Ethereum value is buying and selling round $3,210 as we speak, remaining barely above its weekly low after breaking beneath the long-term pattern line that guided its 2025 construction. This trendline loss will shift momentum to sellers, particularly as spot outflows enhance and the EMA cluster turns into resistance.

Spot outflows enhance as sentiment weakens

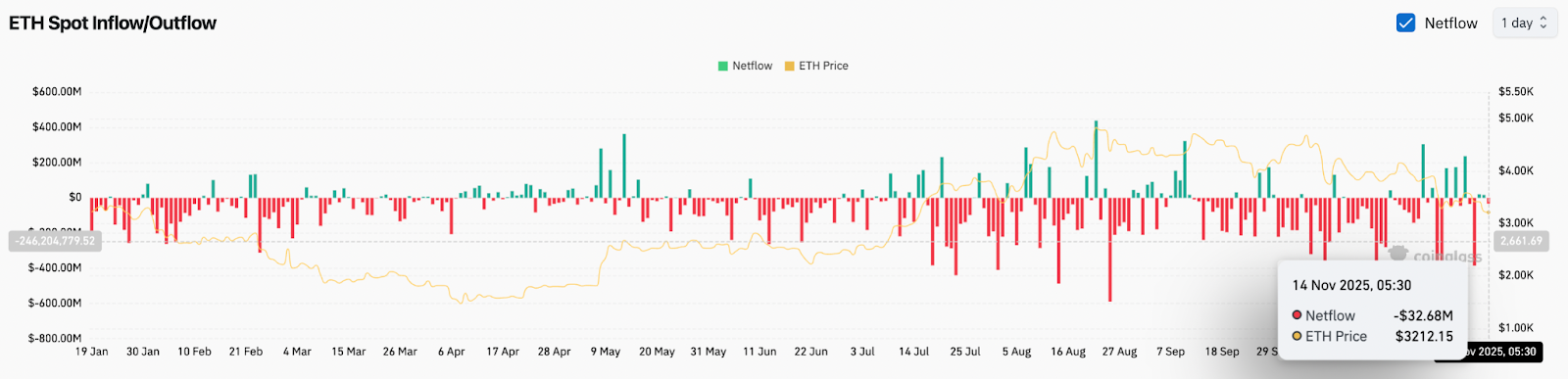

ETH Netflows (Supply: Coinglass)

ETH spot circulate stays destructive. Coinglass confirmed internet outflows of $32.6 million on November 14, extending a multi-week sample of constant distributions. Crimson print continues to dominate the flowchart, reflecting sustained gross sales reasonably than accumulation.

If spot outflows stay destructive whereas value breaks by a serious pattern line, the market sometimes enters a defensive part. Liquidity leaves the ecosystem and patrons lose confidence in short-term upside. The latest decline confirms a cautious shift in sentiment.

Trendline loss makes the construction bearish

ETH value fluctuation (Supply: TradingView)

The every day chart exhibits that Ethereum is decisively beneath the uptrend line extending from April. That is the primary full violation of this construction in over seven months. A trendline break of this size signifies a deeper change in market habits reasonably than only a regular pullback.

ETH is at the moment buying and selling beneath the 20-day, 50-day, 100-day, and 200-day EMAs positioned between $3,563 and $3,842. All the area has become overhead resistance, forming a thick ceiling above the present value.

Bollinger Bands present that ETH has been driving on the decrease band for a number of classes, indicating sustained draw back stress. Sellers had been in a position to hold the value beneath the mid-band at $3,623, which is at the moment a key degree for restoration.

Fast help lies round $3,050 to $3,030, the place the decrease band and pre-October demand zone converge. If this shelf fails, the subsequent main demand zone is round $2,880.

Intraday construction exhibits makes an attempt at stabilization

ETH value dynamics (Supply: TradingView)

On the 30-minute chart, Ethereum is searching for short-term stability above $3,180. Value is testing the VWAP band, a zone that intraday merchants usually use as a steadiness space throughout correction levels.

The RSI has recovered from oversold ranges and is now sitting round 46, indicating an early try to revive short-term momentum. Nonetheless, all rebounds to date have been capped by the VWAP midline positioned round $3,201 to $3,225.

The important thing intraday degree is $3,260. A break above this degree can be the primary change within the upside construction because the sharp drop two classes in the past. With out reclaiming this space, ETH stays susceptible to a recent selloff in direction of $3,100.

outlook. Will Ethereum go up?

Ethereum is at a vital juncture after dropping its long-term pattern line and falling beneath the EMA cluster. The following transfer will depend upon whether or not patrons can reestablish help between $3,180 and $3,050.

- Bullish case: ETH must get better $3,260 after which push in direction of $3,563. A detailed above the 20-day EMA can be the primary actual signal that draw back stress is easing. Momentum will solely change if the value breaks above the EMA cluster and opens the door to $3,840.

- Bearish case: If the every day shut is beneath $3,050, the subsequent demand zone is $2,880. If flows stay destructive and spot distributions proceed, the correction may deepen additional in direction of $2,750.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any form. Coin Version shouldn’t be chargeable for any losses incurred because of using the content material, merchandise, or companies talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.