Ethereum worth stays below strain after the latest selloff that slowed the restoration momentum. $ETH The inventory traded at $2,087, regaining the $2,000 stage, however has not been capable of construct a sustained upside.

The problem dealing with Ethereum lies not solely within the stage of resistance, but additionally indecision among the many keyholder inhabitants.

Ethereum whale sells…then buys once more

Whales and long-term holders symbolize two of probably the most influential teams within the crypto market. Within the case of Ethereum, each teams are sending combined alerts. This lack of adjustment contributes to long-term sideways worth actions.

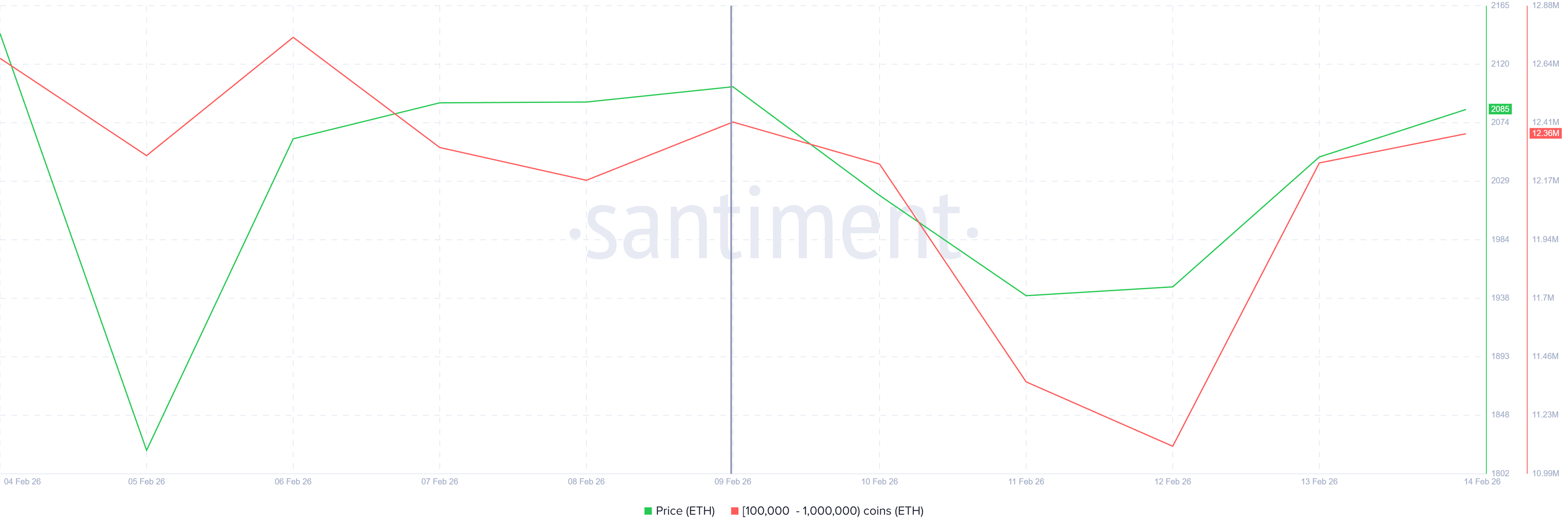

Addresses holding between 100,000 and 1 million $ETH Roughly 1.3 million items offered $ETH The sale is valued at roughly $2.7 billion. Nonetheless, the identical cohort bought 1.25 million items $ETH inside the subsequent 48 hours.

Ethereum Whale Holdings. Supply: Santiment

This speedy reversal resulted in roughly $2.6 billion in shopping for throughout the identical week. Such large-scale back-and-forth exercise creates unbiased fluidity. Because of this, Ethereum worth stays inside a variety relatively than trending decisively upward or downward.

