of Ethereum ($ETH) Markets are at present experiencing a interval of stabilization as geopolitical headlines from the World Financial Discussion board in Davos proceed to drive investor sentiment. After every week of high-stakes rhetoric, the second-largest cryptocurrency by market capitalization has discovered agency footing following a big easing in commerce tensions.

Ethereum worth evaluation: $ETH Cash maintain necessary ranges

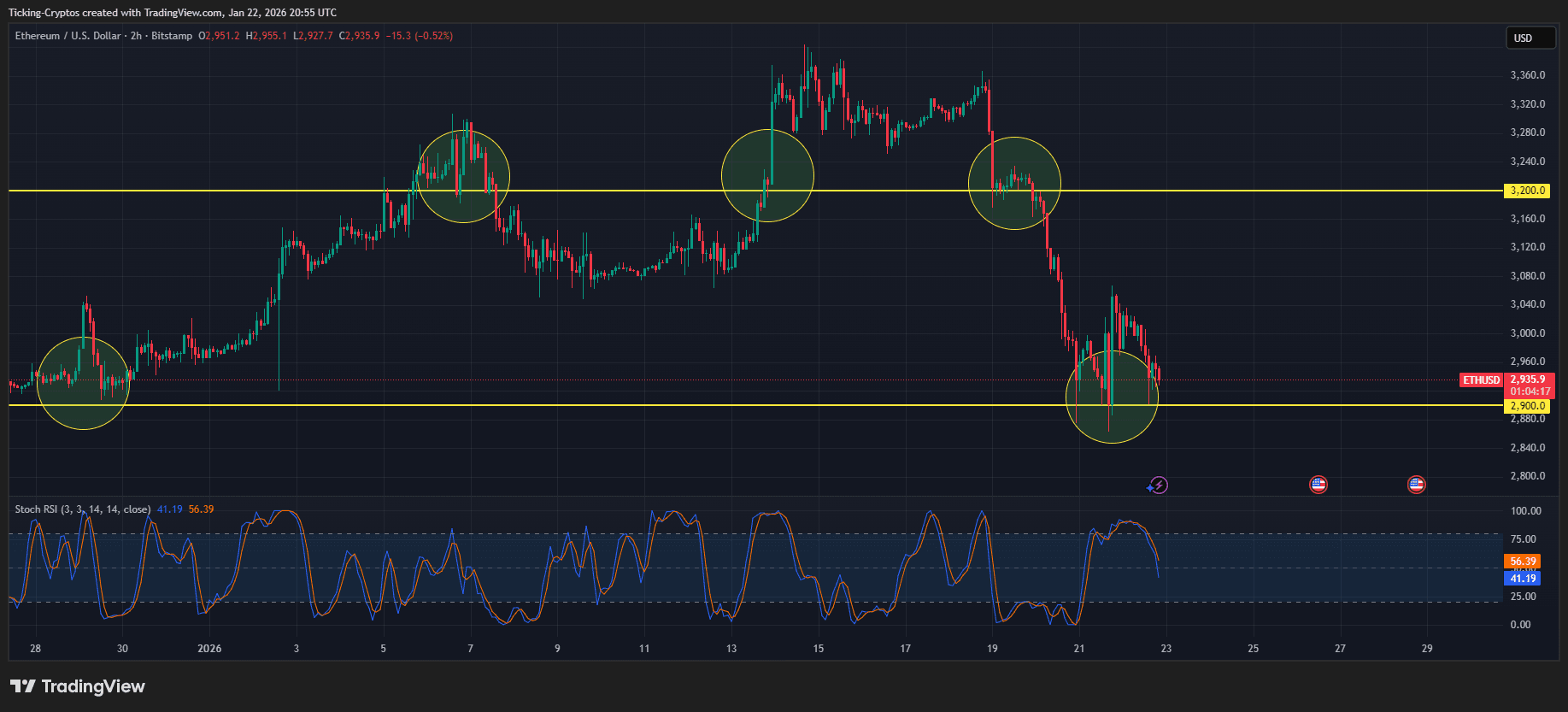

Based on the newest data $ETH worth checklistEthereum is at present testing a big horizontal assist zone round it. $2,900. As proven within the hooked up technical evaluation, the value has repeatedly reacted to this stage over the previous month.

$ETH/USD 2H – TradingView

- assist: The $2,900 zone stays a key ground for bulls. A day by day shut under this might open the door to a deeper correction in direction of $2,750.

- resistance: A yellow horizontal line seems upwards. $3,200 Acts as a powerful ceiling. $ETH It briefly broke above this stage in the course of the month, however was hit by robust promoting strain.

- Momentum: The stochastic RSI indicator is at present trending in direction of oversold territory (under 20), suggesting that the speedy draw back impulse could have reached exhaustion.

Merchants who wish to benefit from these worth actions ought to evaluate the very best crypto exchanges with the bottom charges and highest liquidity throughout unstable durations.

$ETH Coin macro driver: “Davos Pivot”

The restoration in digital property was spurred by President Donald Trump’s newest feedback at Davos. After initially threatening to impose 10% tariffs on European nations that opposed his Greenland ambitions, President Trump introduced a “framework for future agreements” with NATO Secretary-Basic Mark Rutte.

This shift from “power” to “diplomacy” led to a widespread backlash in danger property. in the meantime Bitcoin Though it regained the $90,000 stage, Ethereum managed to stabilize above the psychological $2,900 mark. Regardless of the reassuring rally, Reuters consultants warned {that a} “volatility premium” persists out there as particular buying and selling particulars stay unclear.

Safety comes first in unstable markets

Whereas the newest crypto information suggests a easing of tensions, the sudden coverage shift highlights the significance of self-custody. Macroeconomic shocks can result in change fee suspensions and liquidity strains. To guard your holdings, contemplate transferring your property to a top-rated {hardware} pockets.

Market notes: Throughout this consolidation section, whale exercise stays excessive. Based on the information, giant holders have amassed property price about $360 million. $ETH It’s because the value has fallen in direction of the present assist stage.

Disclaimer: This text is for informational functions solely and doesn’t represent monetary recommendation. Investing in cryptocurrencies is very unstable and entails important dangers.