Ethereum has didn’t regain momentum after falling 15.8% earlier this month. The king of altcoins continues to battle with weak restoration indicators and is buying and selling sideways as traders cautiously alter their positions.

Though promoting strain has eased, Ethereum’s worth restoration stays restricted because of market-wide headwinds.

Ethereum investor promoting recedes

Information from the trade’s Internet Place Change Indicator exhibits that Ethereum outflows have been steadily reducing over the previous few days. This pattern suggests traders are slowing down their promoting exercise, which might favor potential stability in costs.

A constant decline in foreign money outflows sometimes displays a cooling in bearish sentiment amongst merchants. Nonetheless, the present stage represents a pause fairly than a reversal. The decline in gross sales volumes has not but led to vital accumulation, which is a crucial situation for a sustained restoration.

Need extra token insights like this? Join Editor Harsh Notariya’s Day by day Crypto Publication right here.

Adjustments in internet positions on the Ethereum trade. Supply: Glassnode

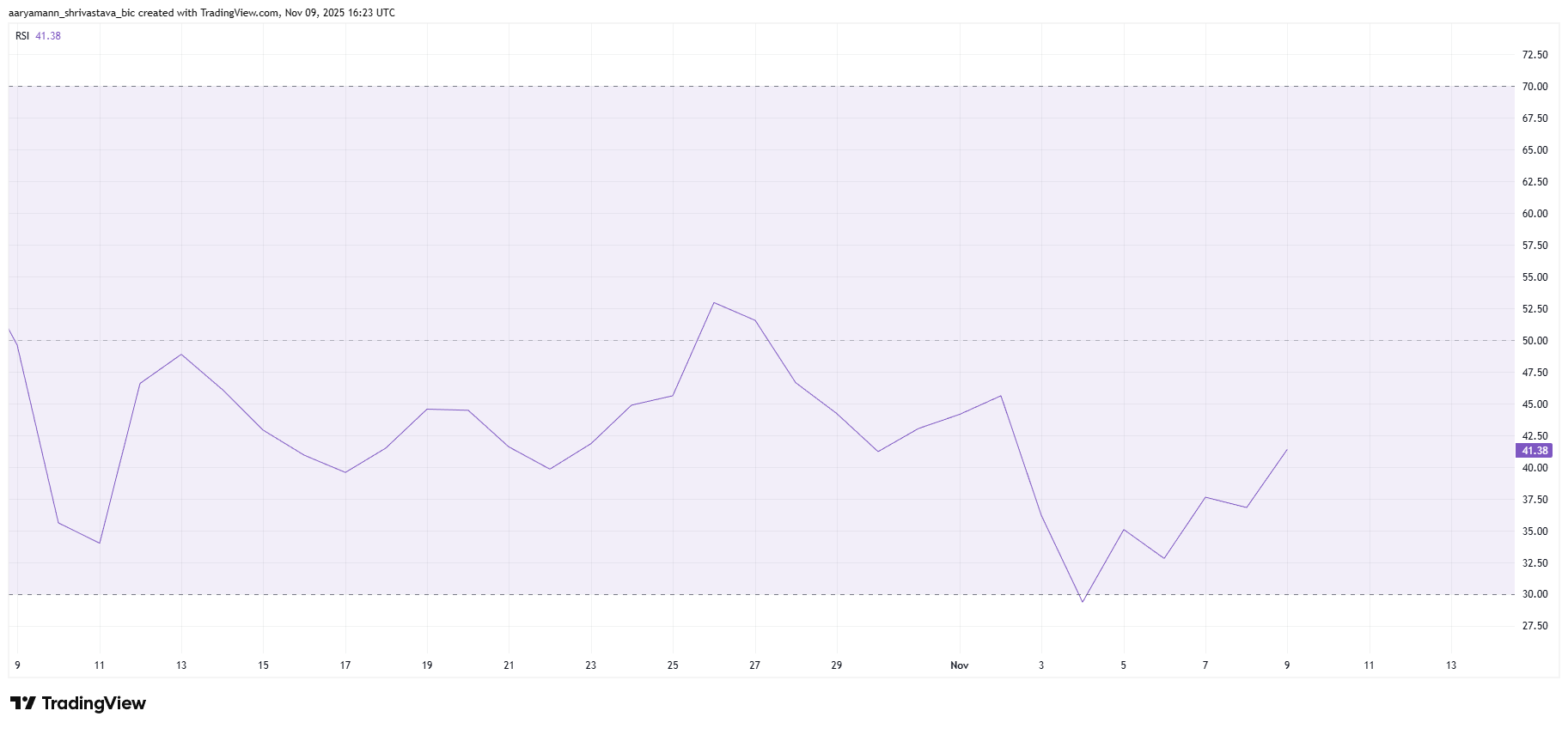

The Relative Energy Index (RSI) gives a cautious indication of Ethereum’s momentum. The indicator stays beneath the impartial 50 mark, indicating sustained bearish strain regardless of a slight rebound from oversold circumstances. This implies that sellers nonetheless have the higher hand and the trail to ETH restoration stays unsure.

