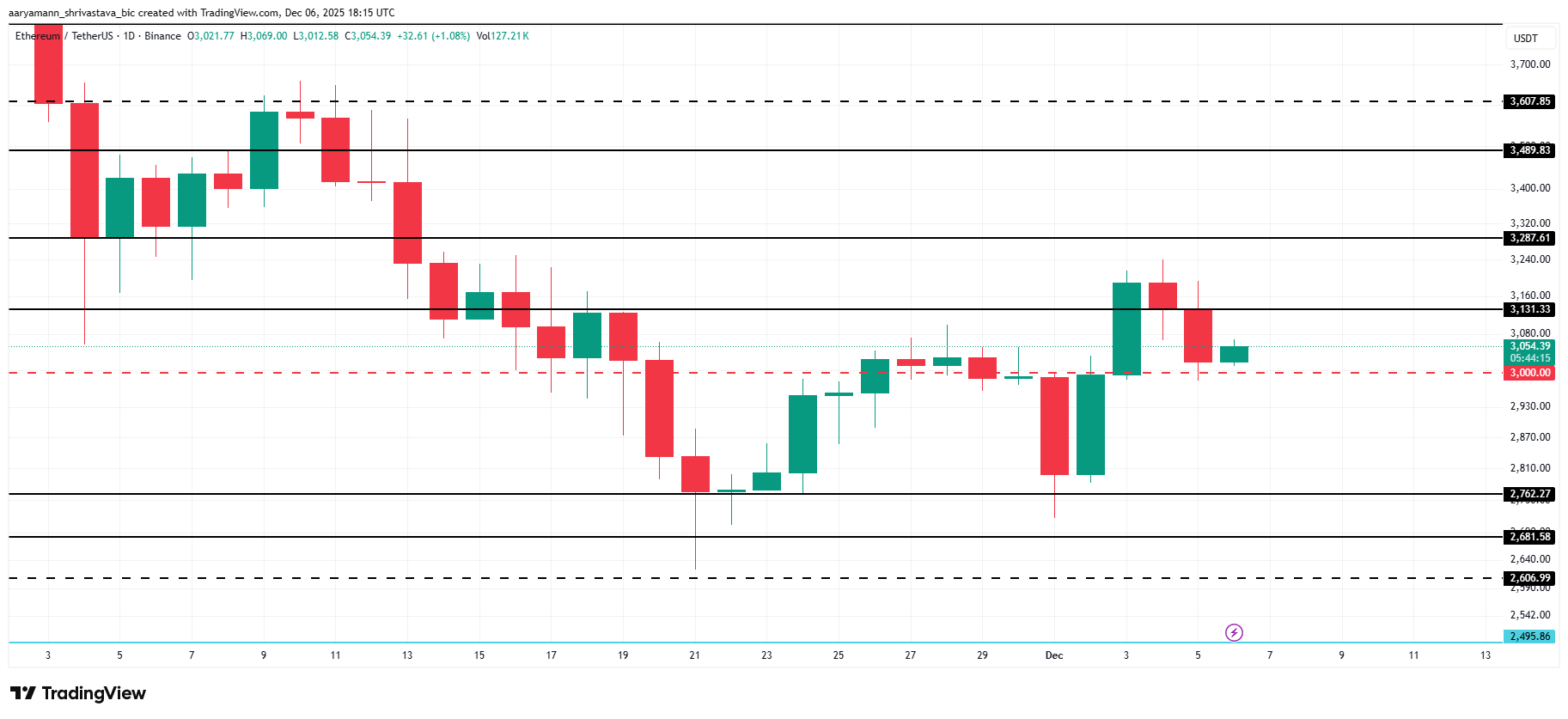

ETH worth might fall once more

Ethereum is buying and selling at $3,045 and stays above the important thing assist stage of $3,000. ETH has been buying and selling tightly round this zone for the previous few days, suggesting some indecision amongst merchants as market cues change.

Blended indicators recommend that ETH might proceed to maneuver sideways close to $3,000 within the quick time period. A breakdown brought on by STH revenue taking or widespread market skepticism may push Ethereum in direction of $2,762 earlier than stabilizing.

ETH worth evaluation. Supply: TradingView

Nonetheless, if the bullish momentum strengthens together with a positive macro setting, ETH may rise above $3,131 and goal $3,287. A full breakout above these ranges would invalidate the bearish outlook and set the stage for a broader restoration part.