Ethereum worth has fallen right into a tense zone after a weak begin in January. Ethereum It is down just below 1% up to now 24 hours, and its 30-day decline has now widened to about 3.6%. On the identical time, costs stay effectively above key long-term helps, and merchants are divided on the route.

What makes this setting tough is the steadiness of threat. Ethereum is buying and selling inside a bearish chart sample, however positioning information means that the draw back is probably not so simple as it appears.

Is Ethereum buying and selling inside a bearish sample?

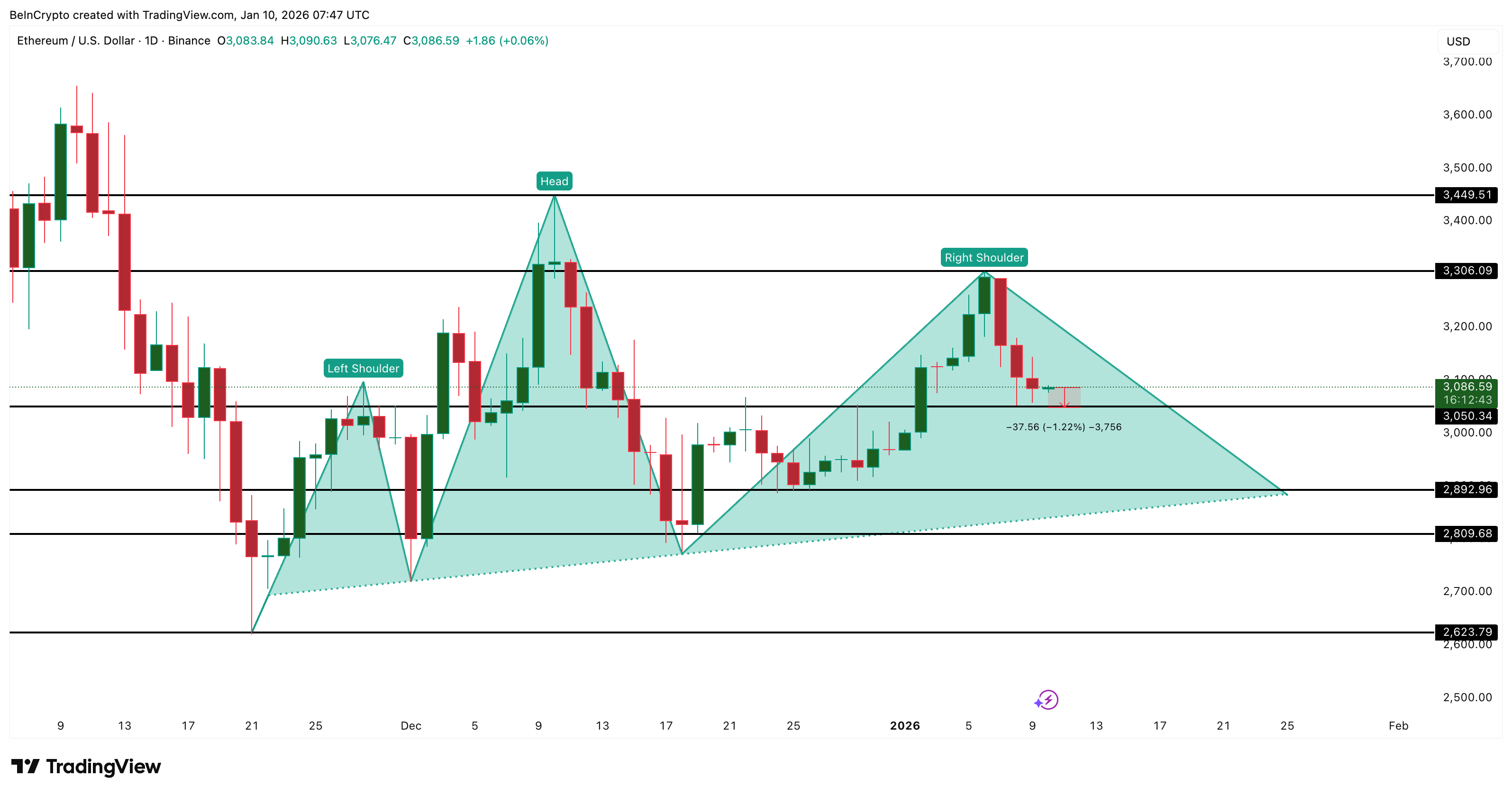

On the each day chart, Ethereum is forming a head and shoulders sample. This can be a bearish construction the place worth types a left shoulder, a better peak referred to as the pinnacle, and a decrease proper shoulder. A break beneath the neckline will verify the draw back.

