Ethereum value motion is tightening in direction of a triangle formation as volatility compresses, indicating a breakout is approaching as dynamic assist and resistance converge.

abstract

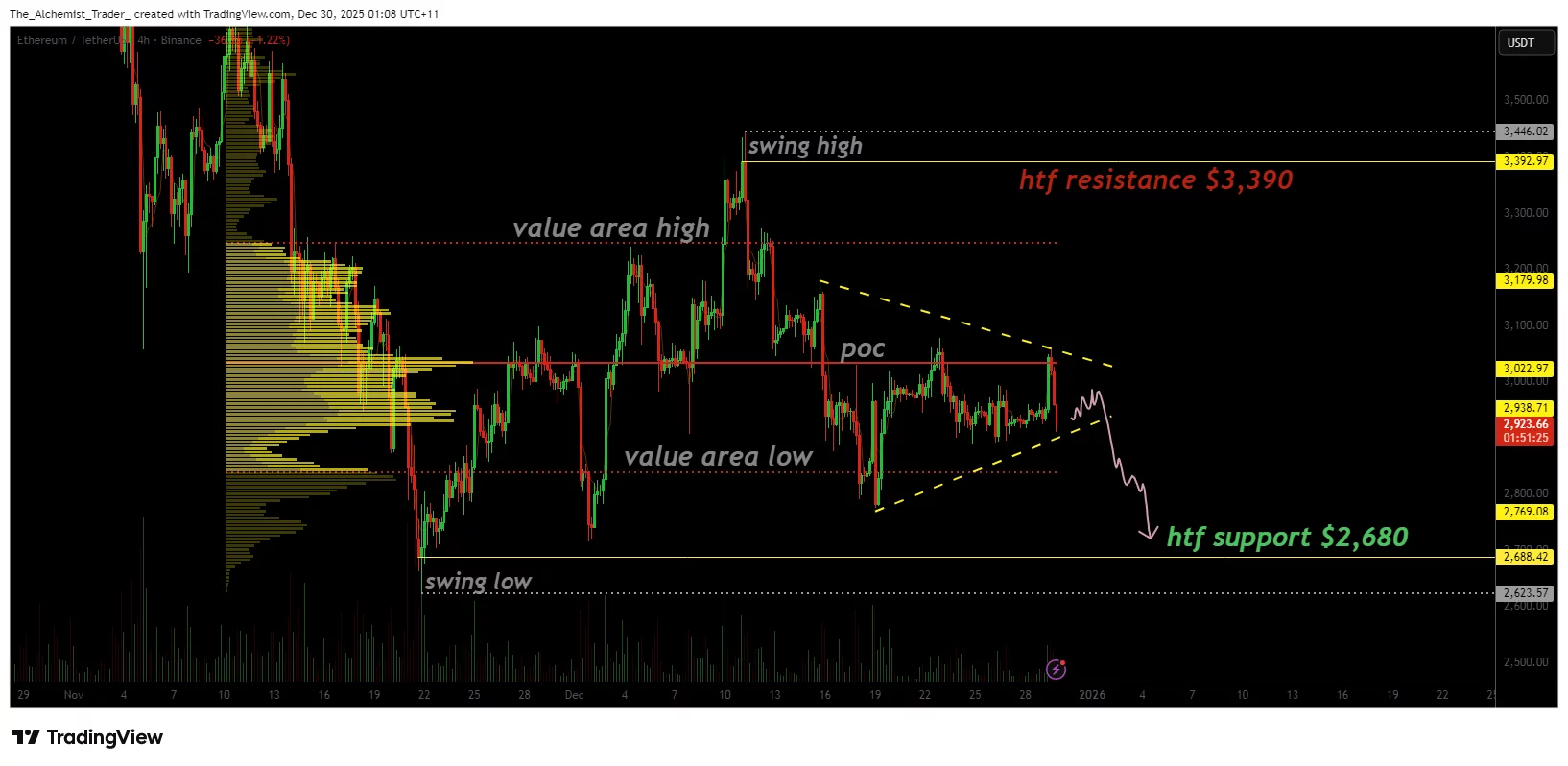

- Ethereum will likely be built-in inside a good triangular construction.