For Ethereum to regain bullish momentum, the RSI must rise above 50 and maintain larger values. Such developments sign renewed investor confidence and elevated buying exercise, which might gasoline a worth restoration.

ETH RSI. Supply: TradingView

ETH worth might ultimately consolidate

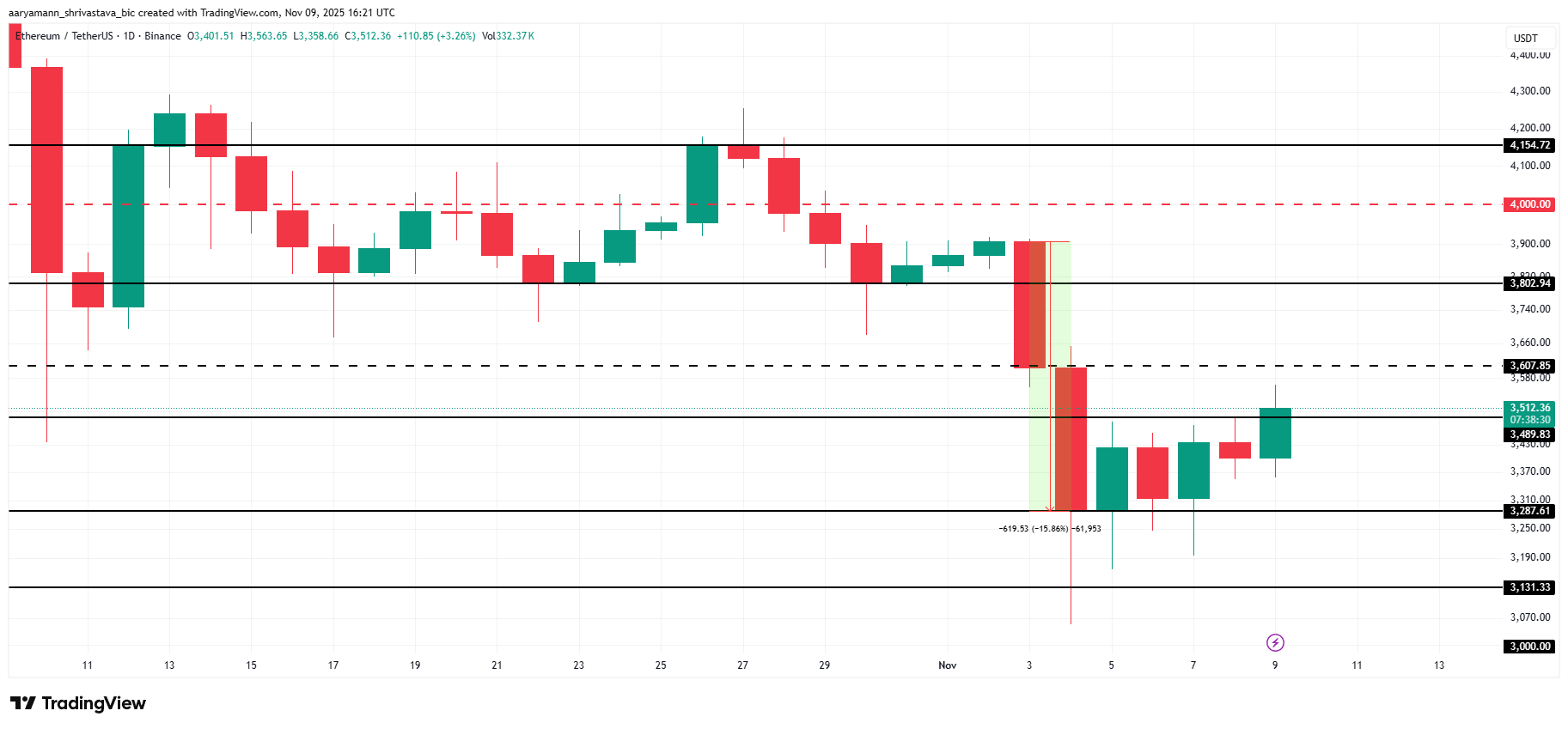

Ethereum is buying and selling at $3,512 and stays simply above the $3,489 help degree after latest volatility. Regardless of the slight enchancment, the king of altcoins stays beneath a key resistance degree and is struggling to completely recuperate from this month’s 15.8% drop.

To verify a pattern change, ETH worth wants to interrupt by way of the $3,607 resistance. Present indicators counsel continued consolidation throughout the $3,489 to $3,287 vary as momentum stays impartial.

ETH worth evaluation. Supply: TradingView

If market circumstances enhance subsequent week, Ethereum might rebound and retest $3,607. A profitable breakout might push the value in the direction of $3,802. This is able to point out new bullish power and invalidate the present bearish outlook.

The put up “Ethereum Traders Promote Reversely, however Value Nonetheless Faces Drawback” was first revealed on BeInCrypto.