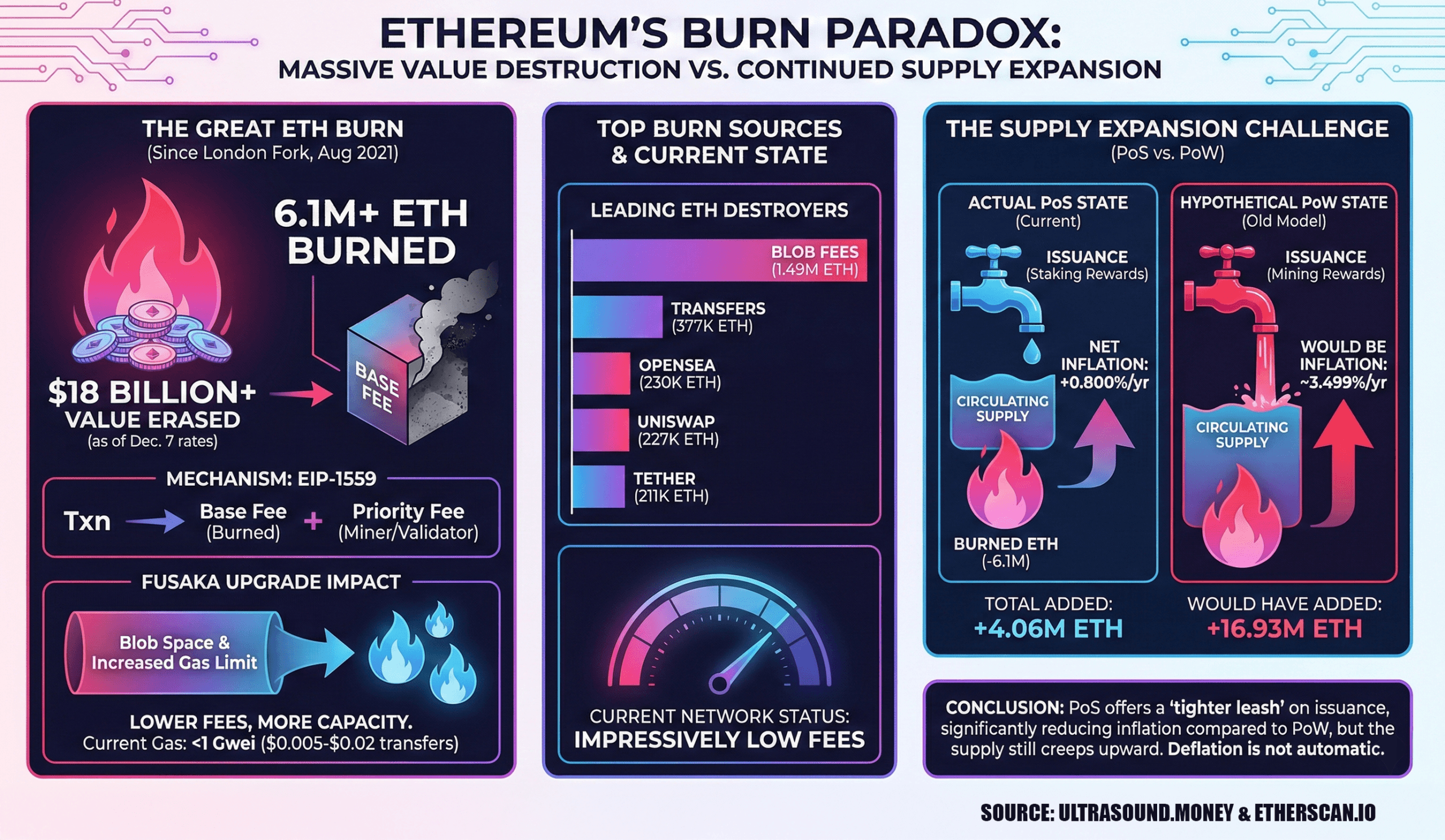

In response to the index, the overall quantity of ETH burned in charges is over the 6 million mark, which means that as of December seventh trade charges, greater than $18 billion in worth has successfully disappeared for the reason that London onerous fork on August 5, 2021.

ETH Bonfire Crosses 6 Million ETH Since 2021 London Improve

Only recently, Ethereum rolled out the Fusaka improve. This dramatically expanded the info and gasoline capability of the community (suppose greater block gasoline limits and far bigger blob house), permitting every block to deal with extra name information and rollup blobs.

The Fusaka improve reorganized Layer 2 (L2) prices and by extension diminished on-chain (L1) gasoline prices. In response to etherscan.io’s gasoline tracker, Ethereum’s on-chain charges are surprisingly low, beneath a single gwei.

As of 11 a.m. ET on Dec. 7, the low precedence charge was hovering round 0.305 Gwei, whereas the excessive precedence charge was round 0.326 Gwei. This places Sunday switch prices between $0.005 and $0.02, whereas good contract strikes corresponding to swaps, NFT gross sales, and bridging run between $0.14 and $0.50 per motion.

When the London onerous fork arrived in August 2021, EIP-1559 was launched. It is a full overhaul of Ethereum’s transaction price mechanism, which introduces dynamic base charges which are mechanically burned on each block and disappear without end.

The fork landed 4 years, 4 months, and a pair of days in the past (together with the bissextile year peculiarity), and since then, 6.1 million ETH value $18 billion has been faraway from circulation. Ultrasound.cash’s indicators reveal that BLOB charges reign as the most important ETH burner, with 1,492,094 ETH disappearing alone.

A standard Ether switch will torch 377,388 ETH, whereas non-fungible token (NFT) market Opensea will cut back 230,051.12 ETH to digital ash. Decentralized trade (DEX) Uniswap v2 was not far behind, with 227,337.27 ETH consumed, and Tether (USDT) utilization vanished with 211,342.55 ETH. Rounding out the highest 5, Uniswap v1 has erased a further 153,585.62 ETH since 2021.

learn extra: Is not there a Santa Rally? Bitcoin derivatives market hints at a chilly December

Regardless of 6.1 million ETH being burned, the community nonetheless reveals an annual inflation of 0.800%, based on statistics over the previous 4 years. Roughly 4,065,657 ETH has been added to the provision for the reason that London onerous fork. The proof-of-stake (PoS) mannequin provides relaxed issuance in comparison with proof-of-work (PoW). If Ethereum had been nonetheless working in a PoW system, the annual inflation charge would have remained at 3.499% and a considerable amount of 16,931,820 ETH would have been added to circulation, based on simulated information.

Whereas PoS maintains issuance in more durable situations, Ethereum provide remains to be slowly rising, reminding everybody that goals of deflation should not automated. However, the community has come a great distance for the reason that London onerous fork, dramatically lowering potential inflation in comparison with the previous PoW period.

Incessantly requested questions ❓

- What prompted the Ethereum mass write?

Ethereum write exercise stems from EIP-1559, which destroys the dynamic base worth of each block. - How a lot ETH has been spent for the reason that London onerous fork?

Greater than 6 million ETH value roughly $18 billion was faraway from circulation. - Did the Fusaka improve have an effect on Ethereum charges?

Sure, Fusaka has expanded block capability and primarily improved L2 transaction prices. - Is Ethereum deflationary in any case this flare-up?

No, although a major quantity of ETH has been destroyed, the community stays barely inflated.