Ethereum is underneath strain as bearish sentiment intensifies throughout the market. Over the previous week, main Altcoins have misplaced 13% of their worth. This brings you down beneath the vital $4,000 degree.

Adverse dealer sentiment and institutional pullbacks have now confronted the danger of testing even lower cost ranges.

The decline within the institutional pullback and lengthy/quick ratios raises issues

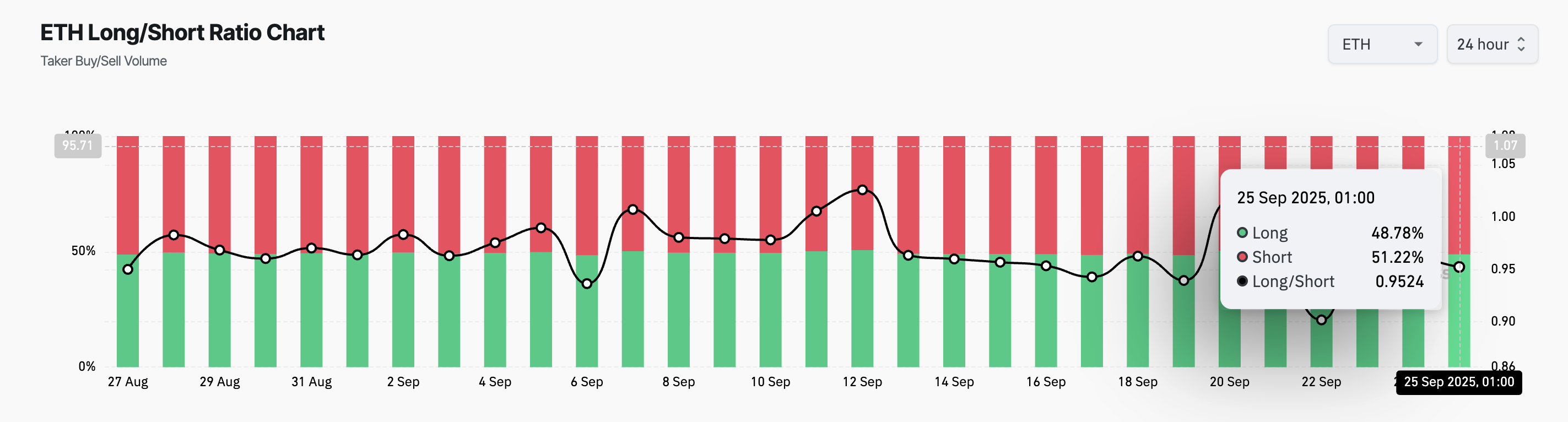

ETH’s Lengthy Lengthy/Brief ratio highlights a rise in bearish bias in direction of cash within the futures market. On the time of urgent, the ratio was 0.95, indicating that extra merchants are betting on that restoration within the quick time period.

For token TA and market updates: Need extra token insights like this? Join Editor Harsh Notariya’s each day crypto publication.

ETH lengthy/quick ratio. Supply: Coinglass

The lengthy/quick ratio of belongings compares the variety of lengthy and quick positions within the futures market. If the ratio exceeds 1, it may be longer than the quick place, indicating that the dealer is primarily betting on value will increase.

Conversely, as seen in ETH, one decrease ratio signifies that almost all of merchants guess on a value decline, indicating stronger bearish sentiment and additional draw back predictions.

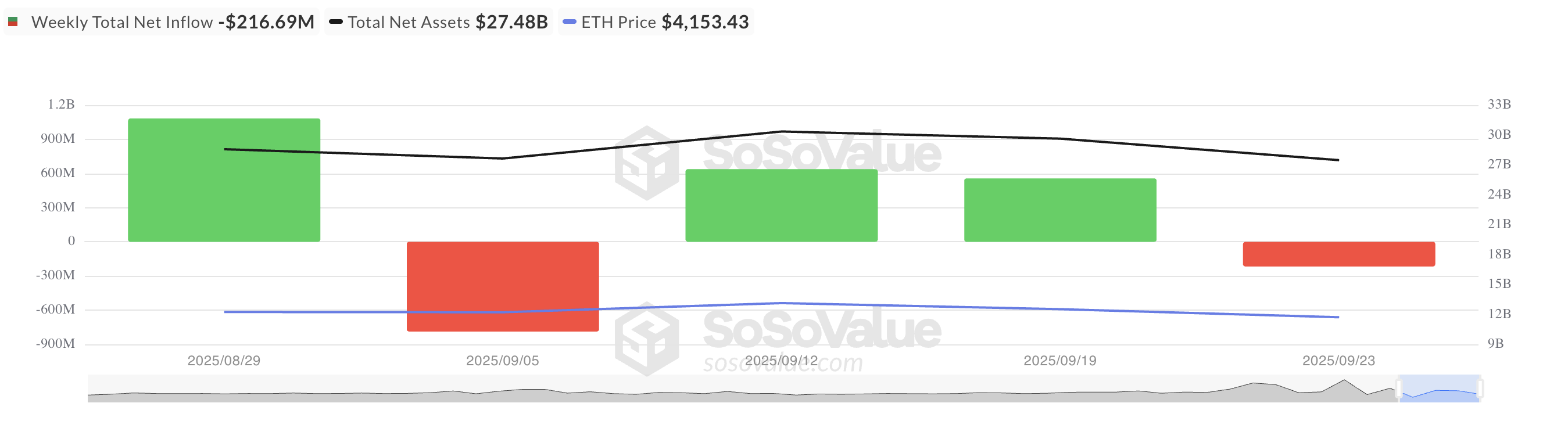

Moreover, this week’s steady outflow from Spot ETH ETFS exhibits institutional traders are pulling again and decreasing their asset assist. For every sosovolu, web outflows from these funds totaled $217 million this week, highlighting retreats by bigger market individuals.

All Ethereum spot ETF web stream. Supply: SosoValue

If an establishment sells or withdraws funds, it may well exacerbate downward momentum, making the belongings extra susceptible to short-term volatility. These main traders’ step-by-step exits are more likely to permit ETH to check low assist ranges within the quick time period.

Ethereum faces a $4,000 check as bears purchase the bottom

The ETH trades at $3,981 at press and hovers for $3,875 on the assist ground. If this value degree provides manner, ETH might immerse itself in an extra $3,626.

ETH value evaluation. Supply: TradingView

Conversely, if demand is returned, the coin’s value might regain energy and rise to $4,211.

Put up Ethereum costs are beneath $4,000 – is there a deeper repair forward? It first appeared in Beincrypto.