Ethereum value has progressively risen in latest periods, indicating a sluggish however regular restoration. ETH has struggled to garner sustained investor assist, limiting its upward momentum.

This lack of perception has made it more and more tough for the altcoin king to succeed in the long-anticipated $4,000 stage, regardless of enhancing broader market situations.

Ethereum whales proceed to say no

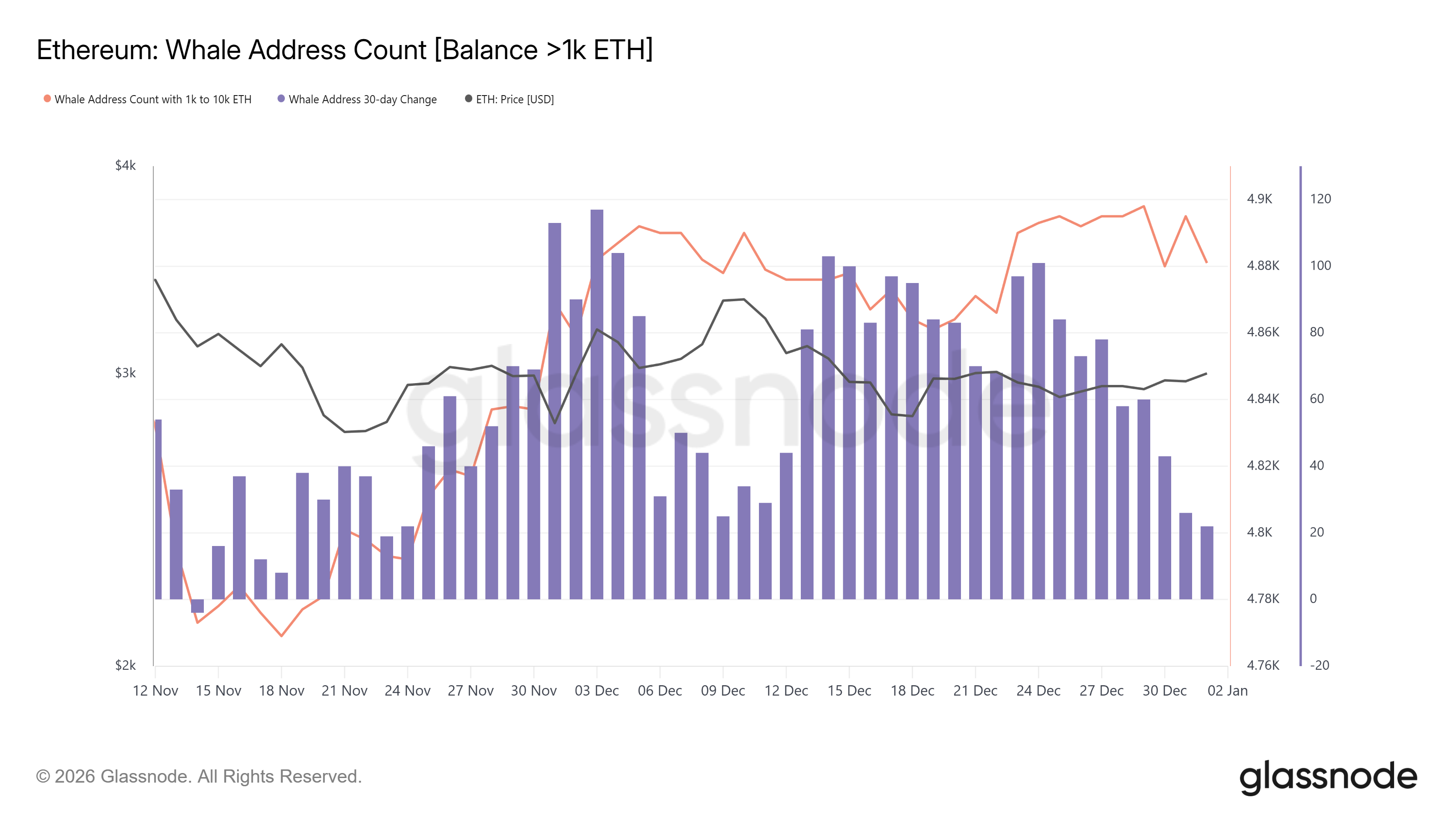

Whale exercise displays rising vigilance amongst giant Ethereum holders. Information monitoring whale addresses reveals reducing modifications over 30 days, indicating declining participation from this influential cohort. A decline in whales sustaining or increasing positions usually signifies weakening confidence in short-term value will increase.