- Compressing volatility is an indication of an impending financial growth.

- The course of the breakout will depend on the amount and key degree.

Ethereum (ETH) value is getting into a key technical part as value motion continues to be compressed inside an more and more tight triangle construction. As volatility steadily declines and each patrons and sellers change into more and more selective, the market is approaching the purpose the place it might probably now not preserve steadiness.

This dynamic support-resistance convergence usually precedes a pointy growth, making the upcoming classes essential to Ethereum’s near-term course.

ethereum value main technical level

- Triangle apex nears completion, hinting at impending volatility growth

- Level of Management (POC) and Worth Space Low (VAL) function main compression zones

- Excessive time-frame assist at $2,680 and resistance at $3,390 outline a wider vary

You might also like: Analysis reveals that feminine crypto buyers favor long-term holdings and secure investments, making them a pure match for Doge Staking

ETHUSDT (4H) chart, supply: TradingView

Ethereum’s present construction is outlined by consecutive falling highs and rising lows, a traditional signal of market compression. This value motion displays indecision reasonably than weak point or energy, as patrons and sellers steadily converge towards equilibrium. Such formations are sometimes resolved by power when one facet takes the initiative.

You might also like: Digital Renminbi will transition to interest-bearing deposits from January 1, 2026

From a quantity profile perspective, value has gravitated across the level of management, an space that represents the best buying and selling quantity inside the latest vary. When the worth consolidates across the POC it typically alerts a steadiness, however a chronic decline at this degree can result in sharp directional actions as soon as acceptance is established above or beneath the worth.

The worth space legislation performs an vital function as a dynamic assist throughout this integration part. Repeated reactions across the area recommend that patrons are nonetheless energetic, however not aggressive sufficient to power a sustained breakout. On the identical time, sellers are unable to carry costs down decisively, reinforcing the concept that volatility is increase reasonably than being launched.

One notable technical issue is the untested excessive timeframe assist close to $2,680. This degree has not but been revisited in the course of the present consolidation, leaving pockets of static liquidity beneath value. The market naturally gravitates towards such areas, particularly when value actions stay range-bound. A draw back break in direction of this degree wouldn’t essentially invalidate the broader construction, however reasonably would full a full public sale rotation inside the vary.

You might also like: Crypto wallets ought to really feel as straightforward as Instagram | Opinion

On the upside, $3,390 stays a key excessive resistance degree. This area marks the higher certain of Ethereum’s broader buying and selling vary and represents an space the place sellers have beforehand regained management. A breakout above this degree would require not solely a structural break from the triangle, but in addition a transparent inflow of bullish quantity to substantiate acceptance.

However within the brief time period, Ethereum’s focus stays on the highest of the triangle. As costs compress additional, volatility continues to shrink, however traditionally this has hardly ever been the case for lengthy. A end result forces the market to resolve, typically leading to impulsive strikes triggered by stops, liquidity, and new participation, particularly as Ethereum staking deposits are beginning to outpace exits for the primary time since June 2025, signaling a possible change in participant conduct.

Importantly, the course of the breakout is set by quantity affirmation. Breakouts with out quantity are likely to fail, resulting in false strikes and sharp reversals. Conversely, a breakout with elevated quantity typically alerts the start of a sustained directional transfer.

From a market construction perspective, Ethereum stays range-bound on greater time frames. The consolidation at the moment unfolding signifies a pause inside the development reasonably than a confirmed reversal. The rotation is more likely to proceed till we are able to confidently break both $2,680 or $3,390.

What to anticipate from future value tendencies

As Ethereum approaches the highest of the triangle, merchants ought to count on elevated volatility within the close to time period. A draw back break might goal the untested assist at $2,680 to clear the static liquidity, however a bullish breakout would require important quantity to problem the resistance close to $3,390.

Till a definitive break happens, Ethereum is more likely to proceed rotating inside a broader greater timeframe vary.

You might also like: Crypto wallets ought to really feel as straightforward as Instagram | Opinion