Ethereum LTH has amassed…however is now on sale

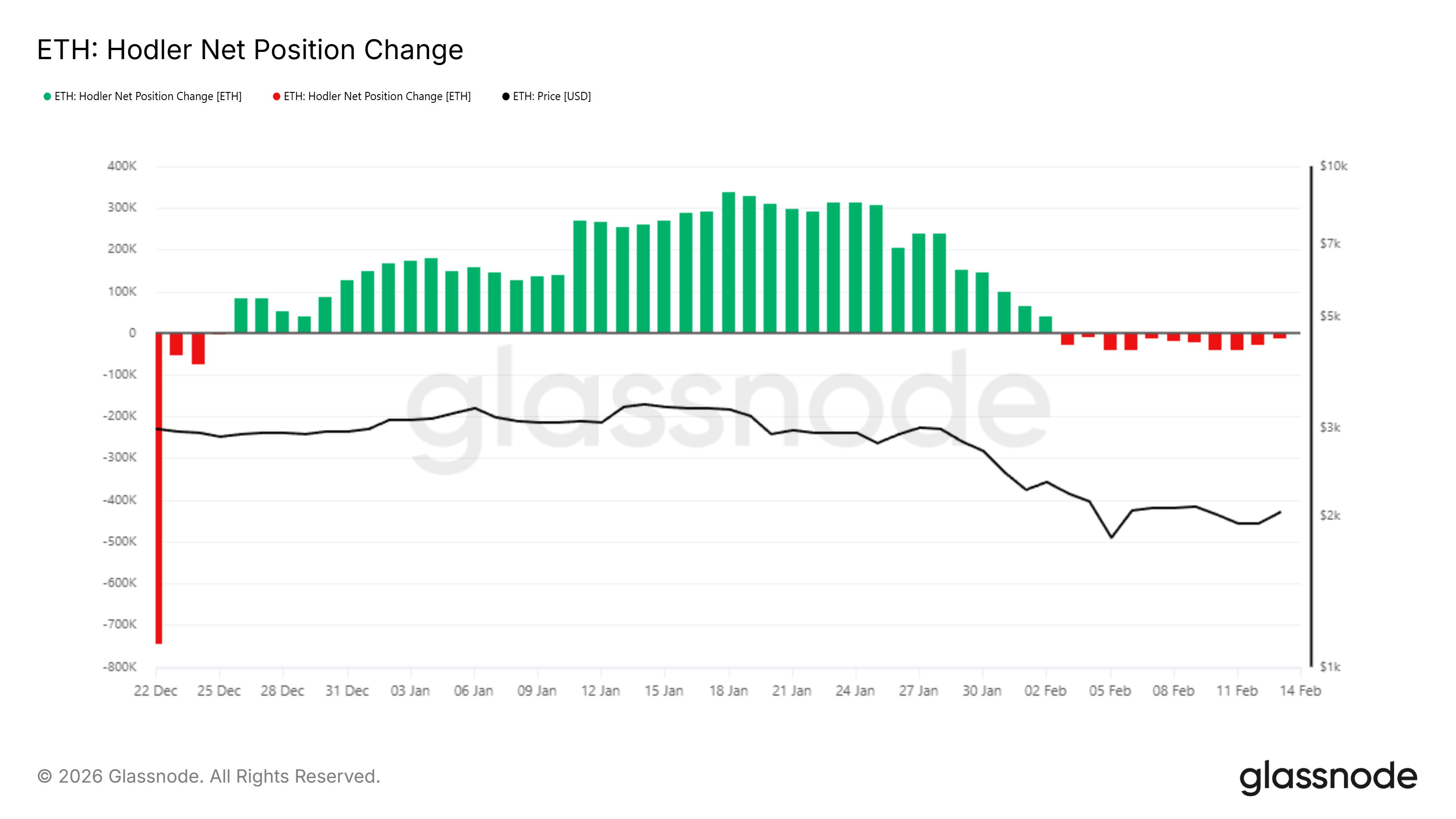

HODLer’s web place change metric reinforces this indecision. This indicator tracks the motion of long-term holders’ balances. The variety of long-term holders has steadily elevated since late December 2025. $ETH.

Initially of February, that pattern modified. Lengthy-term holders have diminished buying exercise and began making modest distributions. Though the promoting strain is much less aggressive, this means elevated uncertainty amongst buyers, which is usually related to robust conviction.

Ethereum HODLer web place change. Supply: Glassnode

Blended whale exercise, mixed with cautious long-term holders, limits bullish momentum. With out sustained accumulation from these cohorts, Ethereum worth will face problem breaking via key resistance ranges.

$ETH The value is caught at round $2,000.

Ethereum was buying and selling at $2,087, efficiently regaining the $2,000 threshold. The subsequent main resistance stage is situated at $2,241. A transfer to that stage requires a transparent bullish bias from the dominant holder group.

Given the present lack of definitive accumulation, consolidation stays the most definitely situation. Ethereum could proceed to hover round $2,000 whereas defending the assist stage at $1,902. Sideways momentum is more likely to proceed till directional certainty emerges.

Ethereum worth evaluation. Supply: TradingView

If whales and long-term holders shift to accumulation once more, Ethereum might rise above $2,241. A sustained rally might lengthen in the direction of $2,395 and probably check $2,500. If the worth clears $2,500, the bearish idea can be invalidated and a stronger restoration pattern can be confirmed.