Within the case of Ethereum, a each day shut beneath the neckline requires a draw back worth motion of roughly 9%. Conversely, transferring about 12% increased will fully invalidate the sample.

ETH”>

ETH”>

bearish Ethereum: Buying and selling view

Need extra token insights like this? Join Editor Harsh Notariya’s Every day Crypto Publication right here.

Momentum isn’t serving to the bulls but. The Relative Energy Index (RSI) measures worth momentum. A hidden bearish divergence signifies a weakening of the energy of the pattern when RSI types increased highs and worth types decrease highs. That is precisely what occurred from early December to early January.

RSI divergence led to say no: TradingView

Since then, the value has returned and no bullish break has fashioned. This leaves the danger of failure energetic fairly than resolved.

Due to this fact, Ethereum stays structurally weak. Nevertheless, construction alone doesn’t clarify all the pieces. The subsequent query is the place the promoting strain will come from.

Quick-term promoting will increase as holder actions weaken assist

On-chain information helps determine who’s promoting and who isn’t.

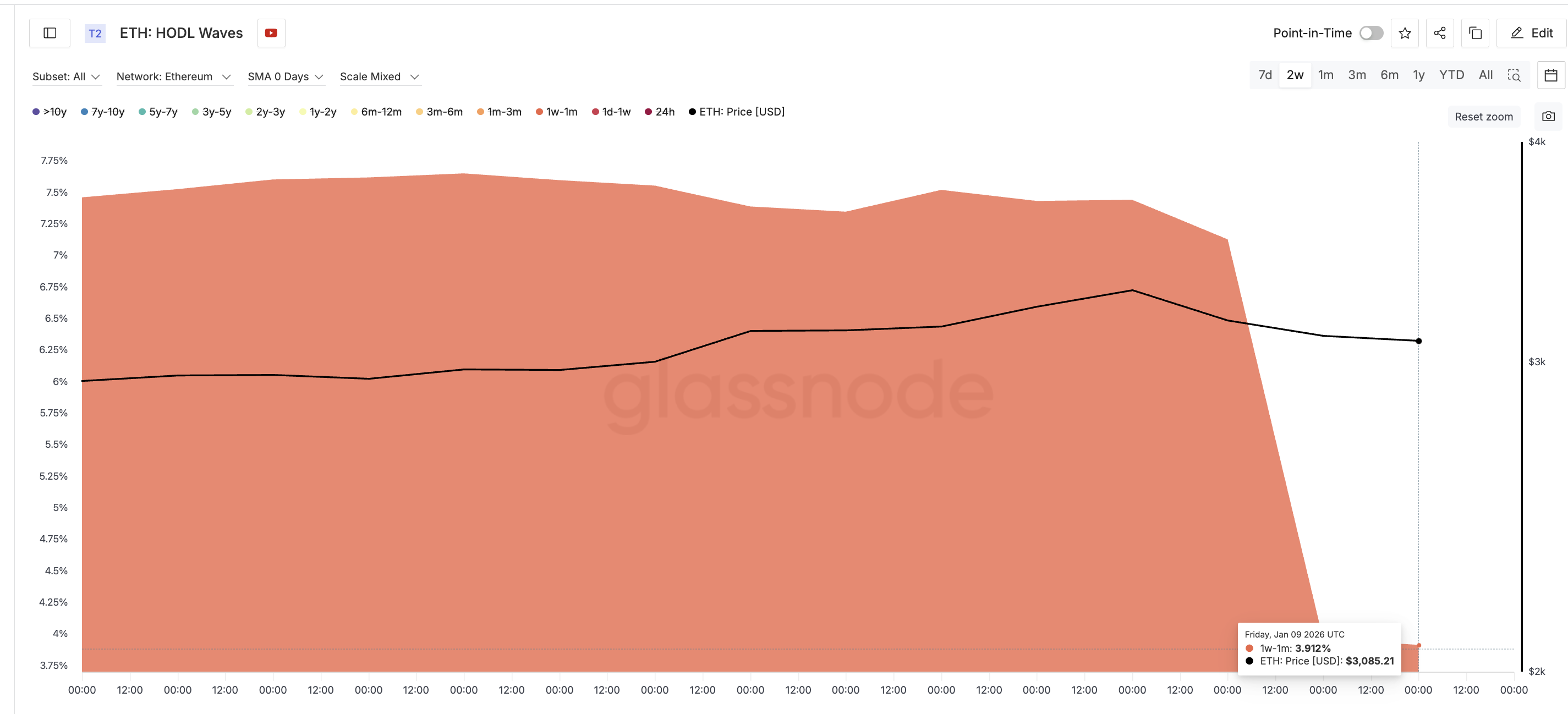

First up is HODL Waves. This indicator categorizes Ethereum provide into teams primarily based on how lengthy the coin has been held. Shorter holding durations sometimes signify speculative funds, whereas longer holding durations mirror conviction.

