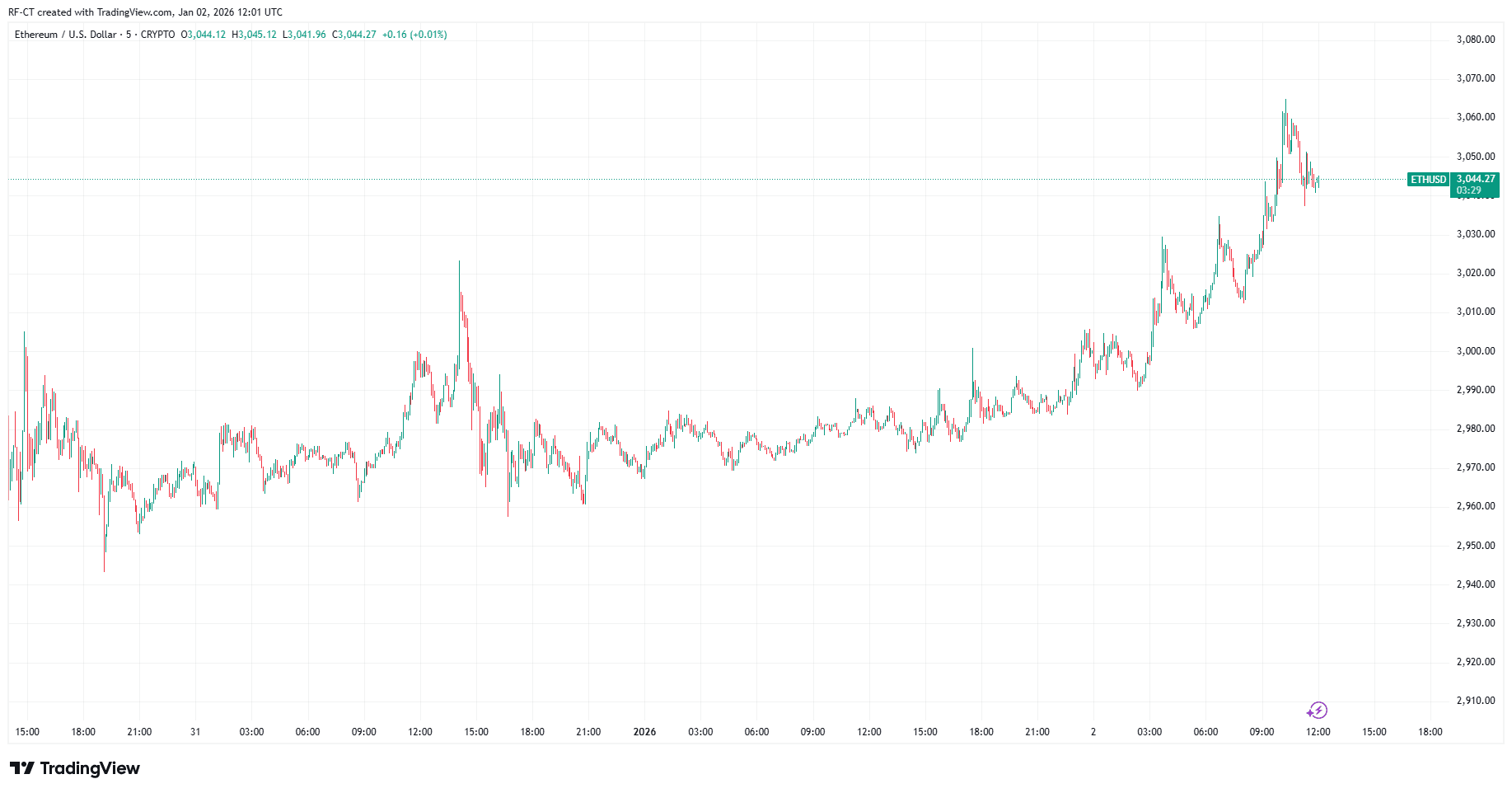

By TradingView – ETHUSD_2026-01-02 (YTD)

Ethereum Pushing to new state returns focus Highest value of the 12 monthsexhibits an entire new momentum cryptocurrency market. This transfer is made at a important second, Billions of {Dollars} of Crypto Choices Expiresetting the stage for short-term volatility in ETH in addition to ETH. Bitcoincontinues to hover close to key resistance ranges.

Ethereum breakout: What’s driving the motion?

ETH has skyrocketed past the previous $3,000 degreereached a brand new yearly excessive and confirmed a robust bullish construction on the chart. Momentum accelerated as patrons stepped in aggressively, pushing costs above the latest consolidation zone.

There are a number of elements coming collectively behind Ethereum’s motion.

- Robust spot demand after weeks of sideways buying and selling

- New confidence in giant crypto belongings

- Derivatives exercise will increase forward of main possibility expirations

From a technical perspective, the ETH breakout means that patrons are nonetheless in management, though a short-term pullback stays doable given present market situations.

Possibility expiration: Why volatility is rising

round it $2.2 billion value of Bitcoin and Ethereum choices It is a situation that always causes sudden actions in the course of the day. When merchants exit or roll positions, value actions can develop into unstable, particularly if the asset is buying and selling near key psychological ranges.

For Ethereum, this implies:

- Sudden spike or pullback close to expiration date

- Elevated liquidation of overleveraged positions

- Attainable false breakout earlier than path stabilizes

Bitcoin is within the background however nonetheless necessary

Whereas Ethereum is main the story at the moment, Bitcoin stays an necessary anchor for the general market. BTC has not too long ago New year-to-date excessive value It’s distinctive and continues to commerce near traditionally vital resistance zones.

So long as Bitcoin stays above the breakout space, Ethereum and different giant altcoins are prone to proceed to seek out help. Nonetheless, any sudden motion in BTC may rapidly spill over into ETH value fluctuations.

Quick-term outlook for ETH

Ethereum’s construction stays bullish, however merchants want to stay cautious within the brief time period. Choices expiration and elevated leverage improve the probability of volatility spiking earlier than a clearer pattern resumes.

Principal ranges to notice:

- help: $2,950 – $3,000

- resistance: $3,100 – $3,200

A stable break above $3,000 would improve the probabilities of additional upside, whereas a rejection may set off a short lived cooldown.

conclusion

Ethereum hits new excessive for the 12 months We’re at a important second for the crypto market. With Bitcoin’s energy and option-driven volatility rising, the approaching classes may decide its near-term path. For now, ETH stays within the highlight, however all eyes are on Bitcoin for affirmation.