The decline suggests whales could also be reassessing their affect amid restricted development prospects. Massive holdings are sometimes gathered throughout the excessive conviction stage. Their present pullback indicators a bearish short-to-medium-term outlook and places stress on Ethereum’s capacity to maintain robust good points with out new demand.

Need extra token insights like this? Join Editor Harsh Notariya’s Day by day Crypto Publication right here.

Variety of whale addresses on Ethereum. Supply: Glassnode

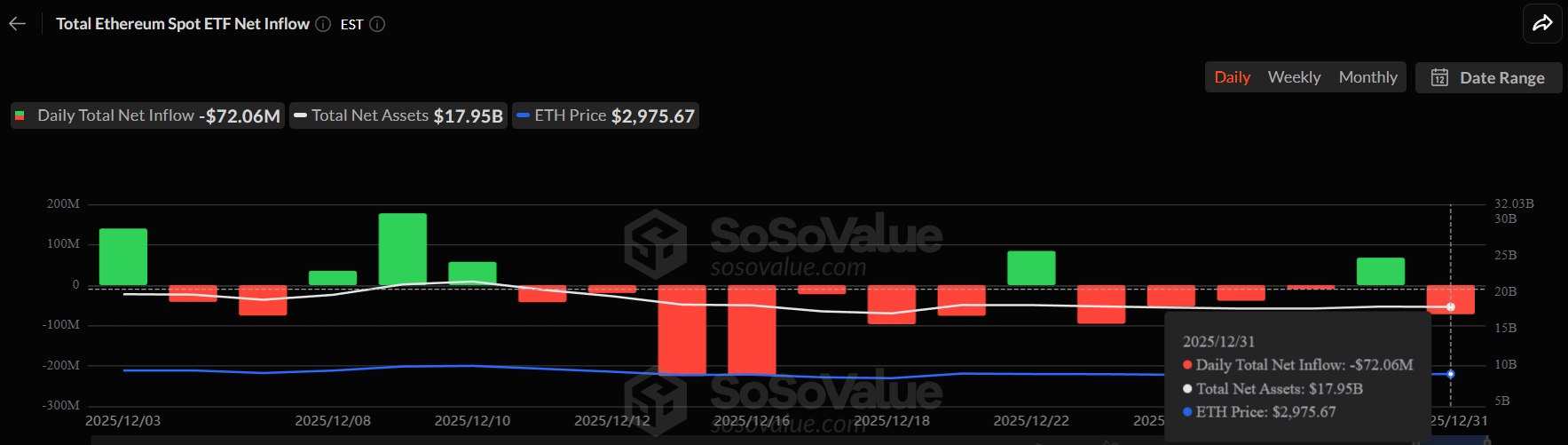

Macro indicators additionally spotlight headwinds to Ethereum’s value restoration. The ETH Spot ETF ended 2025 on a bearish be aware, with complete internet outflows of $72 million. This efficiency displays cautious institutional sentiment throughout a interval of broader market uncertainty.

Even into the brand new 12 months, participation stays low. Up to now month, the ETH Spot ETF recorded inflows simply 5 instances. This partial withdrawal from institutional buyers limits liquidity assist and reduces the chance that the rally can be sustained and not using a clear macro catalyst.

Ethereum ETF Move. Supply: SoSoValue

ETH value is going through a provide disaster

Ethereum value is exhibiting early indicators of energy in 2026. ETH lately reclaimed the $3,000 stage, breaking by this resistance for the primary time in 10 days. Whereas the transfer represents a psychological milestone, it stays solely step one towards the broader $4,000 aim.

The subsequent main hurdle lies at 32% above present ranges, with ETH buying and selling round $3,014. Value motion continues to be constrained inside a descending wedge sample. A confirmed breakout would require a decisive transfer above $3,131, which may shift momentum and appeal to new consumers.