From January sixth to January ninth, the provision share for the 1-week to 1-month cohort fell sharply from 7.44% to three.92%. That is a 47% discount, which helps clarify a lot of the latest state of affairs. Ethereum Worth weak spot.

Dumping of ETH holders”>

Dumping of ETH holders”>

quick time period Ethereum Dump holder: Glassnode

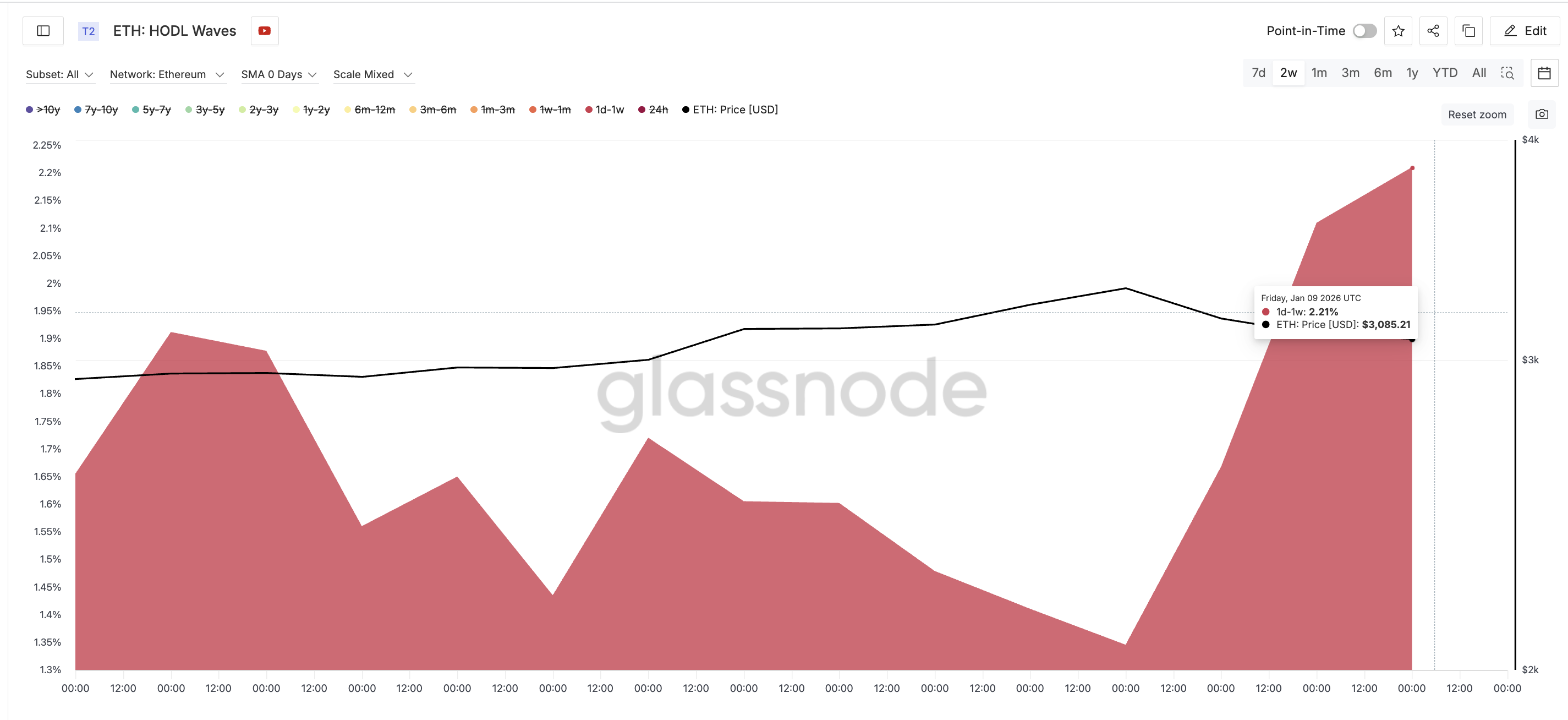

On the identical time, the share of the 1-day to 1-week cohort elevated from 1.34% to 2.21%, a rise of 65%. That is necessary as a result of this group typically sells rapidly when there may be even a slight change in worth.

