Ethereum’s rally in the direction of the $5,000 mark is reshaping its position within the world market. Belongings are shifting from speculative tokens to spare choices for establishments and enormous buyers.

Encrypted reviews reveal that ETF spikes, aggressive whale accumulation and file staking ranges are driving this variation.

Ethereum ETFS anchor system demand

The Ethereum ETF has emerged because the decisive catalyst on the rally, in line with the report. The 9 US-listed funds at present maintain roughly 6.7 million ETH. That is virtually twice the extent seen when market rallies started in April.

The growth adopted a file influx of practically $10 billion between July and August. Surge solidified the ETF as a precedence automobile for publicity to the power.

Ethereum is likely one of the strongest cycles ever.

Institutional demand, staking and chain exercise are near file highs.

ETH solidifies its position as each an funding asset and a significant settlement layer. pic.twitter.com/mguvxwpsma

– cryptoquant.com (@cryptoquant_com) September 11, 2025

Sosovalue knowledge exhibits that September is slower, however final week it raised greater than $640 million in new capital.

That momentum signifies an elevated dependence on buyers in ETFs. It’s proven not solely as an entry level, but in addition as a strategy to preserve a long-term allocation of crypto belongings.

Moreover, giant ETH holders seem to boost this sample. The encrypted knowledge exhibits that wallets controlling 10,000-100,000 ETH have amassed round 6 million cash over the identical interval.

Their complete reserves reached a file 20.6 million ETH, reflecting Bitcoin’s early trajectory after the ETF’s approval.

Staking and community exercise enhances provide

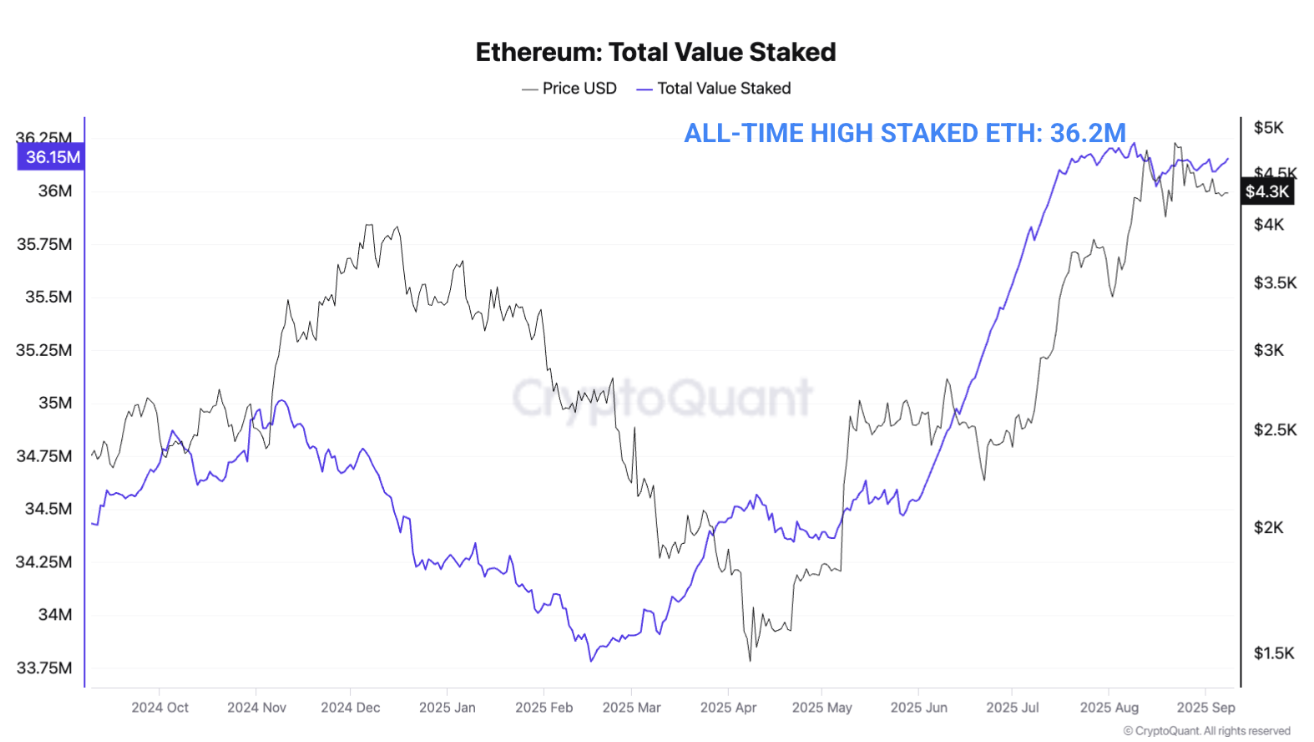

Other than the above components, Ethereum staking actions lock extra ETH than ever earlier than.

Knowledge from Cryptoquant confirmed that Ethereum buyers have locked in one other 2.5 million ETH since Could, pushing the whole quantity of stained ETH to 36.2 million. In line with Dune Analytics knowledge, this represents virtually 30% of Ethereum’s complete provide.

The whole Ethereum was staked. Supply: Cryptoquant

This regular improve reduces the round provide of top-level cryptos and strengthens upward value stress. It additionally exhibits that buyers are dedicated to ETH in the long run fairly than short-term speculative theatre.

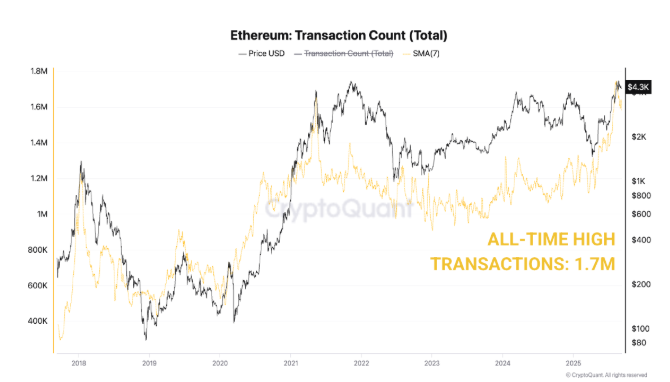

One other robust proof that the market position of Ethereum has modified dramatically is the acceleration of its on-chain utility.

In line with Cryptoquant, day by day Ethereum transactions surged to 1.7 million in mid-August, with the variety of energetic addresses on the community reaching 800,000.

Ethereum transaction rely. Supply: Cryptoquant

On the similar time, good contract calls broke by over 12 million per day. That is an unprecedented stage in earlier cycles.

This exercise stage highlights the position of Ethereum because the spine of decentralized funds, stubcoins and tokenized belongings. Particularly, the community has the very best locked complete and adoption charges for every sector.

Taken collectively, these developments characterize a structural reorganization that exhibits that Ethereum’s valuation relies upon extra available on the market sentiment.

In actual fact, it’s more and more positioned because the purposeful spine of digital commerce. On the similar time, it has turn into a strategic maintain for giant buyers in search of publicity to the rising crypto business.

Put up Ethereum is approaching $5,000 as demand for ETFS and staking resap markets first appeared on Beincrypto.