Ethereum is falling in the direction of $2,100 spacelined with main liquidity clusters and long-tested help zones. Costs are already underneath stress and this stage now stands out as a key level that might form the following route.

Ethereum faces main liquidity zone close to $2,100

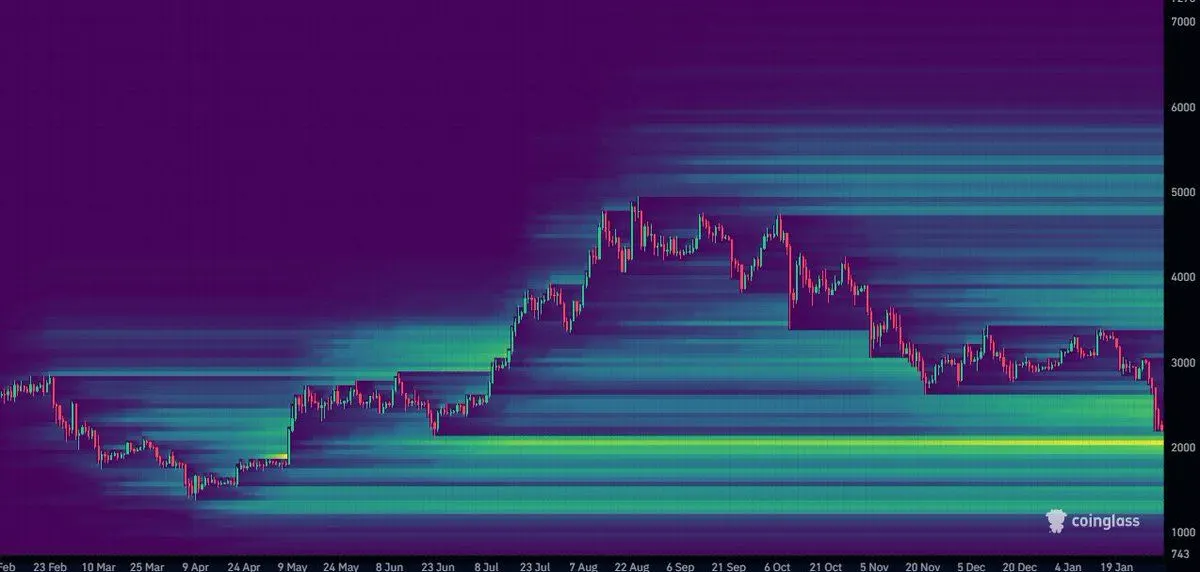

Ethereum is buying and selling decrease as chart information reveals a big focus of liquidity across the $2,100 stage. A heatmap shared by market analyst Osemka reveals dormant liquidity clustered in that zone, suggesting it might act as a significant value magnet throughout the present downturn. Costs have just lately fallen from the low $3,000s to the mid-$2,000s, and the lower cost vary is attracting extra consideration.

Ethereum liquidity heatmap and value fluctuation. sauce: X (Eight)

The liquidity map reveals that purchasing and promoting curiosity has been steadily growing round $2,100 for a number of months. Traditionally, such clusters have a tendency to draw value because the market strikes into testing areas with deeper order circulation. As Ethereum continues its decline, that stage now stands out as the following main space the place buying and selling exercise might intensify.

On the similar time, overhead liquidity seems skinny in comparison with the decrease vary, limiting upside traction within the close to time period. This imbalance explains why the rebound shortly disappeared throughout current periods. Ethereum stays susceptible to continued draw back stress till the value reaches the $2,100 zone or the liquidity state of affairs modifications.

Ethereum exams long-term help zone close to $2,100

Ethereum is closing in on a significant technical help band between $2,100 and $2,200 after an prolonged decline from late 2025 highs. The each day chart reveals that value has returned to the realm that has repeatedly served as a pivot level in previous cycles, with sharp reactions in each instructions. As ETH trades close to $2,326, stress continues to construct round that zone.

Ethereum each day value chart utilizing RSI. sauce: StockCharts / X (Heisenberg)

Momentum indicators spotlight the significance of this stage. The each day RSI has fallen near oversold territory, reflecting extreme draw back depletion slightly than acceleration. Up to now, comparable RSI circumstances have preceded sharp countertrend strikes close to this value vary as promoting stress has eased and patrons have stepped in close to structural help.

Worth historical past strengthens technical alerts. The $2,100-$2,200 vary served as a benchmark earlier than the large rally final 12 months, with restricted draw back throughout the extra extreme correction. As soon as Ethereum stabilizes above this band, its construction favors at the very least a short-term bounce brought on by a imply reversal and quick protecting. But when it continues to fall under that, the main target will shift to traditionally low demand zones.