One other short-term threat construct: Glassnode

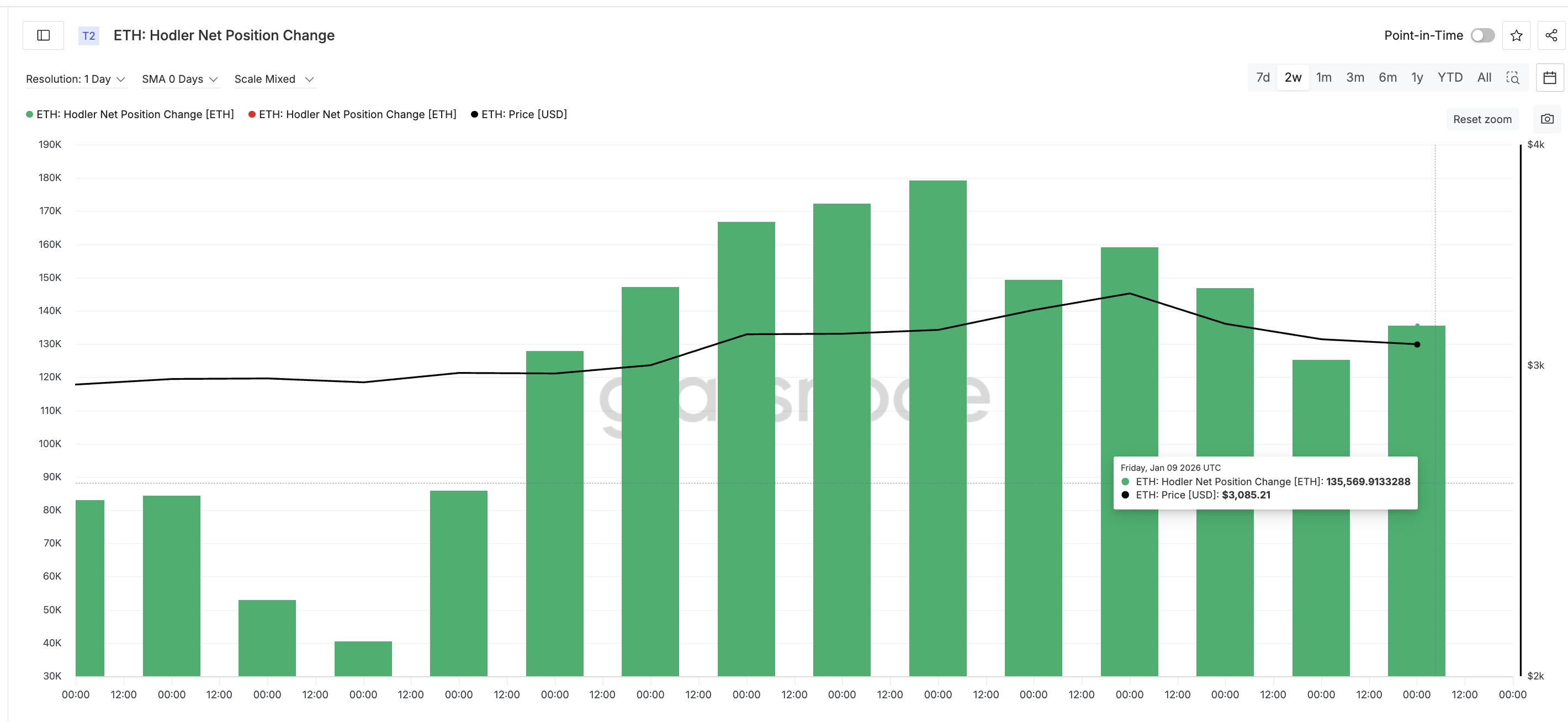

Lengthy-term assist can also be weakening. The Hodler Internet Place Change indicator tracks whether or not long-term holders are including or decreasing publicity. Though this indicator stays optimistic, shopping for strain has clearly slowed down. Internet inflows decreased from roughly 179,000 folks Ethereum Roughly 135,500 folks on January 4th Ethereum By January ninth, storage energy had fallen by 24%.

Slowdown in ETH patrons”>

Slowdown in ETH patrons”>

Ethereum Purchaser Slowdown: Glassnode

Merely put, long-term holders are nonetheless shopping for, however they’re changing into much less aggressive. This reduces draw back safety.

As spot assist fades, consideration turns to derivatives, the place positioning typically determines short-term route.

