Ethereum has repeatedly failed to shut above the $3,000 stage and continues to battle with a value restoration. ETH briefly tried to rise, however then retreated because of promoting stress.

Whereas the value motion stays irritating for holders, the underlying community information factors to strengthening fundamentals that might help a future restoration.

Ethereum holders keep

Ethereum leads all main cryptocurrencies in variety of non-empty wallets. The community hosts over 167.9 million lively addresses with balances. Compared, there are roughly 57.62 million Bitcoins. Different prime cap property lag far behind each networks.

This benefit highlights Ethereum’s extensive consumer base and numerous use circumstances. Decentralized finance, NFTs, and good contract exercise will proceed to drive engagement. Energetic participation displays belief and performs an essential function in sustaining demand.

Need extra token insights like this? Join Editor Harsh Notariya’s Day by day Crypto E-newsletter right here.

Ethereum holder information. Supply: Santiment

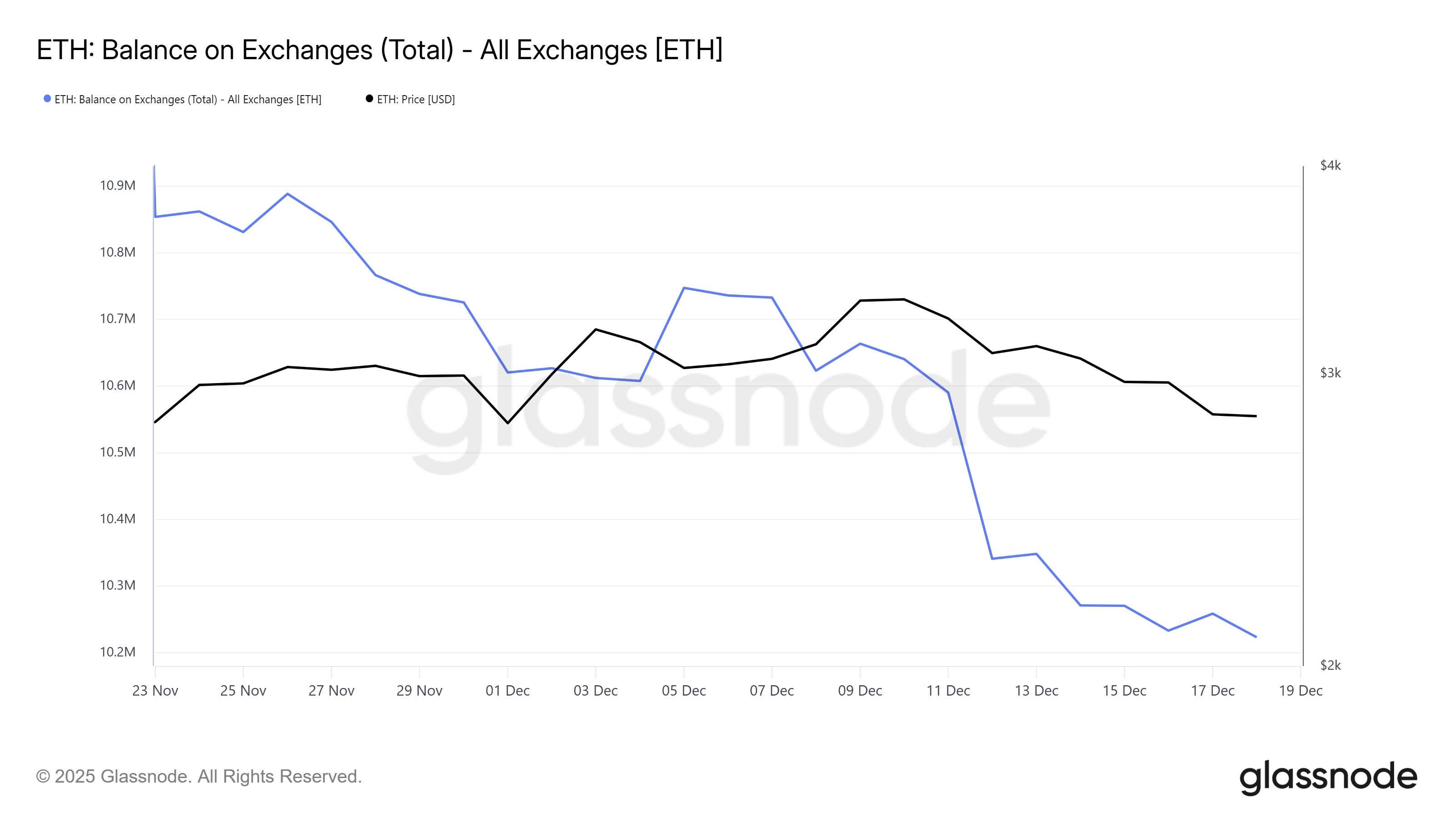

Macro indicators additional help the constructive outlook. Ethereum balances on centralized exchanges have been steadily reducing. Roughly 397,495 ETH has been withdrawn from exchanges for the reason that starting of the month, lowering sell-side provide in the interim.

These outflows counsel accumulation at present value ranges. The worth of ETH withdrawn was over $1.17 billion, demonstrating the boldness of long-term traders. Declining trade balances typically precede a decline in promoting stress, and stronger demand can help value restoration.

Ethereum stability on the trade. Supply: Glassnode

ETH value may break by means of an essential barrier

Ethereum is buying and selling round $2,946 on the time of writing, nonetheless under the psychological stage of $3,000. The asset has constantly rebounded from the $2,762 help zone in latest weeks. This motion reveals that patrons are holding themselves to decrease requirements regardless of widespread uncertainty.

If the supportive development continues, ETH may try one other breakout above $3,000. If this transfer is profitable, it may pave the way in which to $3,131. If momentum continues, the rally may widen in the direction of $3,287, suggesting improved confidence amongst each retail and institutional individuals.

ETH value evaluation. Supply: TradingView

Threat stays if promoting stress will increase. If the value falls under $2,762, the restoration momentum will weaken. Shedding this help may ship Ethereum heading towards the $2,681 stage, marking a four-week low and invalidating the bullish thesis outlined by bettering on-chain indicators.

The article Ethereum outperforms Bitcoin regardless of value stagnant under $3,000 appeared first on BeInCrypto.