ETH value evaluation. Supply: TradingView

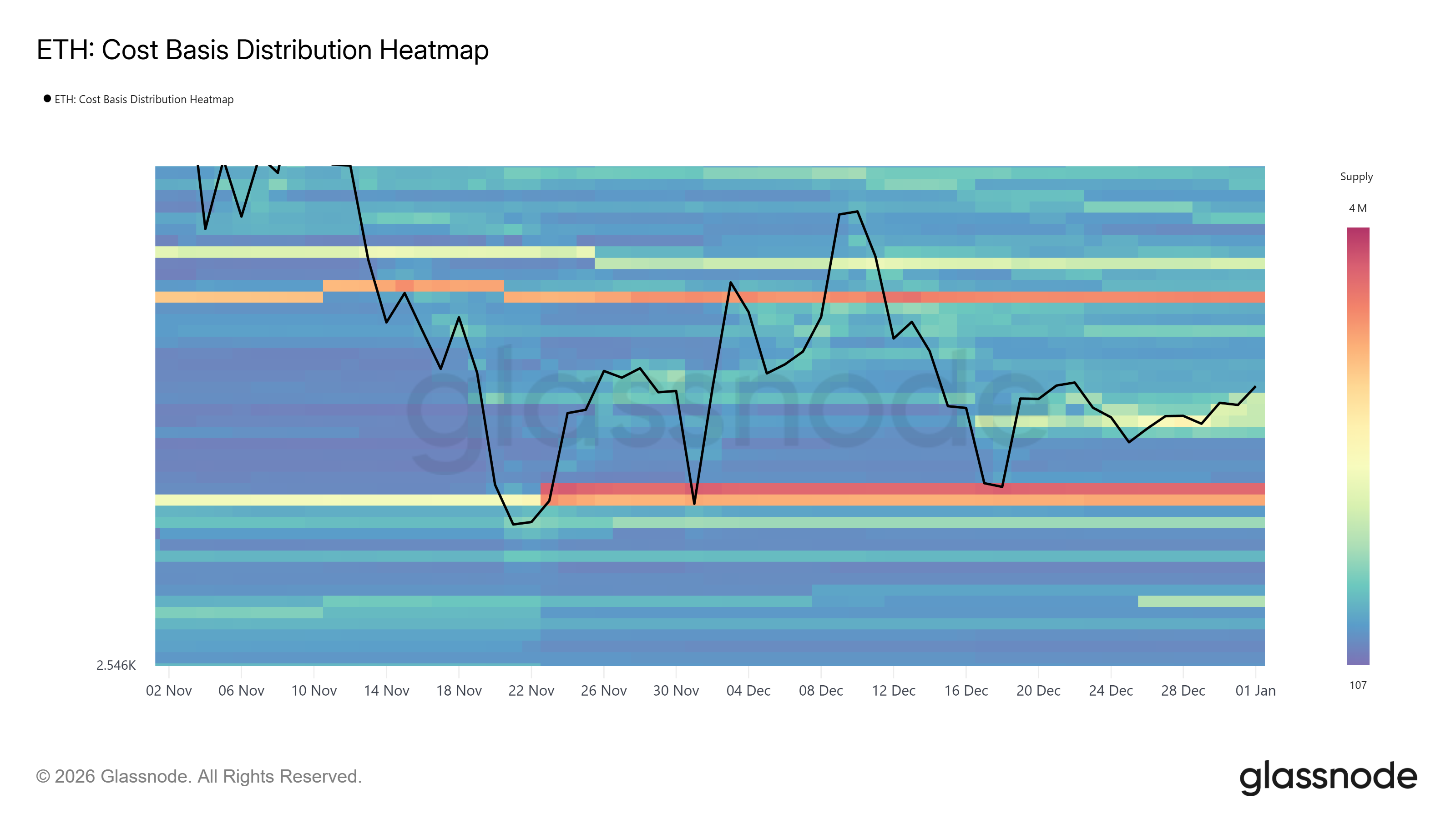

It is laborious to succeed in that stage as a result of there’s a number of overhead provide. The fee-based distribution heatmap reveals roughly 2.83 million ETH gathered between $3,151 and $3,172. This zone acts as a resistance as a result of when the value approaches this zone, many holders could promote to breakeven.

Barring robust demand, Ethereum is prone to consolidate beneath $3,131. This range-bound motion is prone to proceed as sellers take in the pullback and consumers stay hesitant. Such consolidation displays the market ready for affirmation moderately than actively committing to greater valuations.

Ethereum CBD heatmap. Supply: Glassnode

Whether or not the bearish thesis is invalidated is dependent upon new whale and macro assist. Vital inflows into Ethereum through the spot and ETF markets would sign a return to confidence. If institutional investor participation continues, ETH may regain momentum by breaching $3,131 and lengthening its rally towards $3,287.

The submit Ethereum value crossed $3,000, however why $4,000 is a problem appeared first on BeInCrypto.