Ethereum worth stage tightens, derivatives skew will increase rebound threat

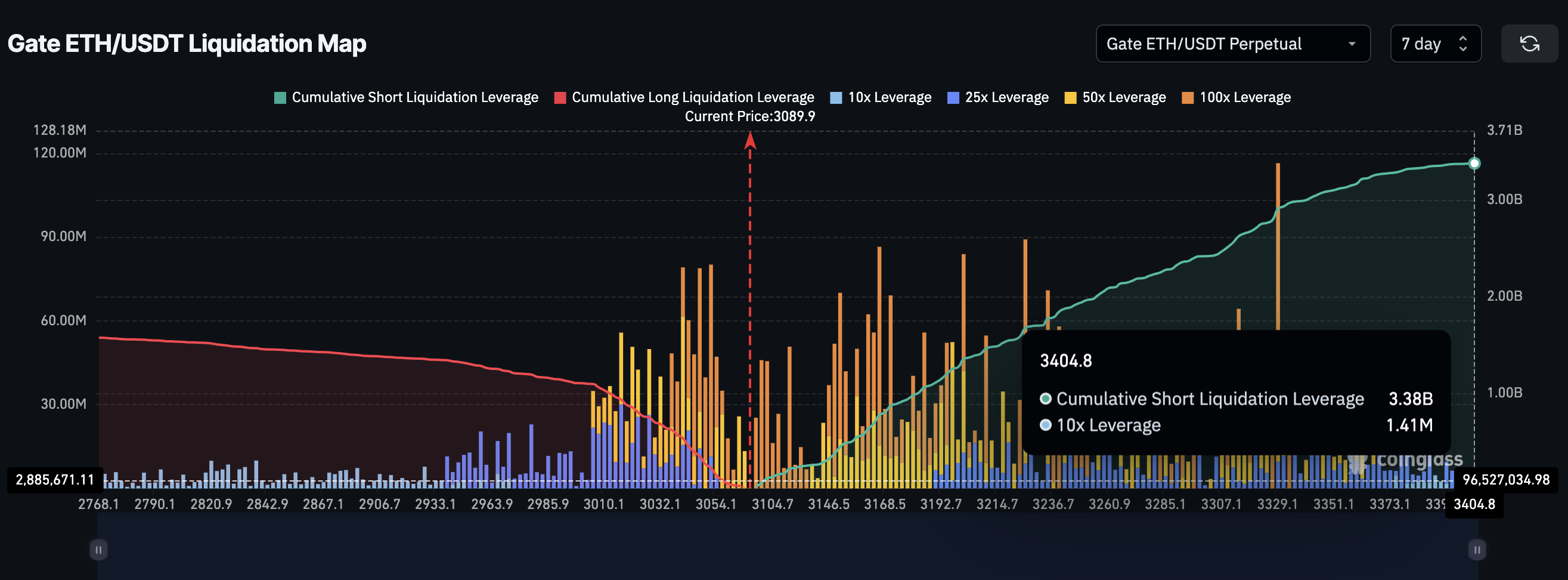

Derivatives information reveals massive imbalances.

Within the main perpetual markets, cumulative quick liquidation publicity is sort of $3.38 billion and lengthy publicity is sort of $1.57 billion. This implies quick positioning outperforms longs by about 115%. Proportion-wise, the market is closely tilted in the direction of anticipating costs to fall.

ETH liquidation map”>

ETH liquidation map”>

Ethereum Liquidation Map: Coin Glass

That is necessary as a result of if the value begins to rise, crowded shorts can gas an upward transfer. Pressured quick masking mechanically creates shopping for strain by way of a “quick squeeze” phenomenon.

The dangers are concentrated at a significant stage. Ethereum is presently buying and selling round $3,080. The primary assist stage to have a look at is $3,050, which is without doubt one of the most necessary ranges within the close to time period and is supported by a number of touchpoints.

That is adopted by $2,890. An in depth of the day beneath $2,809 would verify the bearish sample with an anticipated 9% decline and full the neckline break.

On the upside, $3,300 is the primary stage to weaken the bearish construction. When the each day closing worth is above that zone, the appropriate shoulder begins to be invalidated. Additional motion in the direction of $3,440 will seemingly cancel the sample fully and liquidate all 7-day quick positions, in line with a 12% pullback situation.

Ethereum Worth Evaluation: TradingView

At the moment, Ethereum is caught between waning spot assist and more and more crowded quick trades.

Ethereum’s worth hasn’t collapsed but, but it surely’s not secure both. Promoting strain has arrived and long-term shopping for has slowed by practically 1 / 4, however short-term holders stay energetic. On the identical time, spinoff positioning leaves the door open to sharp countermeasures.

The subsequent decisive transfer will come from the value itself. Whether or not Ethereum falls 9% or rises 12% will rely upon who loses confidence first.

The submit Ethereum worth flirts with 9% threat and 12% hope, any suggestions for steadiness? The submit appeared first on BeInCrypto.