Ethereum (ETH) value is displaying a uncommon technical sign that was final seen six months in the past, simply earlier than it rose over 80%. The token is buying and selling round $4,020, down about 1.8% previously 24 hours, 8.7% in per week, and almost 10% in 30 days, displaying a transparent downward pattern.

Nonetheless, the newest on-chain knowledge and acquainted momentum patterns counsel this decline could also be shedding momentum.

Bullish divergence resurfaces attributable to speedy enhance in overseas trade outflows

The Relative Energy Index (RSI), which measures the velocity and energy of value actions, reveals a bullish divergence. This occurs when the worth is making a low, however the RSI is making a low. This means that promoting strain is easing.

A bullish divergence typically indicators a potential pattern reversal, which implies a downtrend could also be nearing an finish. The final time Ethereum clearly exhibited this sample was between March tenth and April twenty first, when it gained 84.46%. Earlier than that reversal, Ethereum was in the same decline. The present repetition of this setup might point out that the present downtrend is nearing a reversal as soon as once more.

Need extra token insights like this? Join Editor Harsh Notariya’s Every day Crypto E-newsletter right here.

Ethereum value fractal: TradingView

Ethereum whales, that are wallets that maintain giant quantities of ETH, appear to be making ready for this from an early stage. In line with on-chain knowledge, the holdings of those addresses elevated from 1036 million ETH on October 14 to 100.51 million ETH two days later. That is roughly an extra 150,000 ETH, equal to roughly $603 million at present ETH costs.

Ethereum whales preserve including: Santiment

Though at a gradual tempo, this accumulation means that main corporations are repositioning themselves because the market continues to get well.

On the similar time, adjustments in trade internet positions, which observe the quantity of ETH coming into and exiting exchanges, worsened from -1.55 million ETH on October 10 to -1.94 million ETH on October 15.

Rising curiosity from ETH consumers: Glassnode

Detrimental numbers imply extra cash are leaving the trade than coming in, an indication of accelerating shopping for strain as traders transfer their holdings into long-term storage. This 25% bounce in outflows marks the best stage since September twenty fifth. Mixed with whale accumulation tendencies, this may very well be in anticipation of a possible spike in Ethereum costs.

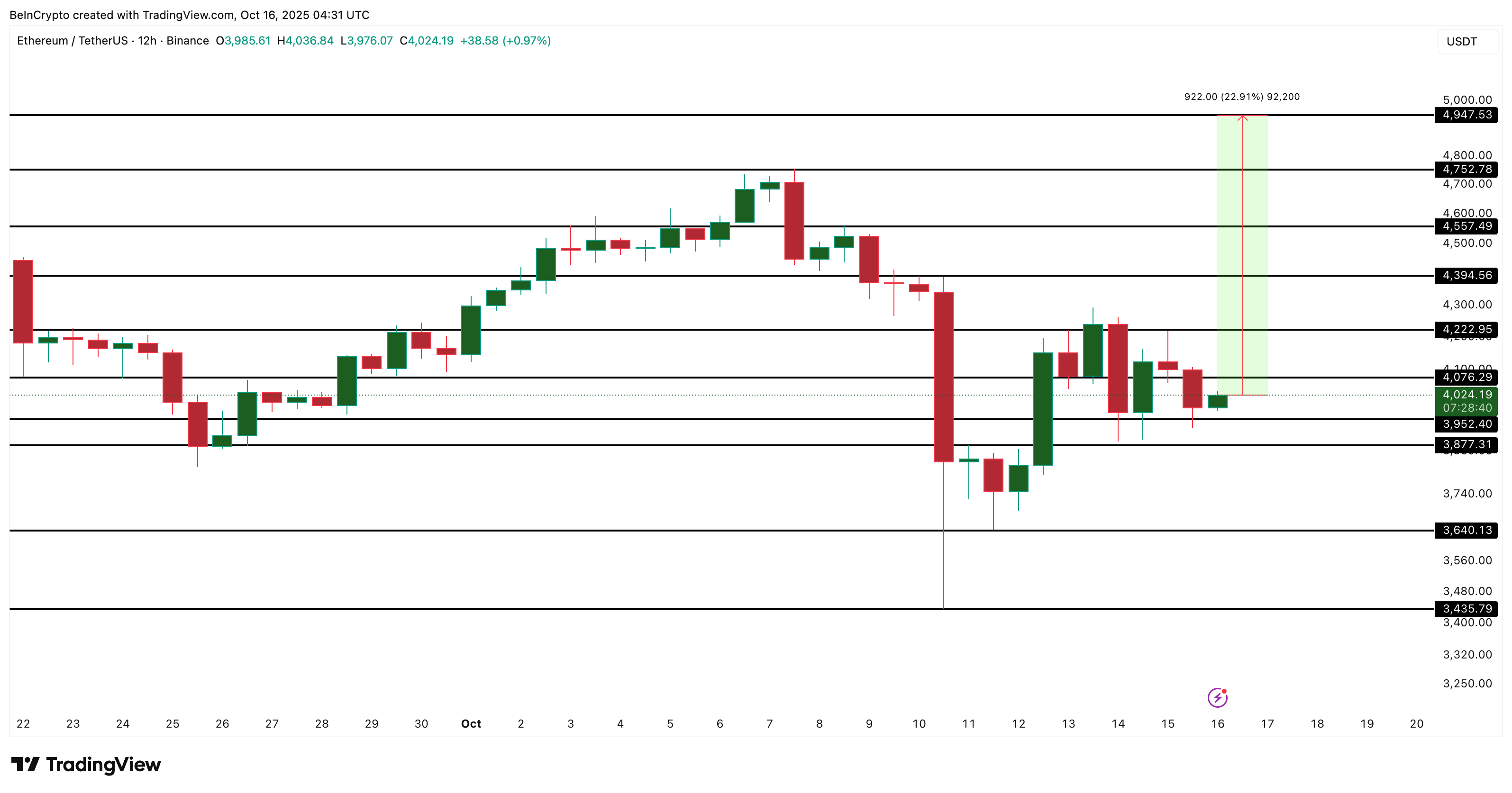

Ethereum value faces critical check close to $4,076

Technically, Ethereum faces instant resistance close to $4,076, with larger targets at $4,222 and $4,557 if the breakout holds. A 12-hour shut above $4,076 might affirm the energy of the bullish sign. If this occurs, the trail to $4,752 and $4,947 (all-time excessive zone) shall be opened.

On the draw back, Ethereum has vital assist close to $3,952 and $3,877. A lack of these ranges might trigger the worth to fall in the direction of $3,640, invalidating the bullish pattern.

Ethereum Value Evaluation: TradingView

General, Ethereum’s setup combines three bullish components. These embrace sturdy momentum indicators (RSI divergences), whale accumulation, and sharp will increase in forex outflows.

If this construction holds and the worth strikes above $4,076 and $4,222, ETH might as soon as once more repeat the identical bullish restoration that started in March, one which turned a fading downtrend right into a multi-week rally.

The submit Ethereum Value Flashes 3 Bullish Alerts as Whales Skip $600 Million in ETH appeared first on BeInCrypto.