Ethereum value at the moment is buying and selling close to $3,613 and is attempting to increase the rebound from the demand zone between $3,300 and $3,450. The rally comes as the newest derivatives information exhibits elevated open curiosity and improved positioning amongst merchants.

Patrons shield key demand zones

ETH value traits (Supply: TradingView)

Ethereum value at the moment stabilized after tagging into a requirement zone that lasted from August to September. This area close to $3,300 to $3,450 is simply above the 200-day EMA of $3,596, which has absorbed vital promoting strain in current periods.

The day by day chart exhibits the worth making an attempt to retake the 20-day and 50-day EMAs. Rapid resistance lies at $3,694 after which $3,887, the place the 50-day and 100-day EMAs are concentrated. Above that, the downtrend line from the year-to-date excessive reaches a value close to $4,001. The construction will stay mounted till patrons shut above that trendline.

Parabolic SAR has damaged beneath value for the primary time in current weeks, displaying early power. The present battle is about management. A detailed above $3,694 will verify step one within the development restoration. A lack of $3,450 will reinstate draw back strain.

Stablecoin development suggests capital will return to Ethereum

🔥 Newest: Ethereum leads stablecoin development with $84.9 billion added prior to now 12 months, based on Artemis. pic.twitter.com/WuAh1xVsVD

— Cointelegraph (@Cointelegraph) November 10, 2025

Ethereum dominated stablecoin provide development this yr, including $84.9 billion, based on Artemis information. No different chain can match this. Tron and Solana are a distant second and third on the charts.

A rise in stablecoin provide usually alerts an inflow of recent liquidity into the ecosystem. Stablecoins function dry powder for buying and selling, market making, lending, and staking. As the bottom of a stablecoin will increase, the chance of future inflows into ETH or ETH-based property will increase.

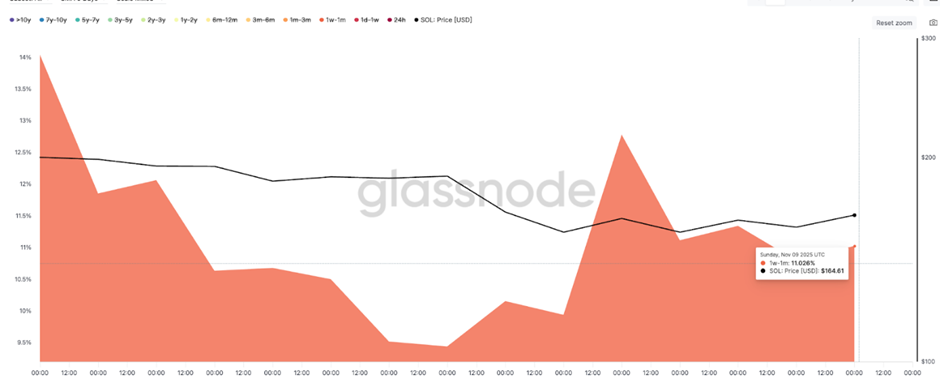

Derivatives information exhibits re-leveraging to rebound

ETH derivatives evaluation (Supply: Coinglass)

Derivatives positioning confirms adjustments in market conduct. Coinglass information displays:

- Buying and selling quantity elevated by 36.32% to $81.6 billion

- Open curiosity elevated by 8.80% to $42.37 billion

- Choices buying and selling quantity elevated by 127.08% to $1.21 billion

A spike in open curiosity signifies that merchants are including publicity somewhat than unwinding. The long-to-short ratio signifies bullish conduct.

- Binance long-to-short ratio: 1.99

- Binance High Dealer Lengthy Bias for Positions: 2.89

- OKX Lengthy to Quick Ratio: 1.61

Spot flows present capital is returning after weeks of outflows

ETH Netflows (Supply: Coinglass)

From most of October to early November, Ethereum confronted spot outflows, which have been an indication of circulation. That has modified at the moment.

The newest Coinglass information exhibits:

- Spot web inflows on November 10 have been $127.82 million

The reversal in spot flows helps the concept traders are returning to Ethereum after key demand zones maintain. This is sensible as a result of spot patrons are sometimes taking long-term positions somewhat than short-term speculative trades.

outlook. Will Ethereum go up?

The setup has modified from being reactive to being constructive. The growth of stablecoins means that liquidity is being constructed on high of Ethereum. Derivatives positioning exhibits that merchants are gaining confidence somewhat than retreating. Spot inflows verify that capital is circulating again into the ecosystem somewhat than leaving it.

- Bullish case: A day by day shut above $3,694 after which $3,887 would verify a development restoration and set targets at $4,300 and $4,500.

- Bearish case: If the day by day shut value falls beneath $3,450, the rebound is void and $3,250 and $3,000 could also be uncovered.

If Ethereum holds the 200-day EMA and clears $3,887, the development will return to increased highs. Shedding the demand zone turns the motion right into a deeper correction.

Disclaimer: The data contained on this article is for informational and academic functions solely. This text doesn’t represent monetary recommendation or recommendation of any variety. Coin Version just isn’t chargeable for any losses incurred because of using the content material, merchandise, or providers talked about. We encourage our readers to do their due diligence earlier than taking any motion associated to our firm.